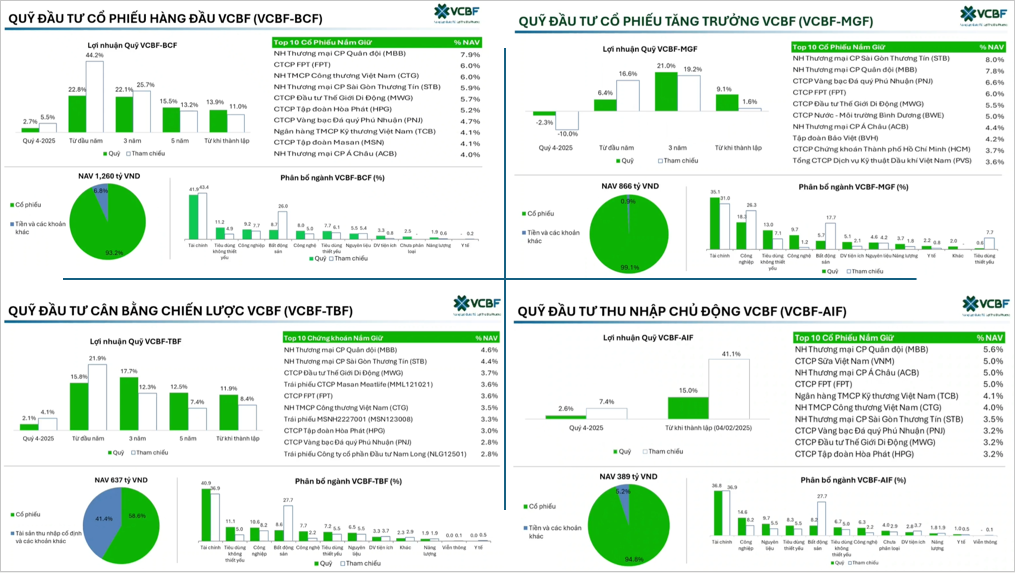

At the Q4/2025 performance report event for open-ended funds managed by Vietcombank Securities Investment Fund (VCBF), Mr. Pham Le Duy Nhan – Portfolio Manager at VCBF provided updates on the Q4 and full-year 2025 results of the equity funds under VCBF’s management. A common trend was that their returns were lower than their respective benchmark indices.

Specifically, the VCBF Leading Equity Fund (VCBF-BCF) recorded a 2.7% return in Q4 and 22.8% for the year, underperforming the VN100-Index. The VCBF Growth Equity Fund (VCBF-MGF) posted a -2.3% return in Q4 and 6.4% for the year, lagging behind the VN70-Index. The VCBF Strategic Balanced Fund (VCBF-TBF) achieved 2.1% in Q4 and 15.8% for the year, falling short of the VN-Index. Lastly, the VCBF Active Income Fund (VCBF-AIF) delivered 2.6% in Q4 and 15% since its inception in 2025, also below the VN-Index.

For VCBF-BCF, the underperformance relative to the benchmark was due to a lower allocation in the real estate sector, at only 8.7% compared to 26% in the VN100-Index, particularly with reduced holdings in VIC and VHM. Conversely, the fund had a higher allocation in the information technology sector, notably in FPT, which has seen unfavorable performance recently.

Additionally, the fund avoided investing in certain high-performing stocks in 2025, such as VJC, GEX, and GEE, due to concerns about the sustainability of their profits and less attractive valuations.

These allocation decisions also contributed to the underperformance of VCBF-MGF, VCBF-TBF, and VCBF-AIF compared to their benchmarks. For VCBF-MGF, the negative return was further exacerbated by a higher-than-benchmark allocation in CTR, a stock that declined nearly 30% due to modest profit growth in 2025.

However, VCBF’s team remains confident in CTR, believing the company will benefit from the development of mobile technology, particularly 5G in Vietnam. Plans include increasing the number of base stations from approximately 12,000 at the end of 2025 to 30,000 by 2030, nearly tripling the current count.

Mr. Nhan noted that VCBF’s equity funds have still outperformed their benchmarks since inception.

Turning to the VCBF Bond Fund (VCBF-FIF), it achieved a 0.8% return in Q4/2025, in line with its benchmark. For most of the period, around 60% of the fund’s net assets were invested in corporate bonds, yielding higher returns than the 10-year government bond yield, which serves as the fund’s benchmark.

For the full year 2025, VCBF-FIF delivered a 5.6% return, outperforming the benchmark by 3%. Over the past three years, the fund has averaged a 7.6% annual return.

|

Performance of VCBF’s equity and balanced funds lagged benchmark indices

Source: VCBF

|

Updating on portfolio changes from Q4 to early 2026 across the managed open-ended funds, VCBF’s Portfolio Manager highlighted several notable adjustments.

BCF reduced its exposure to Vingroup stocks, fully divesting from VIC and lowering its stake in VRE, while also exiting MCH due to its rapid and unexpected price surge. Conversely, the fund increased allocations in MSN, PNJ, DGW, BVH, IDC, and other stocks to maintain portfolio structure, including ACB, FPT, TCB, HPG, MWG, VNM, and VPB.

Similarly, the balanced fund VCBF-TBF increased holdings in ACB, BVH, PNJ, CTG, TCB, VPB, and FPT, while fully divesting from VIC, reducing exposure to VHM and VRE, selling all MCH holdings, and slightly lowering its stake in STB.

For VCBF-MGF, the fund slightly reduced its STB allocation from approximately 8% at the end of 2025 to around 6% currently. It also sold some PVS and fully exited FOX after a strong price rally. On the buying side, the fund increased allocations in PNJ, DGW, BVH, and CTD.

Similar trends were observed in the recently established member fund, VCBF-AIF.

Identifying 4 core stock groups

Looking ahead, Mr. Nguyen Trieu Vinh – Deputy Director of Investment and Head of Equity Investment at VCBF, stated that VCBF will focus on four key stock groups: banking, retail and distribution, construction and building materials, and information technology.

For banking, Mr. Vinh cited factors such as credit growth prospects, fee income expansion, asset quality improvement, and attractive valuations. Specifically, the median P/B ratio of banks was 1.3x as of January 26, 2026, lower than the 10-year average of 1.5x. Additionally, the 17.3% ROE of the banks in VCBF’s portfolio is notably high.

The retail and distribution sector is expected to benefit from strong economic growth and opportunities to gain market share from traditional retail channels.

The construction and building materials sector is poised for growth due to numerous public investment projects and increased demand for residential construction driven by economic expansion and government initiatives to boost housing supply.

For the information technology sector, Mr. Vinh anticipates a recovery in global IT investment demand as tariff risks subside, with continued growth in AI and IT applications. Domestically, both public and private sectors are increasing their focus on digitalization and IT adoption.

– 17:43 30/01/2026

VCBF Celebrates 20 Years of Establishment: “Stepping Forward with Confidence”

On November 27, 2025, in Hanoi, Vietcombank Securities Investment Fund Management JSC (VCBF) proudly hosted a grand ceremony to celebrate its 20th anniversary under the theme “Stride with Trust.” This milestone event commemorates two decades of establishment, growth, and steadfast partnership with Vietnam’s investment market.

Beware of VCBF Brand Counterfeiting Scams

The State Securities Commission (SSC) has received a report from Vietcombank Securities Investment Fund Management JSC (VCBF) regarding suspected trademark and document forgery involving the company.