Source: Compiled by the author

|

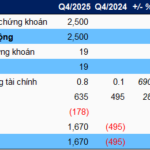

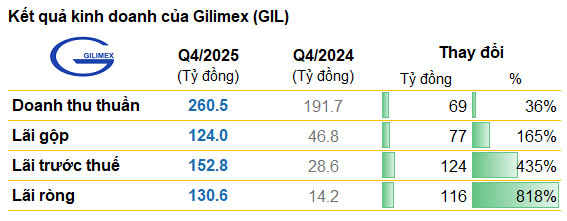

In Q4/2025, GIL recorded a record net profit of VND 130.6 billion, surging by 818% year-on-year, equivalent to over nine times the VND 14 billion profit in Q4/2024. This marks the highest quarterly profit in the company’s history.

The remarkable growth was driven by a record-high gross margin of 47.6%, surpassing the 40% threshold for the first time, significantly higher than the 24.4% in the same period last year. Amid reduced production costs, Q4 revenue soared by 36% to VND 260.5 billion, the highest in two years, though still below the peak levels of 2022 when quarterly revenue exceeded VND 1 trillion.

| Gilimex’s Quarterly Business Results Over the Past 2 Years |

Q4/2025 revenue structure reveals that over 97% stemmed from the sale of goods and finished products. According to the company’s disclosure, the acquisition of new customers and expanded production of plush toys significantly enhanced business efficiency.

The industrial park (IP) real estate segment generated VND 4.8 billion in revenue, accounting for less than 2% of total revenue but 22 times higher than the same period last year. Gilimex is accelerating infrastructure development to deliver land to secondary investors next year, leading to increased operating costs and reduced consolidated profit margins.

Q4 Profit Offsets 9-Month Losses, Full-Year Remains Profitable

Thanks to the exceptional Q4 performance, Gilimex fully offset the record loss of over VND 100 billion in the first nine months, concluding 2025 with a positive profit.

For the full year, the company reported a net profit of VND 30.4 billion, up 16% from 2024. Revenue reached nearly VND 714 billion, a slight increase year-on-year.

| Gilimex’s Business Results Over the Past Decade |

In 2025, the company also improved cost management, with financial expenses halving and management costs declining by 19%. This shift enabled Gilimex to move from operational losses to profitability.

However, these results only achieved approximately 24% of the annual profit target and about 59.5% of the revenue plan.

Record Negative Cash Flow, Bloated Inventory

Despite profit recovery, Gilimex faces significant cash flow challenges. In 2025, net cash flow from operating activities reached a record negative of VND 677.5 billion, marking the fourth consecutive year of negative operating cash flow, primarily due to surging accounts receivable and inventory.

By year-end, inventory totaled nearly VND 1,938 billion, up 18% from the beginning of the year. Finished goods accounted for 32%, raw materials 17%, Phu Bai IP project costs 25%, and Nghia Hung IP project costs 13%.

Among long-term assets, long-term prepayments surged to over VND 242 billion, more than quadrupling from the start of the year, mainly due to land rental and site clearance expenses.

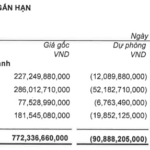

Heavily Loss-Making Securities Portfolio, Surging Debt

By the end of 2025, Gilimex held over VND 747 billion in bank deposits, a slight 1% increase year-on-year. The trading securities portfolio remained at over VND 64 billion, but provisions rose to nearly VND 48.6 billion, reflecting an approximate 75% unrealized loss.

This investment is almost entirely concentrated in Garmex Saigon’s GMC shares, accounting for 95.5% of the portfolio. The prolonged dispute with Amazon not only impacted Gilimex but also had a ripple effect on its manufacturing partner, GMC.

Conversely, total financial debt soared to over VND 971 billion, nearly tripling from the start of the year. Long-term debt accounted for nearly VND 615 billion, all borrowed from MB Bank’s North Saigon Branch.

On the stock market, GIL shares closed at VND 13,600 per share on January 30, down 24% over the past year. Average trading volume reached over 611,000 shares per session.

| GIL Stock Price Movement Over the Past Year |

– 15:00 31/01/2026

Hoa Phat Reports Q4/2025 Profit of Nearly VND 3.9 Trillion, Up 38%

In 2025, Hoa Phat achieved cumulative annual revenue of VND 158,332 billion and after-tax profit of VND 15,515 billion, reaching 93% and 103% of the set targets, respectively. These figures represent a 13% increase in revenue and a 29% surge in profit compared to 2024.

Foodcosa Reports Record Profits in Q4 2025, Barely Breaks Even for the Year

Despite a prolonged streak of poor business performance, Ho Chi Minh City Food Corporation (Foodcosa, UPCoM: FCS) unexpectedly recorded its highest-ever quarterly profit in Q4/2025. However, the full-year results still yielded only a slim profit, insufficient to significantly enhance its financial foundation.