The stock market started the last week of the year of Quy Mao unexpectedly excited. The banking group played a leading role in pulling the VN-Index to close the session on February 5, up 13.51 points (+1.15%) to 1,186.06 points.

The trading was quite active with improved liquidity compared to the previous session, with a trading value of nearly 17,000 billion VND on HoSE. However, foreign trading was a downside when net selling was 93 billion VND across the market.

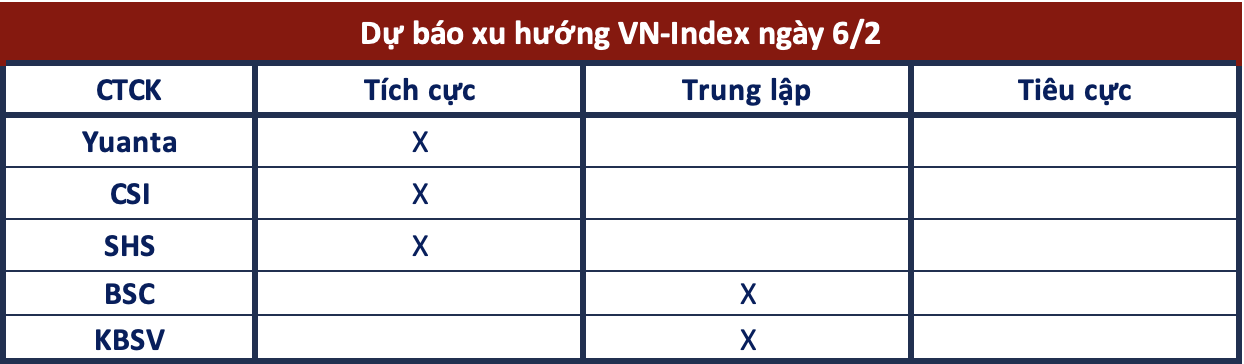

Opinions about the market in the coming sessions are mixed:

Continuing the upward trend

Yuanta Securities: The market may continue its upward trend in the next session. The positive point is that the market shows signs of entering a period of strong positive volatility, and if the market maintains its upward momentum in the next session, the VN-Index may completely surpass the resistance level of 1,187 points. This is the old peak in January 2024.

In addition, the short-term sentiment indicator continues to decline, showing that the market is still diverging between stock groups and money mainly flowing to large-cap stocks. The short-term trend of the general market is still UP, especially the short-term trend of the banking group is assessed as more positive, so investors should pay attention to this group of stocks in the short term.

CSI Securities: In addition to the increase in volatility, the liquidity is also a noteworthy point when the trading volume is high, with the traded volume exceeding the 20-day average. This is a positive sign that the upward trend still shows signs of sustainability in the coming sessions and is likely to quickly approach the resistance level of 1,200-1,210 points.

However, CSI believes that this resistance level is currently very close, so despite the short-term optimistic signal, there is still potential risk when stocks return to the account. Therefore, we maintain a selling attitude and take profit when the VN-Index approaches the resistance level.

Aiming for the resistance level of 1,200 points

SHS Securities: From a short-term perspective, the market in the first upward wave is to move within a wide consolidation channel, and the VN-Index is gradually approaching the short-term psychological resistance level of 1,200 points once again. With a positive view, SHS believes that the short-term movement of the VN-Index will aim for the short-term psychological resistance level of 1,200 points and may have further consolidation oscillations to strengthen internal strength before being able to break through this threshold.

Continued fluctuations

BSC Securities: The VN-Index on February 5 had quite positive developments and closed the session at 1,186.06 points, up more than 13 points compared to the previous session. The market trend is quite positive after nearly 2 weeks of fluctuating in the range of 1,163 – 1,186 points along with the leadership of stocks with large capitalization and improved liquidity. Shaky trading sessions are still taking place as the VN-Index consolidates its trend and moves towards new high levels in 2024.

Risk of reversal

However, the VN-Index is still within the range of influence of the resistance around 1,185 points (+/- 10) and the risk of reversal adjustment needs to be noted in the coming sessions. The scenario of short-term peak formation is only minimized if the index can surpass the upper limit of the resistance zone without undergoing a clear retracement immediately after.