Experts and organizations are expecting a brighter 2024 with many factors supporting economic growth. Many policies and laws have been passed in various sectors, helping to stimulate capital flow in the economy and support businesses in recovering production and business activities.

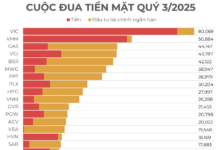

The past year has brought many surprises in the flow of capital across investment channels. While deposits in banks reached record highs and gold prices peaked at 80 million VND per tael, the stock market remained stagnant and the real estate and bond markets were almost frozen. Normally, the process of capital disbursement slows down near the Lunar New Year and then increases again after the holiday. So this year, after the Lunar New Year, the question is whether the flow of money will maintain its momentum and prioritize which investment channel, as there seems to be no sure bet?

The stock market will still attract investment

Mr. Tran Truong Manh Hieu – Head of Strategy Analysis Department of KIS Vietnam Stock Exchange believes that except for the stock market, investors will be hard pressed to invest in other channels, as almost all other channels such as real estate and bonds are still difficult and have not shown signs of recovery.

Mr. Tran Truong Manh Hieu

|

First, when buying real estate, there are two methods: Investors need to have a large capital or borrow. However, investors with their own capital have already invested in the past 2 years. This capital is still available, but in smaller amounts.

For those who borrow money to buy real estate, investors will have to consider a lot of things. Deposit interest rates at banks have decreased significantly, but lending rates, although lower, are still around 13-14% per year. Moreover, there is no certainty to say that the real estate market will recover in the next 3-4 years. The real estate market also depends a lot on the bond market, and this year is the maturity period for many bonds. Therefore, investing in real estate through this channel will not be widespread.

Second, the gold market is being “squeezed”. Domestic gold prices depend on the exchange rate and the global gold price. The world gold price still tends to increase, but the exchange rate after the Lunar New Year is likely to decrease due to the volume of remittances to Vietnam and seasonal factors. After Q1, the exchange rate usually decreases, which will affect the world gold price and subsequently influence domestic gold prices. So Mr. Hieu thinks that money will not flow into gold either.

Third, deposit interest rates at banks are currently only 5-6% per year. This interest rate will not match the potential profits that can be achieved in the stock market in 1-2 sessions. Therefore, the expert believes that the stock market will still be the most attractive investment channel after the Lunar New Year.

Savings deposits still have appeal

Mr. Phan Dung Khanh – Director of Investment Advisory Maybank Investment Bank believes that savings deposits at banks will still be very attractive in Q1.

Mr. Phan Dung Khanh

|

In 2023, the amount of money poured into bank savings reached the highest level in history, mainly in November and December 2023. Therefore, Mr. Khanh predicts that the trend of money flowing into banks and savings deposits will continue into January 2024 and last until the end of Q1.

Afterward, savings deposits may lose their appeal, with the earliest decline in Q1 and early Q2, when money will flow into riskier channels such as stocks, corporate bonds, and real estate.

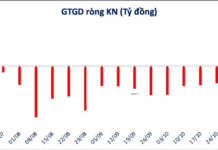

Recently, the stock market has rebounded, but liquidity is low and money flow is weak. Mr. Khanh believes that the selling pressure in the recent phase was not too strong, so even though the money flow was very weak, it was still able to push the market up. The market has increased, but the money flow is concentrated in certain groups. For example, the banking sector does not have a distributed money flow, but is concentrated on a few stocks that have a large impact on the market.

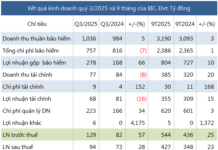

Regarding the stock market, Mr. Khanh predicts that after the Lunar New Year, sectors that may receive more support will be related to the finance and banking industry, but in narrow segments such as securities, insurance, followed by real estate and consumer goods, transportation. The technology industry will also be noted, but it will focus on new technology or traditional companies applying new technology. In addition, the energy sector, mainly green energy and renewable energy, will receive more support.

Waiting for market developments

From the perspective of a long-term stock investor, Ms. T.L believes that money flows will focus on the stock market after the Lunar New Year. This is an investment channel that has the potential to generate good returns in 2024, after gold prices have heated up in recent times. Meanwhile, the real estate market needs more time to recover. However, as an individual investor, Ms. T.L will consider disbursement in parts, as the market is still going sideways with a wide range rather than an upward trend like the period from May to August 2023. Moreover, although Vietnam’s macroeconomic factors have many positive aspects, it is necessary to closely observe the fluctuations of the global economy and politics to make the right investment decisions.

PGS.TS Nguyen Huu Huan

|

PGS.TS Nguyen Huu Huan – Lecturer at University of Economics Ho Chi Minh City (UEH) believes that investment flows will wait for market developments. Specifically, the expert predicts that most of the money will still be in banks and waiting for more positive signals from the stock market and the real estate market. Money will continue to explore these two markets.

If the economy grows better in 2024, the stock market also has the opportunity to grow, as business results will improve and the valuation of businesses will be lower than the current level. When the P/E ratio is low, it will increase the attractiveness for investors compared to the Vietnamese stock market.