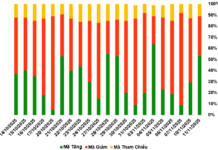

According to the statistics of VNDirect Securities, the stock market tends to increase about 5 days before and after the Lunar New Year holiday. In the past 23 years, the VN-Index has increased in points after Tet for 14 years. However, the return on investment of the market before the holiday is usually higher than that after Tet.

In terms of market valuation, VNDirect believes that the valuation is still attractive and the financial results for Q4 2023 have been announced with a significant recovery, which helps to improve market sentiment. The price-to-earnings ratio (P/E) of the VN-Index in January 2024 is around 7%, lower than in December 2023, mainly due to the upward trend of the VN-Index in January 2024.

The average 12-month deposit interest rate of commercial banks in January 2024 continues to decline. In general, the difference between the P/E of the market and the deposit interest rate remains high. In the context of this high difference and optimistic profit growth prospects of listed companies in 2024, VNDirect expects that domestic capital will continue to flow into the stock market in the coming time.

Statistics of VN-Index before and after Tet in the past 23 years (data: VNDirect)

According to the analysis team of VNDirect, market liquidity can improve positively in the second half of February 2024, when individual investors gradually return to the market after the Lunar New Year holiday. The increase in domestic capital flow can drive the upward movement of the VN-Index towards the psychological resistance zone of 1,200 – 1,220 points this month.

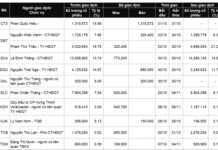

The investment themes in February will focus on the following sectors: banking, ports & maritime transport, and consumer-retail. The Evergrande event poses a potential risk to the international financial market and is a factor to be watched in February.

In the long term, according to the latest policy meeting, the US Federal Reserve (Fed) has lowered expectations for rate cuts in March. The scenario of the Fed starting to cut interest rates from the May meeting is currently favored, with over 90% of the market trusting this scenario (according to a survey by CME Group). This points to a more neutral scenario, in which the Fed starts cutting interest rates from May, and will implement at least three interest rate cuts in 2024.

In the securities market strategy report for February, SSI Securities noted that the positive signals in January are maintained and the VN-Index temporarily approaches the short-term resistance zone of 1,205-1,210 points.

SSI recommends some investment themes in the early months of the year, including: businesses that have reached a business status that has bottomed out and stocks that have rebounded slower than the overall market; businesses that maintain a sustainable growth rate in core activities; information in the shareholder meetings with capital increase plans/business expansion plans of companies after the recovery; businesses that will benefit from the monetary/fiscal support policies of the Government and newly completed laws.

KBSV predicts that the market may face significant adjustment pressure at the resistance zone of 1,185 – 1,205 points and then come down to retest the support zone around 1,145 points. However, the VN-Index can also maintain its upward momentum to break through the zone of 1,185 – 1,205 points before making a short-term adjustment.