Despite the volatile market, BCM stands firm as a leading company in the market. It had the strongest increase of 5.2% in the VN30 group, closing at a price of 65,300 VND per share. GVR, HDB, MWG, OCB, VHM, VGC followed behind. In the context of large stocks, other stocks in the VN30 basket came to the rescue and offset the adjustments of the banking stocks.

BCM (Becamex IDC) increased its price as it recently raised 1.3 trillion VND through its issuance of 5-year bonds with an annual interest rate of 12%. These bonds are non-convertible, without warrants, and are backed by collateral. The collateral consists of land rights in Hoa Phu Ward, Thu Dau Mot City, Binh Duong Province.

Prior to that, on December 20, 2023, the company successfully issued BCMH2328002 bonds worth 406 billion VND. The maturity date is October 6, 2028. Therefore, in just over a month, Becamex IDC has raised 1.706 trillion VND through its bond channel. The bond debt of BCM has now exceeded 12 trillion VND.

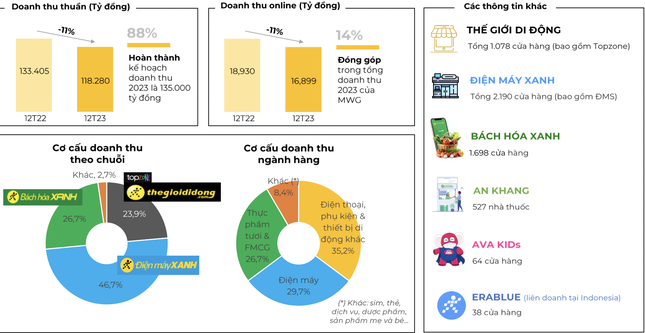

MWG, owned by Mobile World Group, was one of the market leaders, despite the company’s not-so-positive business results for 2023. In Q4 2023, MWG closed nearly 200 of its The Gioi Di Dong and Dien May Xanh stores. By the end of 2023, The Gioi Di Dong (including Topzone) had 1,078 operating stores, and Dien May Xanh had 2,190 stores.

Financial performance of The Gioi Di Dong in 2023.

Throughout 2023, The Gioi Di Dong achieved consolidated revenue of 118 trillion VND, a decrease of 11% compared to the same period in 2022, and completed 88% of its annual plan. Online revenue reached nearly 17 trillion VND, a decrease of 11%, contributing 14% to the total revenue. The company has not disclosed its profit. Notably, in December 2023, the BACH HOA XANH store chain achieved breakeven. MWG expects this chain to generate net profit in 2024.

As for large stocks, a consensus has yet to be found, while smaller stocks in various sectors unexpectedly rose. HBC, TV2, DRC, HII, LIX, VPG, CSM hit their price ceilings. PC1 continued its strong upward trend after diluting its major shareholder. The BEHS group has completely divested all of its capital in PC1. BEHS Joint Stock Company recently announced the successful sale of more than 53.9 million shares, accounting for 17.32% of PC1’s capital within the period from January 22-24.

In addition to the “blockbuster” transactions at PC1, the approaching Lunar New Year also saw some business leaders selling shares, such as NLG and HSG. In particular, Mr. Tran Ngoc Chu continued to register to sell 1.5 million HSG shares, with the purpose of rearranging personal finances. The transaction is expected to be carried out from February 1 to March 1 through matching orders on the exchange and/or agreements…

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)