As one of the top 4 coffee exporters in Vietnam, Mr. Phan Minh Thong, CEO of Phuc Sinh Joint Stock Company, recently shared his insights about the coffee industry, particularly after a year of significant changes like 2023.

According to Mr. Thong, “Looking back at the end of 2022, everyone in the coffee industry was hoping for a bright new year as coffee prices started to improve. After several years of fluctuating between $1,200 and $1,400 per ton, the world coffee prices increased to $1,900 – $2,000 per ton. Everyone was happy, especially the farmers as they made much higher profits.”

Shocking: Coffee supply from Vietnam is not endless

Vietnam is the world’s number one producer and supplier of Robusta coffee, which is known for its affordable price. Roasters around the world have adjusted their coffee roasting formulas by using a significant amount of Vietnamese Robusta coffee. Famous European and American coffee brands have been selling coffee at competitive prices thanks to the low-cost Vietnamese Robusta coffee.

Because of the abundant and cheap supply, coffee buyers worldwide have been happily counting on an endless source of Vietnamese coffee.

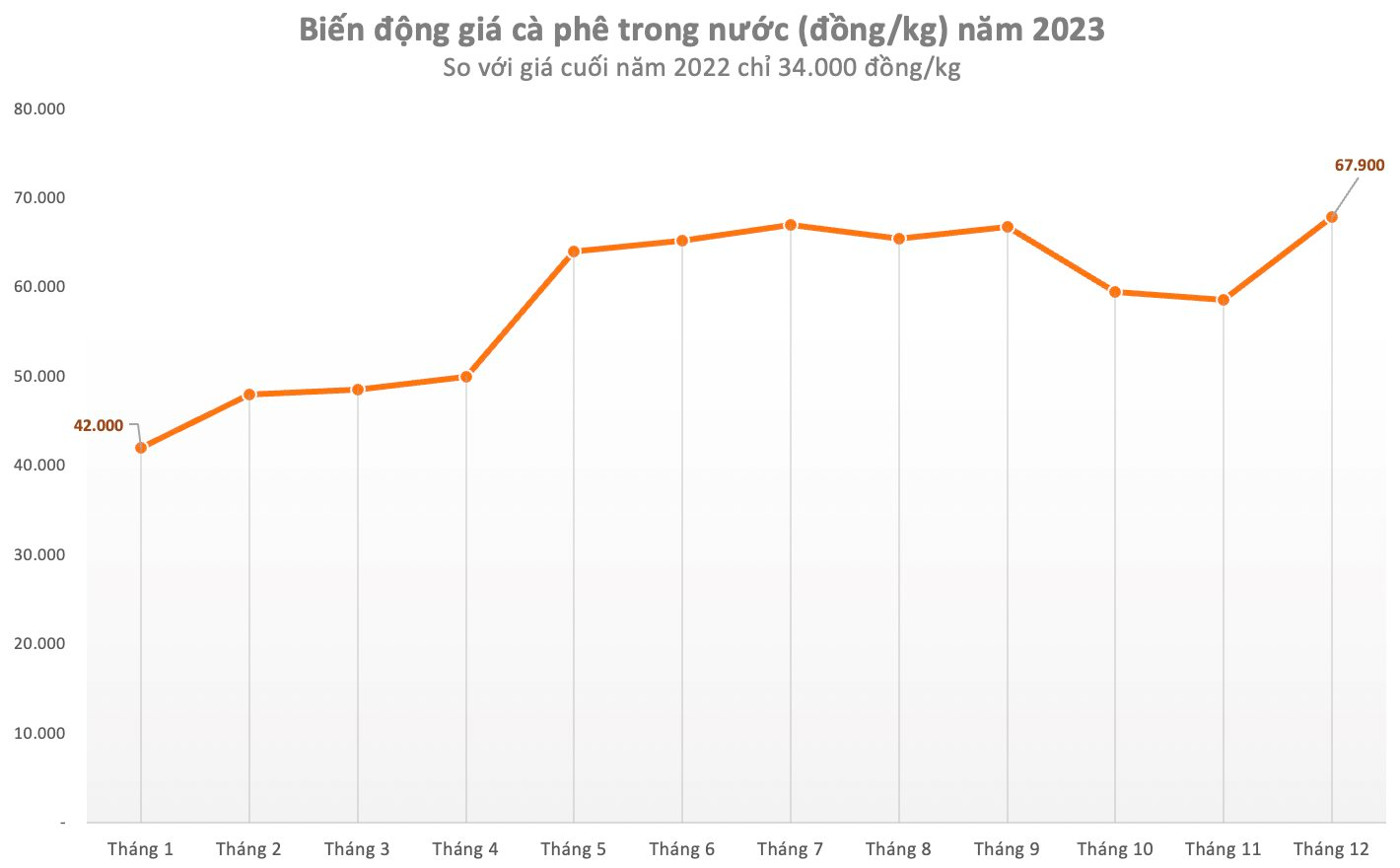

Despite an abundant coffee supply and low prices after the Lunar New Year, coffee prices continued to fluctuate, rising from 42,000 VND/kg to 48,000 VND/kg. This was the first time in 15 years that coffee prices had reached this level. Previously, coffee farmers had been selling their coffee at an average price of 34,000 VND/kg.

Farmers and small suppliers quickly sold off their large quantities of coffee when prices reached 50,000 VND/kg, which almost depleted their stock. Even traders and small suppliers sold off their inventory. According to Mr. Thong, “Not only did the big coffee buyers think the same way, but also almost all major traders and Vietnamese coffee exporters believed there was still plenty of coffee left. For many years, coffee prices had never been so high, so they sold large quantities. Everyone had the same opinion: Vietnam could not run out of coffee!”

However, after May 2023, coffee supply began to dwindle, making it much harder to buy coffee. But when it came to the idea that Vietnam was facing a coffee shortage this year, none of the coffee exporters believed it.

By the beginning of June 2023, coffee buyers started putting pressure on coffee exporters, and it was at this moment that the market was shocked to discover that Vietnam had no coffee left.

Why did this happen?

For the first time in 25-30 years, numerous surveys on coffee-growing regions were conducted. Almost all coffee warehouses were empty, without even a few bags! The question was why this happened.

According to Mr. Thong, “In over 20 years in the coffee industry, we have never seen purchasing directors, traders, and coffee brokers so exhausted. They struggled with pressure from their bosses and buyers whom they had signed contracts with,” a representative from Phuc Sinh explained.

To explain the coffee shortage, Mr. Thong highlighted the need to understand that Vietnam has experienced rapid development over the past 10 years, with real estate being one of the fastest growing sectors. Over the last 10 years, land prices have increased from 200-300 million VND/ha to 2-3 billion VND/ha. Each year, coffee farmers sell a small portion of their land. Over 10 years, this leads to a significant reduction in coffee-growing areas.

Second, after the Covid-19 pandemic, fewer people engaged in agricultural work, resulting in increased labor costs. Lastly, changing weather patterns have also caused significant fluctuations in harvests. These three factors have significantly reduced coffee production.

Throughout this crisis, exporters and suppliers have faced great difficulties. They were under pressure from large coffee buyers. According to Mr. Thong, “Not only were we, the coffee exporters, thinking this way, but most coffee traders and exporters in Vietnam believed that there was still plenty of coffee. For many years, coffee prices had never been this high before, so they sold large quantities. Everyone had this idea in mind: How could Vietnam run out of coffee?”

However, in May 2024, the coffee industry continued to face unexpected challenges. During a recent survey, everyone agreed that the 2023/2024 season had followed a familiar pattern: all parties involved in coffee business began selling hundreds of thousands of tons beforehand. From a price of 50,000 VND/kg, farmers and suppliers in coffee-growing regions sold their coffee in large quantities, pushing prices up to 52,000 VND/kg and 54,000 VND/kg.

The continuous rise in coffee prices has led to greed among coffee farmers, who refused to sell to traders at reasonable prices. Many traders engaged in speculative selling, not delivering the goods, causing chaos in the coffee industry. In the Central Highlands region, many people went bankrupt, and warehouses and companies went out of business.

As Mr. Thong recounted, “Everyone complained about not being able to get their hands on the goods, with export companies having signed contracts for thousands and tens of thousands of tons and having made down payments. However, the suppliers did not deliver the goods, resulting in extremely difficult business situations. The coffee industry was on fire, and many reputable companies shut down and did not deliver the goods.”

If this continues, it will break the coffee industry’s established supply chain that has been built over several decades. Many coffee suppliers in coffee-growing regions will continue to go bankrupt, putting pressure on exporters and causing them to face difficulties, eventually leading to bankruptcy as well.

The rise in coffee prices will also affect small-scale roasters. Many small and medium-sized roasters try to sell their products at lower prices to enter supermarket and retail systems. Despite the doubling of input costs, the selling prices have remained the same. This is a critical turning point for the small and medium-sized roasting industry – an industry that has relied on Vietnam’s cheap Robusta coffee for many years.

As Mr. Thong emphasized, “Looking back at the 20-year journey of the coffee industry, we see that large roasting and coffee distribution companies around the world have taken advantage of making enormous profits from cheap Vietnamese coffee. After making huge profits for decades, they forced coffee sellers, from exporters to traders, to accept delayed payment terms of 150 to 360 days. It may sound funny, but it’s 100% true.”

The same applies to the delivery process. When the harvest was bountiful and consumption demand was low, they were willing to pressure exporters to deliver late, even with full warehouses. They forced them to delay delivery for 3 months to a full year. If they kept delivering, these companies would not make payments and claimed that their warehouses were full and people in their home country were cutting expenses. But when the opposite occurred, and they needed the goods, they would urgently demand them from us.

Doing business was already difficult, but now it is even more challenging. Export companies can do nothing except accept and suffer losses without any compensation.