As 2025 drew to a close, KSF’s Q4 financial report revealed a staggering consolidated total asset value of nearly 120 trillion VND, a sixfold increase in just one year. Transforming from a mid-sized real estate firm, KSF has emerged as a powerhouse with multi-billion-dollar assets, driven by aggressive M&A strategies and rapid land and project acquisitions nationwide.

Within this colossal asset portfolio, standout components include investments in subsidiaries and associates, work-in-progress construction costs, and inventory across dozens of projects. Notably, short-term receivables surged from 9.3 trillion VND to approximately 57.5 trillion VND.

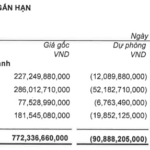

Among its real estate holdings, KSF’s completed projects under its subsidiaries—Sunshine Golden River, Sunshine Sky City, Sunshine Center, Noble Low-Rise Service & Residential Area, Sunshine City, Sunshine Garden, Sunshine Capital Tay Thang Long, and Sunshine Green Iconic—accounted for over 1 trillion VND of the 14.7 trillion VND inventory by period-end. The remaining 13.5 trillion VND stemmed from Noble Palace Tay Ho’s Golf Mansion and Boutique Mansion projects.

The report also highlights KSF’s long-term investment in Kita Invest, valued at over 5 trillion VND. By year-end 2025, KSF’s subsidiary, DIA Investment Corporation, held nearly 121.2 million shares in Kita Invest, representing 18.2% of its charter capital. Kita Invest holds rights and benefits for a high-rise residential and commercial project on CT05 and CT06 plots within Nam Thang Long Urban Area, Tay Ho District, Hanoi.

Conversely, KSF holds a 5.8 trillion VND receivable from Kita Invest, tied to a October 2025 investment cooperation agreement for acquiring and developing the CT05 and CT06 projects.

Rendering of Kita Capital Ciputra Tay Ho.

|

|

Just days before year-end, Kita Invest unexpectedly raised its charter capital from 1.15 trillion VND to 6.65 trillion VND without disclosing shareholder details. Founded in 2019, its original shareholders included Kita Group Corporation, Ms. Dang Thi Thuy Trang, and Mr. Nguyen Duy Kien. Its current legal representative is Mr. Do Xuan Canh, Chairman of the Board. The CT05 and CT06 projects, part of the GIA by KITA luxury real estate line within Ciputra Urban Area, span 59.6 thousand m². Developed by Kita Invest, the complex features 10 towers, each 40 stories high, offering over 2,000 apartments, penthouses, and shophouses adjacent to a 65-hectare central park. |

In its standalone financial statements, KSF invested over 14.1 trillion VND in subsidiaries by year-end, a 2.4-fold increase from the beginning of 2025. Notable additions include 545 billion VND in Sunshine Tay Ho Corporation, 1.15 trillion VND in DIA Investment Corporation, nearly 6 trillion VND in SunshineHomes Development Corporation, and 115 billion VND in SCG Construction Group Corporation.

Among its massive receivables, over 1 trillion VND stems from real estate transfers and investments; 11.7 trillion VND from advance payments to sellers for projects like Sunshine Sky City in Ho Chi Minh City (2.8 trillion VND), Noble Palace Tay Thang Long in Hanoi (3.4 trillion VND), and Noble Crystal Tay Ho and Noble Palace Tay Ho (5 trillion VND).

Remarkably, KSF extended unsecured loans totaling 22.9 trillion VND to corporate and individual partners over 12 months, with interest rates ranging from 5–12% per annum. Interest and principal are repaid upon maturity, and borrowers may use funds as legally permitted.

Additionally, KSF lent 1.1 trillion VND to corporate partners over 60 months at a variable rate of 4.8% per annum plus the average savings interest rate. These loans may convert into equity stakes or grant purchase rights for the borrower’s invested capital.

– 17:13 30/01/2026

West Lake Waterfront Property Prices Hit Nearly 2 Billion VND per Square Meter

Not only are property prices soaring in the Old Quarter, but the real estate market around West Lake is setting new records, with some townhouses listed at nearly 2 billion VND per square meter. This unprecedented surge continues to astonish Hanoi’s property market in the early days of 2026.

Vinhomes Records Staggering VND 42.111 Trillion Profit in 2025

In 2025, Vinhomes achieved a consolidated net revenue of VND 154,102 billion. The total consolidated net revenue, including core operations and joint business ventures, reached VND 183,923 billion, with a consolidated after-tax profit of VND 42,111 billion, setting new records. These figures surpassed the year’s initial targets, marking a 30% and 20% increase compared to 2024, respectively.