The latest statistics from FiinRatings show that as of February 5, 2024, the corporate bond market recorded 4 issuance transactions with a total value of VND 6.45 trillion from 4 companies.

These 4 companies include: Ho Chi Minh City Infrastructure Investment JSC (CII) issued VND 2.8 trillion convertible bonds with a 10-year term at an interest rate of 10% per year for the first 4 quarters and then floating at a premium of 2.5% higher than the reference interest rate. The bondholders have the right to convert into shares at a price of VND 10,000 per share.

Vingroup (VIC) successfully issued VND 2 trillion bonds to the public with a 3-year term and a fixed interest rate of 15% per year for the first year and then floating at a premium of 4.5% higher than the reference interest rate.

Investment and Development of Transportation Corporation, a non-public company, successfully issued VND 450 billion private bonds with a 3-year term and an interest rate of 6.5% per year. BOT Ninh Thuan One Member Co., Ltd. issued VND 1.2 trillion private bonds with a term of 9.75 years and an interest rate of 10.5% per year.

Among them, the bonds of CII, with the characteristic of convertible into shares, attracted the participation of more than 4,000 domestic individual investors, accounting for 80.14% of the total offering volume.

Although the issuance value in January 2024 is modest, compared to the same period in 2023, the total issuance value is also at a level of VND 490 billion. Looking back at the stages of 2021 and 2022, the total successful offering value in January 2024 is still too modest, as it is in a very active stage with a corresponding issuance value of VND 10.4 trillion (2021) and VND 19.7 trillion (2022).

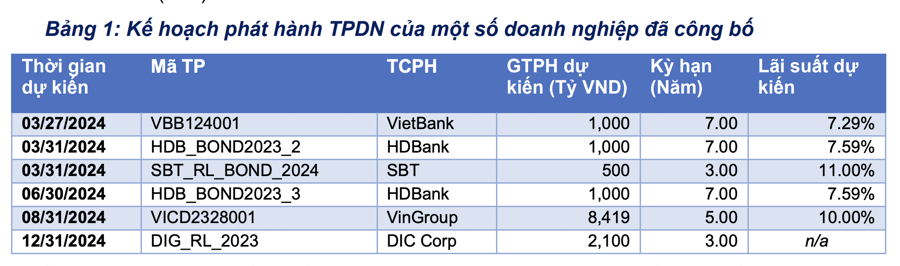

Based on the current information, it is observed that several companies plan to issue bonds in the near future, mainly banks such as HB Bank, VietBank, and two real estate companies including Vingroup and Investment and Development Corporation (DIG). The total issuance value is more than VND 10 trillion.

Looking further into 2024, although it is difficult to forecast the expected issuance value for the entire year, FiinRatings still believes that the prospects for the corporate bond issuance channel in 2024 will be more active than in 2023 for the following reasons.

First, banks are actively issuing bonds to improve capital capacity. Although this group has not announced all their plans, most banks will have plans to raise capital through corporate bonds this year in order to supplement debt capital to meet the credit growth target in 2024 (expected at 15% for the whole system for 2024) as well as in the following years.

In addition, supplementing bank bond capital will increase Tier 2 capital and contribute to better meeting the capital adequacy and risk management targets of the SBV, for example, requirements for the ratio of short-term capital use for medium and long-term lending.

Second, low interest rate environment and favorable conditions for long-term fundraising: To attract investors, most current bond offerings have floating interest rate mechanisms and are indexed to the reference rate of major banks. In addition, the domestic interest rate environment is forecasted to remain low, while international interest rates are expected to decrease in the coming years.

This will be a major catalyst for industries and businesses in need of long-term capital to consider issuing bonds in preparation for business expansion, especially when the macroeconomic context has seen strong recovery in the last few months of 2023.

Third, expanding bond supply: Not only commercial banks, consumer finance companies will also enter a new growth phase after a declining year of 2023, as issues related to the bad debt recovery of many units have been resolved.