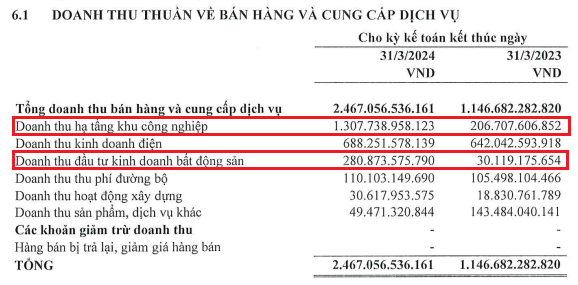

Total IDICO Corporation (HNX: IDC) announced its consolidated financial statement for the first quarter of 2024 with revenue of over VND2,467 billion, an increase of 115% compared to the same period last year. In particular, the two segments with remarkable growth were industrial park (IP) infrastructure revenue of nearly VND1,308 billion, 6.3 times higher than the same period, accounting for 53%; and revenue from real estate business investment of nearly VND281 billion, 9.3 times higher.

Source: IDC

|

After deducting the cost of goods sold, gross profit reached more than VND1,098 billion, 3.6 times higher than the same period. Gross profit margin also increased from 27% to 45%.

| Gross profit margin IDC from Q1/2019 – Q4/2023 |

Total expenses in the period increased by 6%, to nearly VND128 billion. Finally, IDICO’s net profit was over VND695 billion, 4.7 times higher than the same period last year.

Source: VietstockFinance

|

The company said that during the period, revenue from IP infrastructure lease contracts that met the conditions for one-time revenue recognition under the regulations contributed to the company’s profit growth.

IDC‘s 2024 Annual General Meeting of Shareholders held on April 26 approved the business production plan with total consolidated revenue of VND8,466 billion and pre-tax profit of VND2,502 billion, up 13% and 22% respectively compared to the implementation in 2023. The company also maintains a dividend payout ratio of 40% this year.

Compared to the plan, IDICO achieved 30% of the total revenue target and 40% of the pre-tax profit target after the first quarter.

In 2024, IDICO aims to lease 145 hectares of IP land and 50,000 square meters of factory buildings. In addition, IDC focuses on completing legal procedures to be approved for Tan Phuoc 1 IP (470 hectares in Tien Giang) for implementation in 2024, creating impetus for development from 2025.

In addition, the IP projects in Hai Phong, Ninh Binh and other localities are also being urgently carried out by IDICO regarding procedures and legal documents to create a land fund of over 2,000 hectares for the coming years.

As of March 31, 2024, IDC‘s total assets were over VND17,386 billion, down 2% compared to the beginning of the year. IDC is holding cash and cash equivalents of VND1,108 billion, a decrease of 17%, mainly in bank deposits with terms of not more than 3 months at over VND935 billion and nearly VND156 billion in non-term bank deposits.

Short-term financial investments are nearly VND967 billion, an increase of 6%, in which term deposits of over 3 months to 12 months at the bank are nearly VND927 billion and VND40 billion are bond investments. In total, IDICO is depositing over VND2,000 billion in the bank.

Inventories recorded over VND1,858 billion, an increase of 43% compared to the beginning of the period and accounting for 11% of total assets, with the majority being deferred production and business costs. The cost of construction in progress also increased by 12% to over VND1,122 billion, concentrated in Hau Thanh IP of over VND373 billion, Que Vo 2 IP of nearly VND178 billion, …

Source: IDC

|

On the other side of the balance sheet, IDC‘s total liabilities were over VND10,894 billion, a decrease of 5% from the beginning of the period. In which, the “savings” is over VND5,278 billion, a decrease of 7%, accounting for 48% of the total debt; short-term and long-term financial debt is over VND3,039 billion, a decrease of 14%, accounting for 28% of the company’s total debt.