According to a newly published report, Lumen Vietnam Fund expects the Vietnamese stock market to have a stronger growth momentum as it enters the Year of the Dragon (Giap Thin) with many supporting factors.

Firstly, the expected profit growth of listed companies is projected to recover about 15-20%, with contributions from all sectors. Specifically, the financial sector is expected to grow by 20% in 2024, supported by low interest rates and the recovery of credit demand for banks, improved liquidity, and the preparation for stock market upgrades in securities companies.

The construction materials and consumer goods sectors are forecasted to recover their revenue in 2024, along with expanding profit margins, to drive profits to increase by over 50%. The industrial and technology parks are expected to maintain double-digit growth as in previous years. Meanwhile, the real estate and oil sectors may experience lower growth.

Secondly, this foreign fund assesses that the interest rate environment will continue to support the market. With inflation cooling down, the changes in Fed policies in 2024 could reduce the pressure on the global financial market. Other central banks have followed suit by lowering interest rates or planning to do so. This allows Vietnam to maintain a low-interest rate environment and focus on stimulating growth.

In addition, the upgrading story is expected to become clearer. Lumen Vietnam Fund assesses that Vietnam is in the final stage of upgrading its emerging market status. New regulations on pre-capital raising may be proposed in the middle of 2024 to meet the last two requirements of FTSE, implying potential upgrades in the future. The new KRX trading system is also undergoing final testing before its official launch in mid-2024.

This foreign fund forecasts that FTSE’s upgrade of the Vietnamese stock market will take place as early as September 2024 or March 2025. This could attract significant foreign capital and improve the market’s liquidity. “The upgrade can lead to a better balance of transactions between organizations and individuals and can significantly change the evaluation of the stock market,” emphasized Lumen Vietnam Fund. Meanwhile, MSCI’s market upgrade will take more time, expected to happen in 2026-2027.

Although having positive prospects, Lumen Vietnam Fund also believes that the Vietnamese stock market will face fluctuations in the first half of the year due to conflicting views on the economic recovery. Potential obstacles include the speed of export recovery and fluctuations in the real estate market. In the second half of the year, the global market and the Vietnamese economy will continue to grow, thereby becoming a catalyst for the stock market.

Portfolio focusing on finance, real estate,…

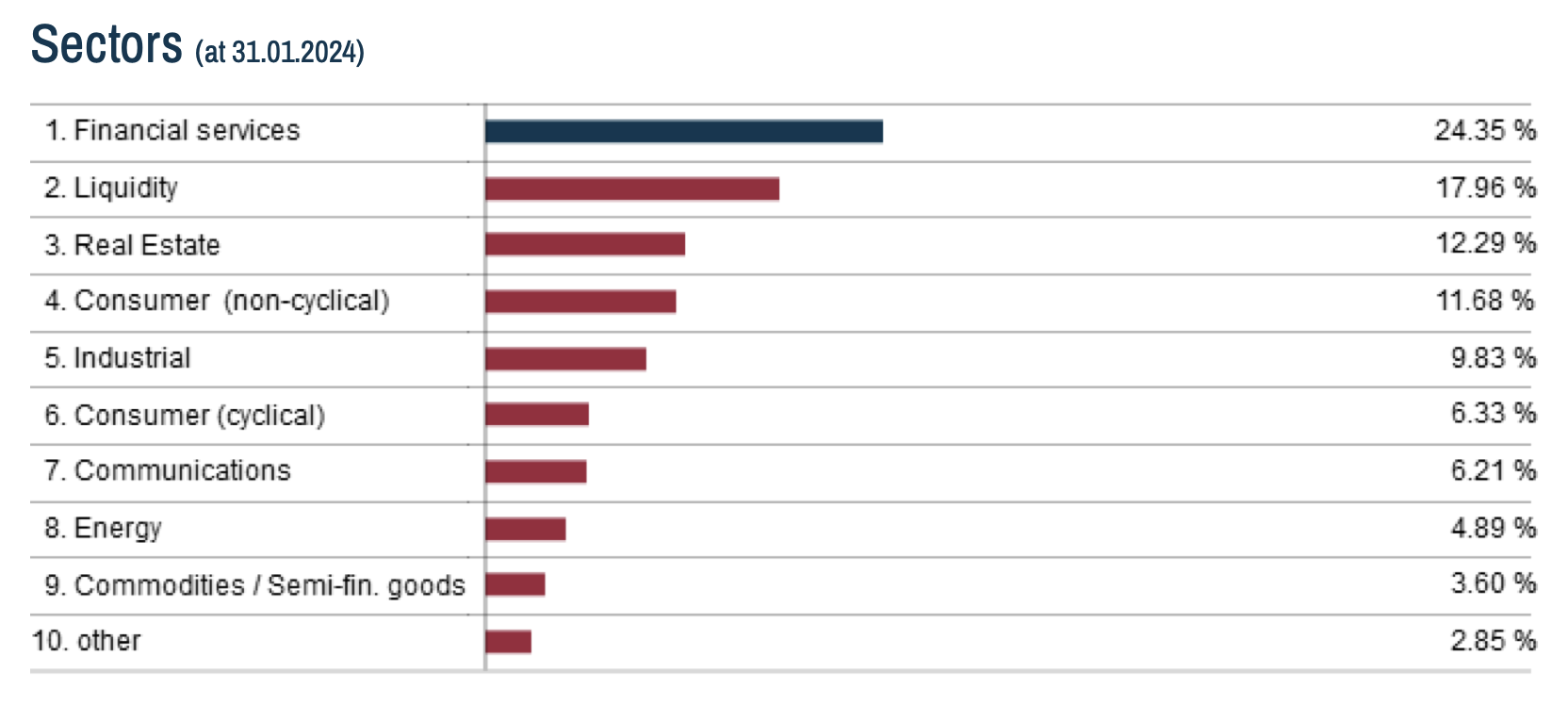

Lumen Vietnam Fund said it would maintain a strategy of holding 30-40 stocks, focusing on some main industry groups. As of the end of January 2024, the fund had a size of more than USD 340 million, of which 82% was stocks and the rest was cash.

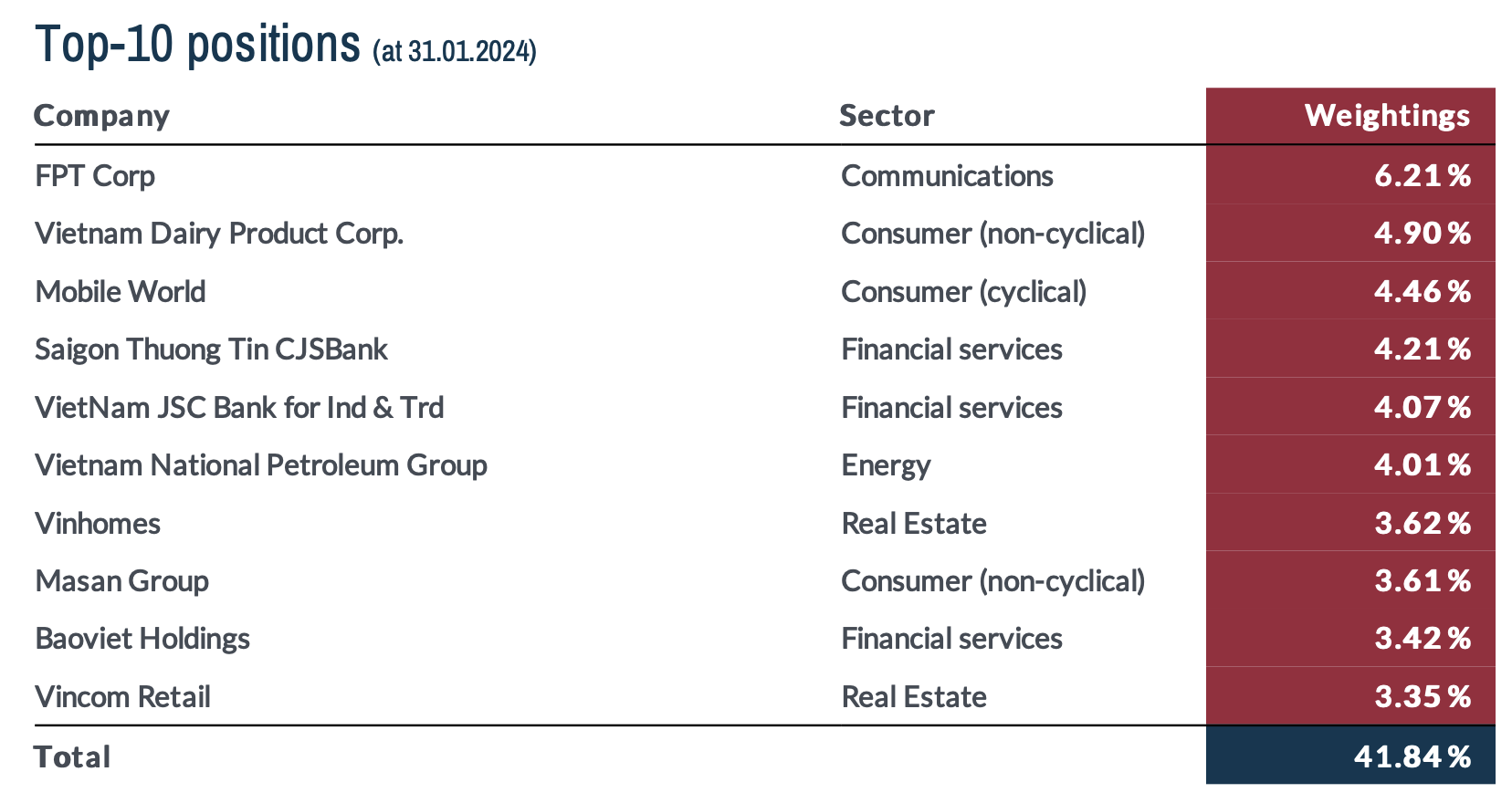

The portfolio focuses on the finance and real estate groups. The top 10 largest investments in the portfolio are FPT, VNM, MWG, STB, CTG, PLX, VHM, MSN, BVH, VRE. The fund’s investment performance achieved only 1.8% in the first month of the year, lower than the 3% increase of the VN-Index.

In the finance sector, Lumen Vietnam Fund will prioritize companies with good asset quality and the ability to quickly recover alongside economic recovery. The fund also pays attention to essential consumer goods companies with attractive valuations and clear restructuring strategies to enhance operational efficiency.

In the real estate sector, within the industrial segment, the portfolio aims at companies owning large land funds in strategic locations for future cargo transportation advantages. The housing real estate segment will prioritize companies with targets to develop affordable housing products in the future, and have strong financial balance sheets.

In the industrial sector, the fund focuses on leading transport and logistics companies with clear competitive advantages and benefiting from future FDI capital flows. Additionally, Lumen Vietnam Fund also targets companies in the energy sector that benefit from recent policy changes by the Government aimed at providing more stability for the entire industry.