MSCI has just announced the February review list with the most important indexes of the frontier market MSCI Frontier Markets Index.

Specifically, MSCI has added 3 Vietnamese stocks to the MSCI Frontier Markets Index, including FTS, NKG, and SJS. In the opposite direction, no Vietnamese stocks were removed from the index.

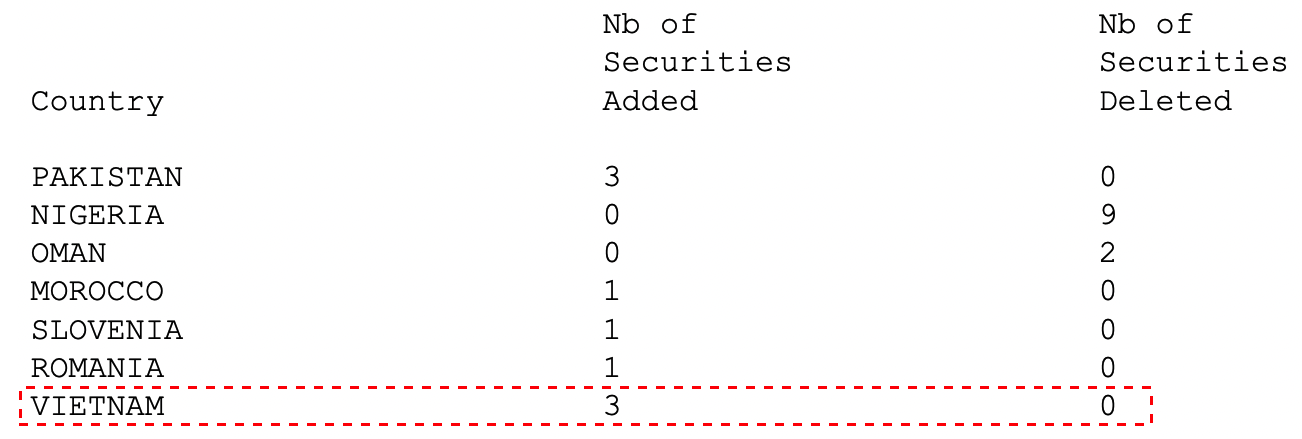

In addition to the 3 new Vietnamese stocks, the MSCI Frontier Markets Index also added 3 Pakistani stocks, 1 Slovenian stock, 1 Moroccan stock, and 1 Romanian stock. In the opposite direction, this index removed 9 stocks from Nigeria and 2 stocks from Oman. Therefore, after this restructuring, the number of stocks in the MSCI Frontier Markets Index will decrease to 209.

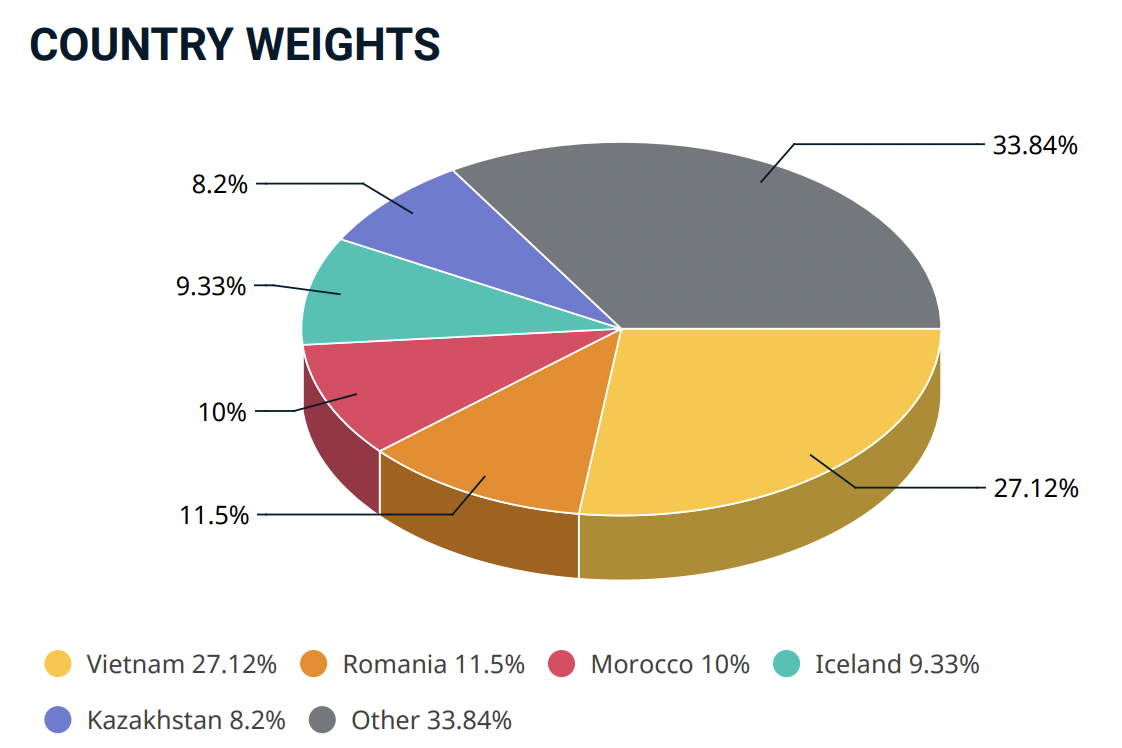

Vietnam is currently the largest market in the MSCI Frontier Markets Index. As of January 31, 2024, Vietnam’s market share in the MSCI Frontier Markets Index is 27.12%, followed by Romania (11.5%), Morocco (10%)… There are currently many large funds, with hundreds of millions of dollars in size, allocated to frontier markets (including Vietnam) based on the MSCI Frontier Markets Index.

Market share of the markets in the MSCI Frontier Markets Index as of January 31, 2024

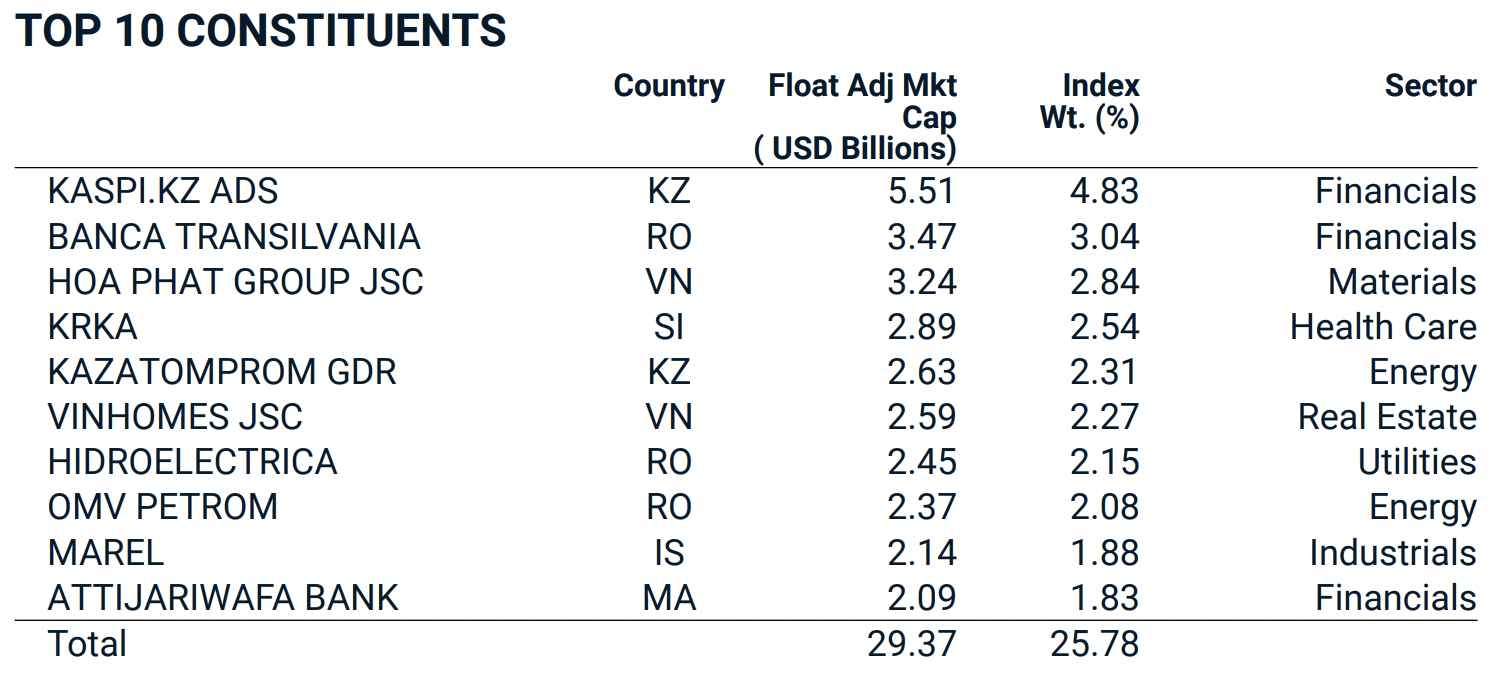

The top 10 largest stocks in the MSCI Frontier Markets Index as of January 31 include 2 Vietnamese stocks, including HPG (2.84%) and VHM (2.27%)

Top 10 stocks in the MSCI Frontier Markets Index as of January 31, 2024

Meanwhile, with the less important index set being the MSCI Frontier Markets Smallcaps Indexes, this index added 5 Vietnamese stocks, including GAS, DHA, NAF, VPH, and VTO to the list. In the opposite direction, the index removed NKG, SJS, and VPD (of which NKG and SJS were removed to add to the MSCI Frontier Markets Index).

Vietnam currently accounts for the largest share in the MSCI Frontier Markets Smallcaps Indexes with a share of 31.47%. However, no significant funds are currently disbursing into frontier markets according to this index set.

The changes of the above index sets will take effect from February 29, 2024. The next restructuring will take place on May 14, 2024.

Expectation of attracting billions of USD after being upgraded

In the latest update report, SSI Securities stated that the biggest obstacle for Vietnam for FTSE Russell to upgrade the market to an emerging market (EM) is the handling of the issue of having to pre-fund the transactions of institutional investors. While domestic individual investors have a business for lending margin to solve this problem, under current regulations, institutional investors must all pre-fund 100% before trading, which is not in line with international practices.

To address this issue, SSI can implement 2 methods. The first is the long-term solution, by applying the Central Counterparty Clearing (CCP) model. The second is the short-term solution where securities companies will provide payment support for institutional investors (Non Prefunding Solution – NPS). The Ministry of Finance plans to amend some relevant legal documents in 2024 to be able to implement the NPS model. FTSE Russell will rely on feedback from institutional investors to evaluate whether the NPS model is efficient or not.

SSI predicts that the decision to classify Vietnam into the EM category of FTSE Russell may take place as early as September 2024 (in the positive scenario) or March 2025 (in the base case scenario) and take effect 6 months later.

With the free float market capitalization of Vietnam currently around 35 billion USD – about 1/4 of Indonesia and Thailand. From there, SSI estimates that Vietnam’s proportion in the FTSE EM index is about 0.7% – 1.0% and FTSE Global is 0.1%. This could help Vietnam immediately attract about 1.7 – 2.5 billion USD when the upgrade decision takes effect.