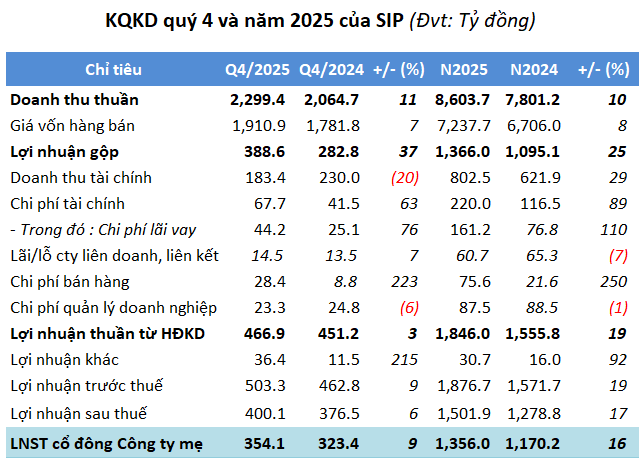

Saigon Investment Corporation (HOSE: SIP) has released its Q4/2025 consolidated financial report, revealing a net revenue of over 2.299 trillion VND and a net profit of 354 billion VND, marking an 11% and 9% increase year-over-year, respectively.

Source: VietstockFinance

|

While 2025 didn’t see explosive growth, SIP still achieved record-high results, with net revenue nearing 8.604 trillion VND, a 10% increase from the previous year. Utility services (electricity and water) in industrial zones (IZs) contributed 81% of the revenue, totaling over 6.993 trillion VND (up 7%), while real estate sales generated over 220 billion VND. Net profit reached 1.356 trillion VND, a 16% increase. Despite conservative planning, SIP significantly surpassed its targets.

| SIP Concludes 2025 with Record-High Business Results |

By the end of Q4, SIP’s total assets reached over 28.7 trillion VND, a 15% increase from the beginning of the year, with bank deposits of nearly 5.2 trillion VND, accounting for 18% of total capital.

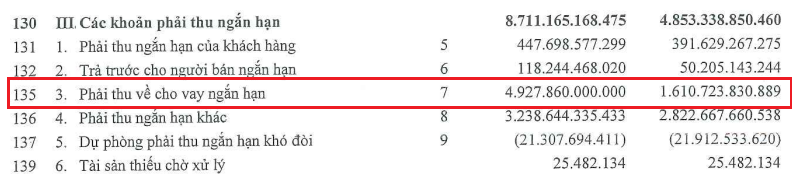

Notably, the company’s short-term receivables exceeded 8.7 trillion VND, up 80%, primarily from short-term loans totaling over 4.9 trillion VND, more than triple the figure from the start of the year. According to the report, these loans are provided to business partners with terms under 12 months, contract-based interest rates, and secured collateral. Third parties collaborate with borrowers to manage cash flow and ensure repayment of loans, investments, and deposits, guaranteeing timely fulfillment of payment obligations.

Additionally, over 3.2 trillion VND in other receivables is primarily attributed to advance payments for land compensation in IZ projects.

Source: SIP

|

Construction in progress totaled nearly 2.15 trillion VND, down 7%, with the majority allocated to the Phước Đông Bời Lời IZ-Urban-Service Complex (over 1 trillion VND), Lê Minh Xuân 3 IZ (589 billion VND), Southeast IZ (219 billion VND), Lộc An – Bình Sơn IZ (176 billion VND), and the Thanh Phước Port project (93 billion VND).

Liabilities reached nearly 22.9 trillion VND, a 13% increase year-over-year, primarily consisting of customer deposits and unearned revenue (13.4 trillion VND, up 10%), accounting for 59% of total liabilities, representing advance payments for land and factory rentals. Financial debt rose 34% to over 4.8 trillion VND, making up 21% of total liabilities.

SIP specializes in investing and developing IZs, providing utility services (electricity, water), leasing factories, and waste management.

The company manages and leases four IZs spanning over 3,300 hectares, including the Phước Đông IZ in Tay Ninh—the largest industrial-urban-commercial complex in the province (pre-merger) with a total area of 2,436 hectares, of which 2,189 hectares are dedicated to industrial production, and an initial investment of approximately 350 million USD.

Two IZs in Ho Chi Minh City—Lê Minh Xuân 3 (311 hectares) and Southeast IZ (342 hectares)—and one in Dong Nai—Lộc An – Bình Sơn IZ (nearly 498 hectares, located 10 km from Long Thanh Airport)—complete the portfolio.

In February 2025, Deputy Prime Minister Tran Hong Ha approved the investment policy for the Long Duc IZ (Phase 2), covering nearly 294 hectares. The investor is VRG Long Duc Investment Corporation, a subsidiary of SIP with a 75% voting stake.

In a January 23rd analysis report, Mirae Asset Securities noted that SIP holds approximately 1,200 hectares of IZ land, with the Lộc An – Bình Sơn and Long Duc 2 IZs expected to see land value appreciation as infrastructure nears completion. This will reduce travel times to seaports, Ring Road 3, and Long Thanh Airport.

– 15:39 30/01/2026

Groundbreaking Ceremony for Nationally Accredited School Funded by Corporate Sponsorship in Thuận Giao Ward

On January 28, 2026, the groundbreaking ceremony for Binh Chuan 3 Primary School was held in Thuan Giao Ward, Ho Chi Minh City. This project is implemented through a public-private partnership, fully funded and executed by Phat Dat Real Estate Development Corporation (HOSE: PDR), with a total investment value of approximately 145 billion VND. The aim is to construct a modern primary school that meets national standards, gradually aligning with international benchmarks.

Ho Chi Minh City Continues to Apply Land Price Table Under the 2024 Land Law Pending the Issuance of Coefficient K

While awaiting the issuance of the new land price adjustment coefficient, Ho Chi Minh City will continue to apply the current Land Price Table for calculating land use fees and financial obligations, ensuring the rights and interests of both citizens and businesses.