The State Securities Commission has just approved Hoang Anh Gia Lai (HAGL, HAG) for a private placement of 130 million shares. During the 10-day offering period, HAGL is required to submit a report along with a confirmation from the bank where the account was frozen to UBCK.

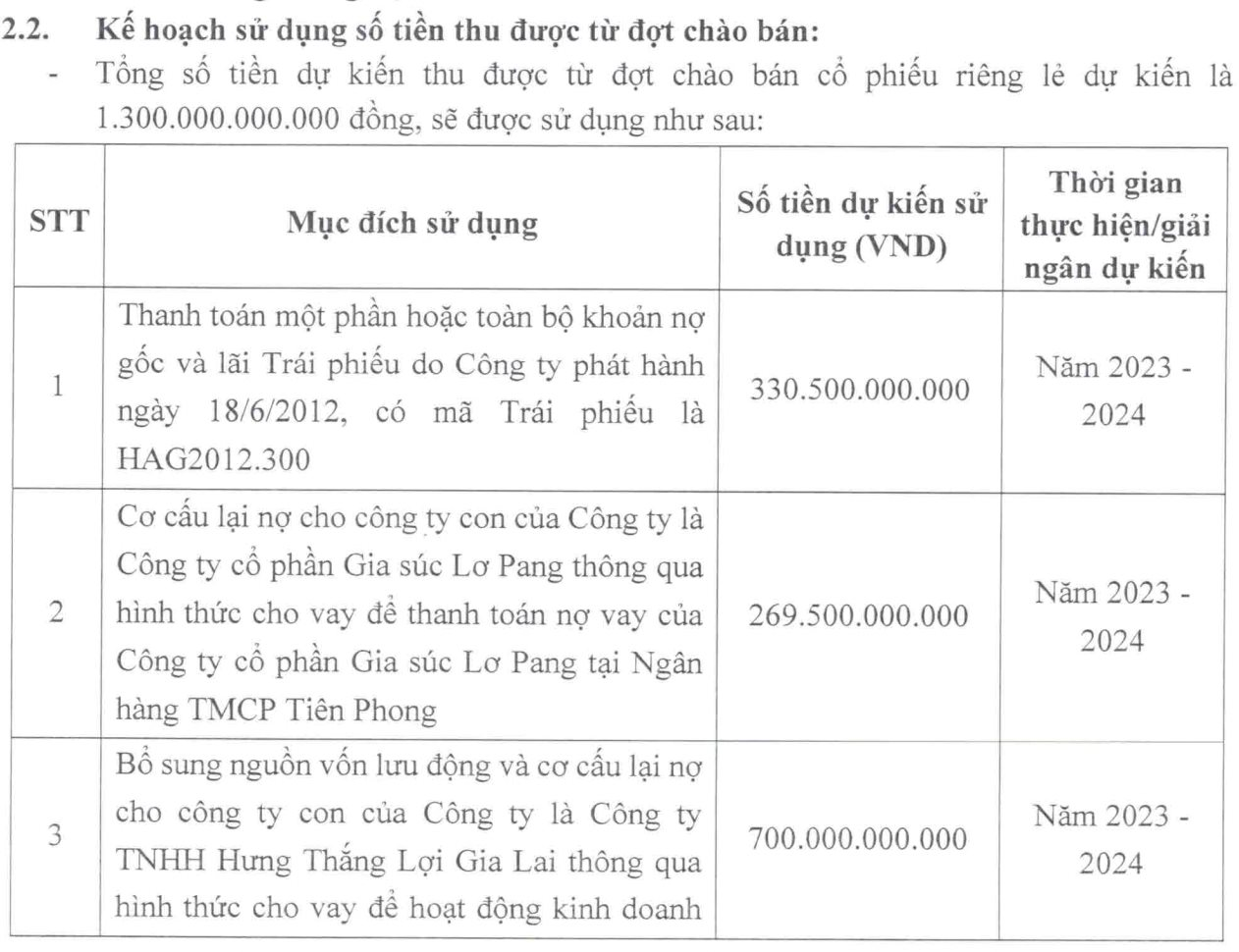

According to the issuance plan, the total amount to be collected is VND 1,300 billion. The company will use this amount for the following specific purposes:

(i) VND 347 billion will be used to partly or fully pay the principal and interest on HAG2012.300 bonds;

(ii) More than VND 253 billion will be used to restructure debt for the subsidiary, Gia Su Loc Pang, specifically to repay the debt to TPBank;

(iii) The remaining VND 700 billion will be used to supplement working capital and restructure debt for another subsidiary, Hung Thang Loi Gia Lai.

The 3 investors participating in this round of issuance by HAGL are all related to Mr. Thuy, including: LPBank Securities Company (LPBS) is expected to buy 50 million shares, Thaigroup Corporation will buy 52 million shares, and individual Nguyen Duc Quan Tung is expected to buy 28 million HAG shares.

On January 18, Mr. Nguyen Duc Quan Tung officially became the CEO of LPBS. It is known that both LPBS and Thaigroup are related to Thaiholdings, a company associated with the name of Mr. Thuy, who is currently the Chairman of the Board of Directors of LPBank.

If successful, the total ownership ratio of these 3 investors will be 12.3% of the capital.

Thaigroup, established since 2007, was formerly known as Xuan Thanh Group, operating in various fields such as cement, hotels, and hydroelectric power. After restructuring, Thaigroup is now a subsidiary owned by Thaiholdings with a stake of 81.6%.

LPBS was formerly known as Lien Viet Securities Company, with a charter capital of VND 250 billion, where LPBank is a major shareholder holding a 5.5% stake.

LPBS has passed a plan to increase its charter capital to VND 3,638 billion, ranking among the top securities companies with the largest charter capital in Vietnam. Part of the capital will be used to implement the investment plan in HAGL in this private placement.

Thaiholdings currently does not directly hold LPBS shares. Since December 9, 2023, Mr. Le Minh Tam has become the Chairman of the Board of Directors and the legal representative of the company. His predecessor, Ms. Vu Thanh Hue, has been appointed as Deputy Chairman of the Board of Directors. Mr. Tam also serves as an independent member of the Board of Directors at LPBank.

Ms. Vu Thanh Hue is a member of the Board of Directors and Deputy General Director of Thaiholdings.