On January 29th, shares of MSR, representing Masan High-Tech Materials Corporation, surged to their upper limit (14.8%), closing at 36,400 VND per share. Since the beginning of 2026, MSR shares have climbed nearly 48%.

MSR shares have been on an upward trajectory, fueled by the soaring price of tungsten.

According to Reuters, tungsten prices hit record highs in January due to tightening supply, China’s export controls, and strong industrial demand, forcing buyers to scramble for supplies in an already tight market.

Traders report that ammonium paratungstate (APT), a key tungsten raw material, is trading at a record $1,125-$1,150 per metric ton unit (mtu) in China. Prices in Rotterdam have also reached all-time highs, around $1,100. Many predict prices will climb even higher in the coming weeks.

Source: ChinaTungsten

“There are multiple reasons for the tungsten price surge – a tight market, high demand from defense, aerospace, industrial, and gas sectors, supply issues (lower ore grades and other problems), and most importantly, export restrictions from China,” a London-based trader told Reuters via email.

China, which dominates global tungsten mining and processing, announced export controls in February 2025, requiring exporters to obtain government permits before shipping their materials.

Last month, Beijing released a list of 15 companies authorized to export tungsten, a move that could centralize control and limit material availability for foreign buyers.

“China’s export volumes have dropped nearly 40% year-on-year since the controls were implemented,” said William Parry-Jones, founder of Wolfram Advisory and an expert in tungsten market analysis and critical materials supply chain strategy.

According to Reuters, the global supply shortage intensified after China’s new controls on dual-use material imports to Japan took effect this month. Japan is one of the largest importers of tungsten from China.

Rising tungsten prices have benefited Masan High-Tech Materials, which operates the Nui Phao mine. According to the Dai Tu District People’s Committee in Thai Nguyen Province, Nui Phao’s tungsten output accounts for approximately 33% of global tungsten production excluding China, making it the world’s second-largest tungsten mine. It is one of the largest identified tungsten deposits outside China.

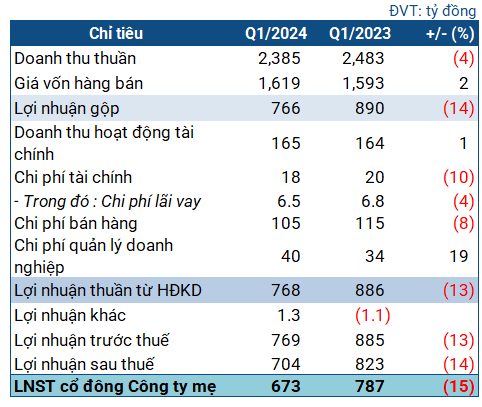

In 2025, Masan High-Tech Materials reported revenue of 7.443 trillion VND, a 48% decrease from 14.336 trillion VND in 2024, primarily due to the exclusion of 8.934 trillion VND in revenue from HCS after its removal from consolidated financial statements. Revenue increased by 1.166 trillion VND on a comparable basis (excluding HCS).

Tungsten revenue reached 4.458 trillion VND in fiscal year 2025, a 33% increase year-over-year. Florit revenue rose 7% to 1.432 trillion VND, driven by higher selling prices, while copper revenue reached 1.304 trillion VND, reflecting stable domestic sales volumes. MSR also recorded 63 billion VND in bismuth cement product revenue in Q4 2025 after signing an agreement with a strategic customer.

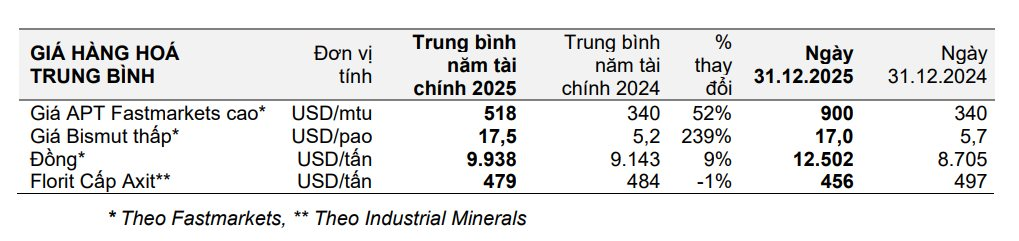

In 2025, the average APT selling price was $518/mtu, a 52% increase from $340/mtu in fiscal year 2024. As of December 31, 2025, APT prices soared to a record $900/mtu.

MSR reported after-tax profit of 222 billion VND in Q4 2025 – the highest quarterly profit since 2022 – and 11 billion VND for the full fiscal year 2025.

Based on indicators and subject to internal approvals and changes, MSR expects revenue of 11.9-12.5 trillion VND and after-tax profit of 50-300 billion VND in 2026.

This preliminary budget reflects APT prices in the second half of 2025. If the 2026 tungsten market maintains prices between $1,080-$1,325/mtu – historic highs throughout the year – MSR anticipates significantly higher actual 2026 financial results than forecast.

Vietnam’s “Treasure” Ranks Top 3 Globally, Behind Only China and Russia: General Secretary Urges Accelerated Action

Vietnam’s hidden treasure boasts an impressive reserve of approximately 100,000 tons, waiting to be discovered and appreciated by the world.

Masan’s Nui Phao Tungsten Mine Receives Planning Adjustment Approval

On November 24, 2025, Deputy Prime Minister Tran Hong Ha signed Decision 2581/QD-TTg, amending the master plan for the exploration, exploitation, processing, and utilization of mineral resources for the period 2021–2030, with a vision to 2050 (originally issued under Decision 866/QD-TTg on July 18, 2023). Among the adjusted areas is the Nui Phao Tungsten Mine in Thai Nguyen Province.