Most stock market participants tend to desire quick wins, meaning they want stocks to increase in value right after placing a buy order.

The demand from the majority of market participants has driven service providers to respond. Investment funds publish monthly investment performance data, and some even do it daily. During the beginning of the month or year, many analysts also make regular recommendations for stocks worth buying to earn profits in that month or year.

However, determining the future price of a stock in a specific short-term period is a challenging timing game. There is a wise saying on this topic:

“Time in the market is better than timing the market.”

Investment legend Warren Buffett has also said that the key factor in his success is living long enough to enjoy the benefits of compound interest. If you are not a genius but aspire to achieve similar results to the veteran, then emulating proven models is worth considering.

“You can’t produce a baby in one month by getting nine women pregnant,” Warren Buffett once said. No matter how talented you are, some things take time to produce results.

Master investors always advise against chasing short-term gains and instead focus on maintaining a long-term perspective and approach. That’s why, when thinking about investing in the early days of the Year of the Snake (2024), you should try projecting a longer-term vision for the next few years, such as until the Year of the Goat (2027), for example.

So, what does a long-term approach bring?

Long-term investment encourages a more structured and serious approach to market participation. This is because holding stocks for a long time cannot be seen as only a green or red dot on the price chart, but must be seen as representing ownership rights in a business. Therefore, the effectiveness of your investment will be linked to the performance of the companies.

Being serious in analysis activities will certainly help you avoid common pitfalls, such as stocks of shell companies or overoptimistic attitudes that lead to significant damage to a portfolio.

Secondly, long-term investment helps eliminate emotions from the investment equation to a considerable extent. If you participate in the market long enough, you will understand that emotional control is a prerequisite for realizing profits. However, this is easier said than done, and not everyone has the ability to remain calm when faced with stock price fluctuations – the ups and downs of one’s own asset value.

While stock prices change every second, the fundamental aspect of a business does not fluctuate at the same frequency. Staying focused on the long-term aspects of a business will help you separate yourself from the emotional frenzy on the trading floor and avoid being caught up in the market crowd’s psychological fluctuations. If you are an individual investor viewing stocks as a means of making money on the side, this also helps limit the influence of stocks on your main work and life.

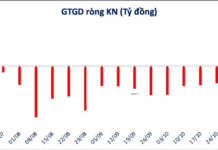

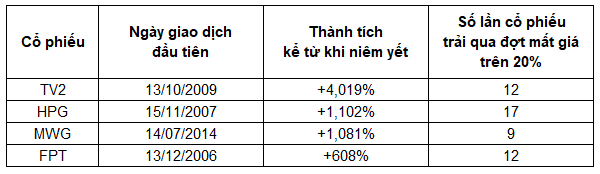

Super stocks also have “rainy days.”

Even star stocks in the long-term experience periods of steep declines. How do you hold on to them if you are too concerned about market volatility?

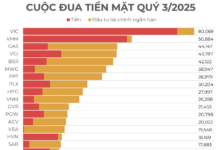

Data as of the close of January 4, 2024. Source: Vietstock Finance

|

Another issue is that you may miss out on large profits if you insist on timing market participation. Timing stock trades is a task that very few can consistently maintain accuracy in. Meanwhile, if a person misses the few periods of strongest price increases for a stock in particular or for the market in general, then it will be very difficult to catch up to the average return. Instead, try to exist in the market for a long time, which will create conditions for the compounding effect to do its job well.

Finally, long-term investment creates a significant cost advantage. Compared to tradespeople, investors naturally save a bunch of transaction fees. In addition, in Vietnam, personal income tax on stock transactions is applied to the transfer value of the sale, not on the profit generated from the price difference between buying and selling. That means whenever you sell stocks, you have to pay tax, whether the trade is profitable or not. In contrast, long-term stock buyers and holders, even with very large profits, only pay a small tax (0.1%) calculated on the transaction value of the sale.

As can be seen, just pursuing a long-term approach will help you avoid unintentionally participating in the game of losers – where profit is required just to break even due to considerable transaction costs and taxes.