KBSV Securities Joint Stock Company’s report states that VN-Index has had a third consecutive month of gains, rebounding from the 1,020-point level established in early November 2023 to a peak of 1,187 points in mid-January 2024.

Attractive stock accumulation zone

At the close of trading in January 2024, the VN-Index stood at 1,164 points; trading volume reached 17 billion shares, up 10.3% from the previous month. Contributing to the positive momentum in the first month of 2024 are banking stocks such as BID, CTG, MBB, and ACB…

The P/E ratio (price/earnings per share) is currently around 15.5 times; with historically low deposit interest rates and expectations of economic recovery this year, KBSV sees the market as being in an attractive range for accumulating stocks for the medium to long term.

Fluctuations of the VN-Index over the past month. Source: Fireant

In February 2024, KBSV maintained a volatile market scenario with a recovery trend driven by the positive Q4 and full-year 2023 business results. Additionally, foreign capital returning as net buyers has supported market liquidity and boosted the overall index. Despite ongoing risks related to global political tensions and exchange rates…, macroeconomic factors are providing some reassurance for investor sentiment.

KBSV forecasts that the market may face significant correction pressure around the resistance zone of 1,185 – 1,205 points, and then go down to retest the support zone around 1,145 points. However, the VN-Index may also maintain its upward momentum and break through the 1,185 – 1,205 point range before experiencing a short-term correction.

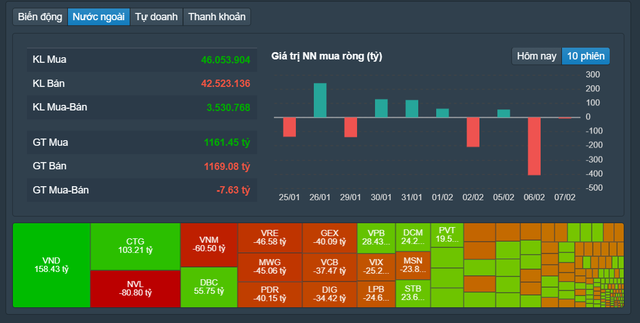

Foreign capital buying and selling value in the past 10 sessions. Source: Fireant

RongViet Securities Joint Stock Company (VDSC) estimates that the overall market P/E ratio of 13.6 times will help ease foreign pressure on the market, opening up opportunities for investors to accumulate core stocks. The expected range for the VN-Index in February 2024 is 1,160 – 1,200 points.

Which stocks to choose after the Lunar New Year?

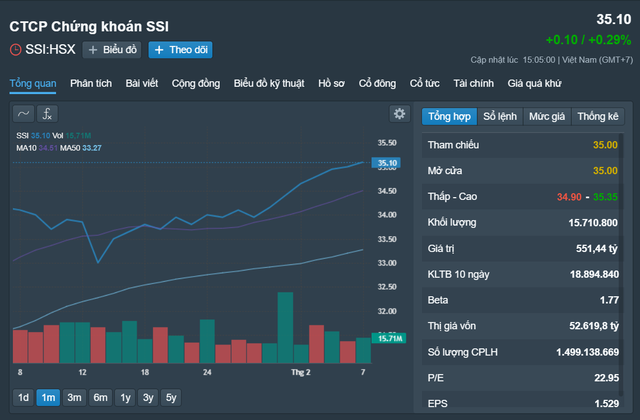

In terms of investment portfolios, KBSV recommends that investors consider SSI shares of SSI Securities Corporation with a target price of VND 38,000 due to the benefits from the declining interest rate trend. The anticipated deployment of the KRX trading system and same-day trading (T0) will also make the market more active.

Another promising stock is FPT shares of FPT Corporation, with a target price of VND 108,500. Just before the Lunar New Year holiday, FPT shares saw positive gains, bringing high expectations for investors in the opening session tomorrow, February 15.

FPT shares are highly regarded for their potential in main business areas such as foreign information technology, education, and especially the long-term driver from the semiconductor chip sector.

SSI shares are currently priced at VND 35,100. Source: Fireant

FPT shares are currently priced at VND 104,900. Source: Fireant

In addition, other potential stock choices are GVR (target price of VND 27,400/share), PVT (VND 29,100/share), PVD (VND 34,300/share), TNG (VND 25,000/share), PC1 (VND 32,600/share), CTD (VND 76,200/share), VTP (VND 75,000/share), MWG (VND 51,600/share).

VNM shares are currently priced at VND 67,600/share. Source: Fireant

QNS shares are currently priced at VND 47,700/share. Source: Fireant

For the short term, in February, investors may consider buying or selling shares of VNM of Vietnam Dairy Products Joint Stock Company and QNS of Quang Ngai Sugar Joint Stock Company.

This assessment is based on the forecast of continued cooling of certain agricultural produce prices, and the downward trend in powdered milk and soybean prices, which improves the profit margins of food and beverage companies significantly compared to the same period in 2023.