Comprehensive land use planning at three levels

The Land Law of 2024 approved by the XV National Assembly aims to institutionalize Resolution No. 18-NQ/TW dated June 16, 2022 of the Party Central Committee on “continuing to renew and improve the system and policies, enhancing the effectiveness of land management and use, creating momentum to make our country a high-income developed country”.

The issuance of the Land Law is a key task in the direction of improving the land system and policies in line with the socialist-oriented market economy with the goal of creating a legal framework for the efficient, sustainable and resource-saving management and use of land.

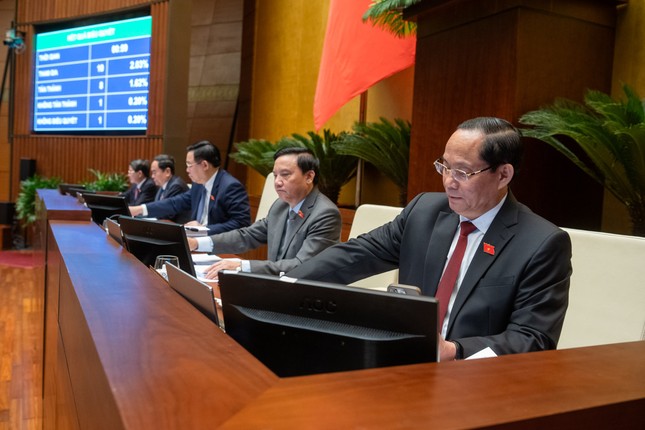

The leaders of the National Assembly participate in the voting of the revised draft Land Law

The Land Law of 2024 consists of 16 chapters and 260 articles, focusing on improving regulations and policies on:

– Building a comprehensive land use planning system at three levels; renewing the process, content and methods of land use planning.

– Land allocation, land leasing, land use purpose changes; carrying out land allocation and land leasing mainly through land use rights auction, bidding for land use projects; specifying strict cases of land allocation and land leasing without land use rights auction and bidding for land use projects; specifically regulating cases of one-time payment land rentals that are suitable for the nature and purpose of land use to ensure stable revenue.

– Authority, purpose, scope of land recovery, specific conditions and criteria for land recovery for socio-economic development for national and public interests; land compensation, support, resettlement, land recovery for national defense, security, socio-economic development for national and public interests.

– The mechanism for determining land prices based on market principles, inspection and supervision mechanisms of the central government and People’s Councils in building land price lists…

– Land for ethnic minority people; land managed and utilized by agricultural and forestry companies.

– Granting land use rights certificates, ownership rights to houses attached to land.

– Multi-purpose land use regime; agricultural land combined with commercial and service activities; defense and security land combined with production labor activities, economic construction; religious land combined with other purposes; multi-purpose water-use land; coastal encroachment activities…

– Delegating authority to localities in land management and use within their territories, while establishing inspection, supervision, and inspection mechanisms at the central level through regulations on a centralized and unified land information system and land database; promoting administrative reform, digital transformation in land management and use; ensuring centralized, unified management, operation, connection and sharing of information from central to local levels.

Safe and sound credit organization system

The Credit Organizations Law of 2024 consists of 15 chapters and 210 articles, an increase of 5 chapters and 47 articles compared to the current Credit Organizations Law, focusing on improving regulations and policies on:

– Organization, management, operation, risk management of credit organizations; preventive measures, restrictions on manipulation, dominance of credit organization activities through regulations on strict standards, conditions for managers, executives of credit organizations; enhancing tasks and powers of the Management Board, Members’ Council, Control Board of credit organizations…

– Credit organization activities that meet the requirements for ensuring safe operation while creating conditions for credit organizations to provide diverse products and services, including supply through electronic means; supplementing regulations on controlled testing mechanisms in the banking sector.

– Organization and activities of policy banks to assert their legal status, creating conditions for the development of these banks.

– Dealing with weak credit organizations, such as regulations on early intervention, special control, special lending by credit organizations based on enhancing their responsibility, ensuring the safety and soundness of the credit organization system.

– Dealing with bad debts, collateral assets based on legalizing some appropriate contents in Resolution No. 42/2017/QH14 of the National Assembly.

– State management, inspection, examination, supervision in the banking sector.