HAG has announced that it has paid off VND 357.5 billion in principal of HAGLBOND16.26 bonds on February 2, 2024. The next payment will take place in Q1/2024.

It is known that the HAGLBOND16.26 bond series was issued on June 30, 2016, with a maturity date of December 30, 2026 (a 10-year term).

Recently, on January 15, HAGL also made a payment of VND 84.5 billion in principal for this bond series. The payment source was obtained from the liquidation of assets and the sale of HNG shares.

Prior to that, on November 28, 2023, HAGL made a payment of VND 200 billion in principal for the aforementioned bond series, thanks to the amount received from the collection of debts from Hoang Anh Gia Lai International Agriculture Joint Stock Company (code: HNG).

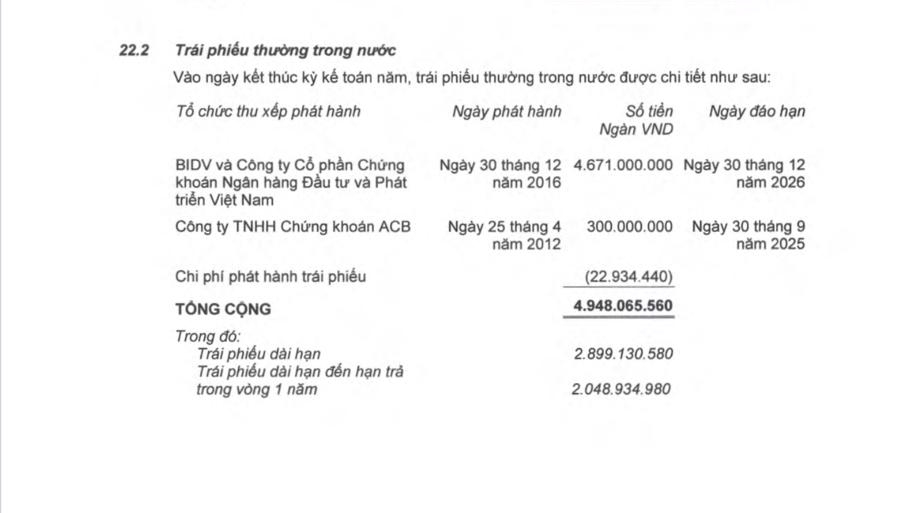

By December 31, 2023, HAGL had incurred VND 4,948.1 billion in loan debts, 100% of which were bond debts at 2 issuing organizations, namely BIDV Bank, BIDV Securities Corporation (BSC), and ACB Securities Corporation (ACBS), a decrease of VND 592.2 billion compared to the beginning of the year. Among them, long-term bonds accounted for VND 2,899.1 billion, and short-term bonds due for repayment in 2024 amounted to VND 2,048.9 billion.

In addition, HAGL also had interest expenses to be paid amounting to VND 3,586.5 billion, an increase of VND 504.2 billion compared to 2022.

Related to the bond repayment plan, in the capital utilization plan of VND 1,300 billion expected to be raised from the sale of 130 million shares at an offering price of VND 10,000 per share, HAGL stated that it would allocate VND 346.7 billion to prepay the entire principal and interest of the HAG2012.300 bonds issued by the company on June 18, 2012, at ACB Securities.

Regarding the business results: According to the consolidated financial statements for Q4/2023, the business results of the Company showed positive changes and somewhat addressed the reasons for the stock being placed under alert. Specifically, the after-tax profit of the parent company in 2023 reached VND 1,709 billion; The total after-tax profit attributable to shareholders in 2023 reached VND 1,817 billion.

Regarding investment in projects: The Company is still focusing on developing its core products, including bananas, durians, and pigs.

Regarding financial restructuring: In 2023, the Company liquidated some non-performing assets and financial investments to partially repay the BIDV bonds, thereby significantly reducing interest expenses and partly generating cash flow, maintaining stable business operations in the context of a difficult market.

HAG stated that with the optimistic signals and potential projects mentioned above, the Company is confident that its upcoming business activities will achieve many positive results, gradually reduce and eliminate accumulated losses, and address the reasons for the stock being put on alert.

At the end of the trading session on January 2, the stock price of this company fell to VND 14,000 per share.