The Vietnamese stock market has seen a strong start to the year, thanks to the banking sector taking the lead. After a period of inactivity, banking stocks have surged, with the spotlight on the three state-owned banks Vietcombank, VietinBank, and BIDV. With double-digit gains since the beginning of the year, VCB and BID stocks have reached new highs, while CTG is approaching its highest level in 2021.

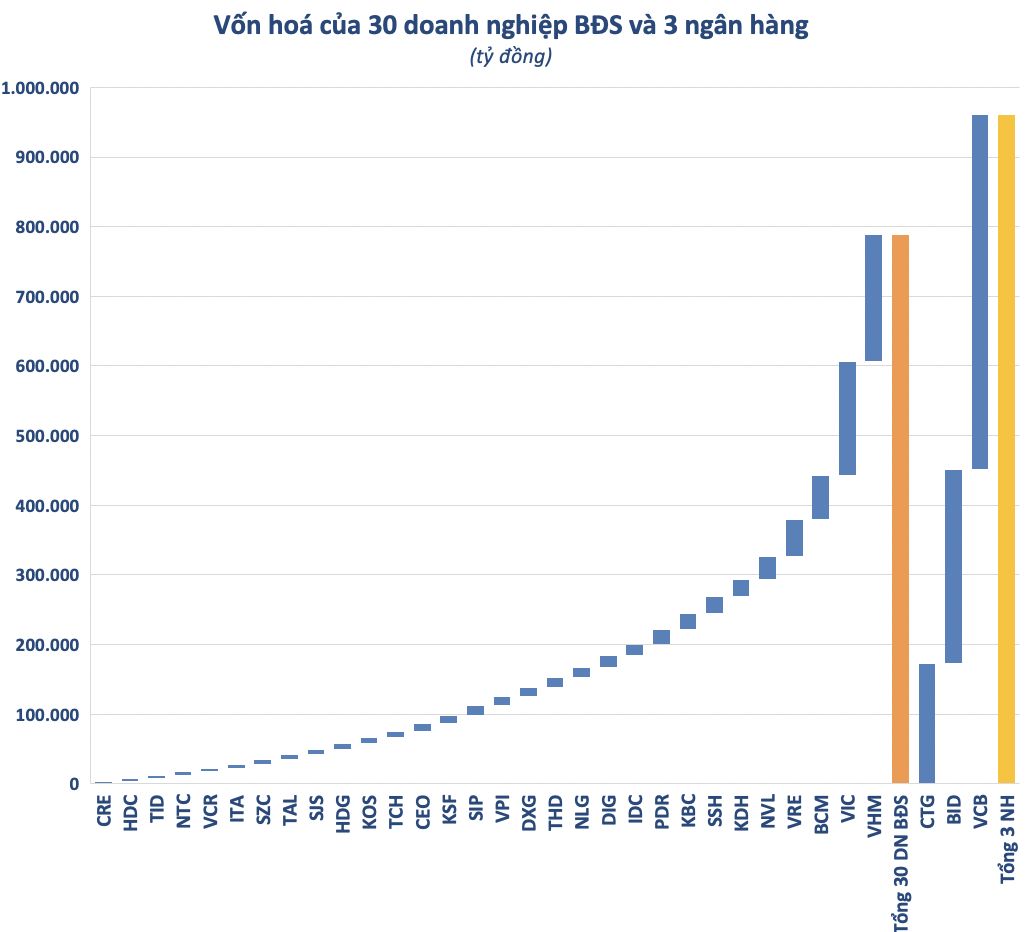

The strong performance of banking stocks has led to a significant increase in the market capitalization of these banks. Compared to the beginning of January 2024, Vietcombank’s market cap has increased by 61 trillion VND (~2.7 billion USD) to 510 trillion VND, BIDV’s market cap has increased by 31 trillion VND (~1.3 billion USD) to 278 trillion VND, and CTG has added 28 trillion VND (~1.1 billion USD) to reach 173 trillion VND.

On the other hand, the real estate sector has seen some recovery but remains far from its previous peak, with some leading real estate stocks showing clear signs of slowing down in recent times. In fact, the difficulties facing the real estate sector since 2022 have caused many real estate stocks to plummeted in value, losing billions of VND in market capitalization.

The focus is on the “Vingroup” group of stocks – which account for nearly half of the entire real estate sector’s market capitalization – which has started a corrective phase since the beginning of 2022. By mid-August 2023, the successful IPO of VinFast on the US stock market, coupled with favorable business results, helped boost the stock prices of VHM and VIC in a short period of time.

However, after the period of rapid growth, these stocks also followed the overall market trend and started to decline. Currently, Vingroup’s market capitalization is only 163 trillion VND, while Vinhomes’ market cap is 182 trillion VND. These figures have dropped significantly compared to the peak period at the end of 2021.

To highlight this contrast, if we combine the market capitalization of Vietcombank, BIDV, and Vietinbank (~960 trillion VND), it has already surpassed the market capitalization of the top 30 largest real estate companies (~788 trillion VND). In a broader perspective, the market capitalization of the three state-owned banks has also “exceeded” the entire market capitalization of real estate companies listed on the stock exchange (~852 trillion VND).

In reality, the Vietnamese stock market has become somewhat imbalanced with the dominant share of real estate and banking stocks. In the past, the banking and real estate sectors were often evenly matched in terms of market capitalization. However, since the second half of 2021, more and more “headwinds” have appeared, causing the real estate sector to lose its momentum.

Recalling 2022, especially the second half of the year, the market experienced a downturn due to reduced liquidity, a credit crunch for businesses, and a decline in equity and customer deposits, which weakened real estate companies and real estate stocks.

However, starting from 2023, the government and related ministries and agencies have introduced a series of supportive policies to tackle difficulties and boost confidence in key projects. Low-interest rates and a more favorable legal framework have created expectations and a strong recovery for real estate stocks.

Despite these “boosting” measures, the short-term prospects of the real estate industry remain uncertain as companies still face difficulties related to fundraising and project progress that may not meet expectations due to legal issues. This is also one of the reasons why real estate stocks have not yet escaped the current downturn.

For the banking sector, after a long period of being constrained by high bad debt and low credit growth, the “king” stocks have shown signs of a comeback as the tightening measures are gradually changing towards a more positive direction.

2024 Outlook for Banking and Real Estate

Although 2024 is still expected to be a challenging year for the banking sector in terms of asset quality, SSI Research believes that the situation will improve compared to 2023 thanks to reduced capital costs and improved pre-provision operating profit (PPOP), which helps banks create a better provisioning buffer.

In the basic scenario, SSI Research predicts that GDP growth could recover within the range of 6.0% – 6.5%, with average interest rates remaining at their lowest level in recent years and the State Bank of Vietnam (SBV) being flexible in terms of recognizing and provisioning for bad debt. According to estimates, the 2024 loan growth of the banks in the research scope is expected to reach 15.4% year-on-year, a better growth rate than the 4.6% in 2023.

KBVS Securities also expects that the low-interest rate environment at the end of 2023 will continue in the following year, driving credit growth and improving capital costs for banks. The projected credit growth for 2024 is expected to remain around 12-13% in the context of a moderate overall economic recovery, with differentiation between banks depending on their credit room.

Moreover, KBVS Securities believes that the P/B ratio of the entire sector has reached a low level (1.4x), approaching the lowest point in 2020 and 2022. While the banking sector may still face some difficulties in the near future, the research team believes that the overall picture of the sector has shown enough bright spots to justify higher valuations for stocks in this group.

Regarding the real estate sector, ACBS Securities believes that although the real estate industry in 2024 has advantages from the continued low-interest rate environment and increased investment in infrastructure and supportive laws, debt repayment pressure and the development of real estate companies may continue to face difficulties due to over 125 trillion VND of corporate bonds that will mature in 2024, the highest amount in 5 years. In addition, the lengthy project approval process, prolonged land clearance process, and rising compensation costs could lead to faster housing price growth than personal income growth.