On January 29th, the price of SJC gold bars officially surpassed the 190 million VND per tael mark. This surge has significantly impacted individual investor demand. In response, retailers have diversified their product portfolios, making them more accessible.

Mini gold products have emerged as the hottest trend this Lunar New Year, attracting numerous major players.

The “Fractionalization” Trend for Liquidity: From 0.1 to 0.05 Taels

The market has witnessed a clear segmentation in competitive strategies. While 0.5 or 1 tael used to be the standard, companies are now racing to reduce weights to the lowest possible levels.

Notably, Huy Thanh Jewelry launched the “Kim Chi Bảo” line with a weight of just 0.05 taels. This is currently the smallest weight available in the market, significantly lowering the entry barrier and allowing customers to own 24K gold for as little as 1.33 million VND.

Meanwhile, Bảo Tín Mạnh Hải focuses on the 0.1 tael segment with the “Tiểu Kim Cát” collection (Pine, Chrysanthemum, Bamboo, Plum). Their strategy emphasizes affordability by waiving manufacturing fees, bringing prices down to around 1.9 million VND to attract cost-conscious consumers.

PNJ’s Differentiation: Lifestyle Focus and Doraemon, Hello Kitty Licensing

Instead of joining the race to minimize weight or reduce manufacturing costs, PNJ has adopted a “Lifestyle” approach and focused on emotional value.

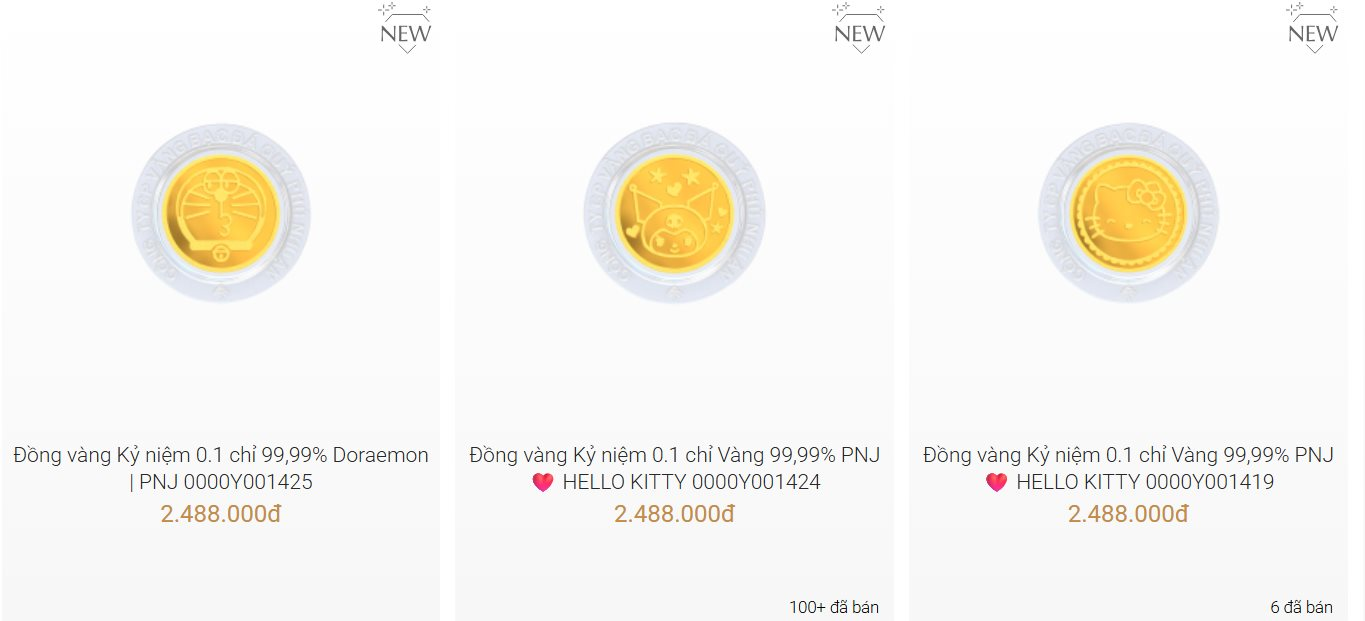

For this year’s season, PNJ introduced 0.1 tael commemorative gold coins featuring Doraemon, Hello Kitty, and Cinnamoroll. Priced at approximately 2,488,000 VND per item, higher than the market average for the same weight, PNJ successfully tapped into the self-expression desires of Gen Z and office workers.

A key element of this strategy is PNJ’s transformation of gold from a stored asset into a collectible and gift item through the “Blind Box” concept with the “Mã Tiến Đắc Lộc” collection.

PNJ maintains its premium position through corporate gifting (B2B) and artistic craftsmanship (ARTA).

Solid gold statues and “Thiên Mã Đăng Hoa” gold coins, valued from tens to hundreds of millions of VND, continue to secure revenue from VIP and corporate clients.

PNJ’s Financial Performance and 30% Stock Price Increase

PNJ’s focus on high-craftsmanship retail products (mini IP gold, lifestyle jewelry) over traditional thin-margin gold bars has positively impacted its financial health.

In 2025, PNJ reported record net revenue of 34,976 billion VND and net profit of 2,829 billion VND, a 33.9% year-over-year increase.

Notably, gross profit margin improved significantly to 22.0% (from 17.6% in 2024). This improvement stems from the retail segment contributing 69.6% of total revenue, offsetting the decline in traditional 24K gold sales.

On the stock market, PNJ’s share price reached 123,300 VND on the morning of January 29th, 2026, a 4.05% increase. Since its accumulation phase around 94,000 VND in early November, the stock has surged over 30%.

This performance reflects market confidence in PNJ’s sustainable growth potential, driven by its diversified product portfolio catering to both mass-market and premium segments.

Urgent Gold Dealer Announcement for Northern Buyers: Effective Tomorrow!

The announcement came on a day when gold prices surged dramatically, breaking records and capturing the attention of the public.

SJC Gold Price, Ring Gold Price Surge on December 20th

On the morning of December 20th, domestic gold prices surged by approximately 200,000 VND per tael compared to the previous day.