| EMS faces challenging business in 2023 |

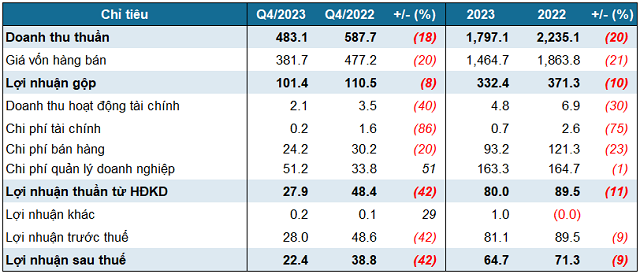

According to the financial statement for the fourth quarter of 2023, the net revenue in the last quarter of the year of the “big player” in express delivery reached 483 billion VND, a decrease of 18% compared to the same period. After deducting all costs of goods sold and other expenses, EMS had a net profit of over 22 billion VND, a decrease of 42%.

Explaining the decline in results, EMS stated that due to the complex and unstable global economic situation, the domestic market is fiercely competitive, making the company’s business operations and customers face many difficulties. EMS also mentioned that it had made efforts to reduce service costs, but due to the emergence of a large amount of overdue receivables, leading to an increase in the provision for difficult-to-collect receivables, the business results did not meet expectations.

For the whole year of 2023, net revenue decreased by 20% to 1,797 billion VND, the lowest in 5 years, mainly due to the core operation of postal delivery services decreasing by 21% to 1,608 billion VND, accounting for nearly 90% of total revenue. Agency services and other services decreased slightly, without significant impact.

However, the gross profit margin improved by 2 percentage points to 18.5%, helping EMS‘s gross profit decrease to 322 billion VND. Another positive point is that selling expenses decreased by 23% to 93 billion VND, due to significant cuts in labor costs and other cash expenses.

Finally, EMS had a pre-tax profit of 81 billion VND, a decrease of 9% (achieving 90% of the annual plan) and a net profit of nearly 65 billion VND, also decreasing by about 9%, marking the lowest net profit level in the last 3 years of the company.

|

Business results for the fourth quarter and the whole year of 2023 of EMS

Unit: billion VND

Source: VietstockFinance

|

At the end of the fourth quarter, EMS‘s total assets were nearly 676 billion VND, a decrease of 7% compared to the beginning of the year. The majority of this is the value of short-term receivables of over 413 billion VND (accounting for 61%), a decrease of 23%. In addition to external customer receivables of over 216 billion VND, EMS also generated receivables of over 205 billion VND with related parties, including nearly 200 billion VND receivable from Vietnam Post Corporation (VNPost) – the parent company owning 84.14% of EMS‘s capital.

In the context of difficulties in core business operations, EMS has strengthened financial investment, with a 30% increase in short-term deposits to over 33 billion VND and a new generation of long-term deposits of 76 billion VND.

In terms of capital structure, EMS has nearly 374 billion VND of payable liabilities, mainly to pay employees nearly 82 billion VND and short-term payable expenses nearly 61 billion VND, while no borrowing occurred.