The VN-Index closed the 7th trading week of 2024 at 1,209.7 points, up 37.15 points or 3.17% from the previous week’s close, with a slight decrease in liquidity. The trading data for the week of 7/2024 was calculated from February 5-16, 2024, excluding the Tet holiday.

The average trading value per session (calculated across all 3 exchanges) in the 7th week was VND 19,313 trillion, a slight decrease of -2.1% compared to the previous week but still higher than the 5-week average (+2.1%).

Looking at the weekly time frame, liquidity increased in the Banking, Securities, Chemical, Agriculture & Aquaculture, Food, and Oil & Gas Services sectors, while it decreased in the Real Estate, Steel, and Retail sectors.

Foreign investors were net sellers of VND 1,371.9 billion, with a net selling volume of VND 1,081.5 billion in matched orders. The main net buying sectors for foreign investors were Chemical and Basic Resources. The top net buying stocks for foreign investors included CTG, MSB, FRT, VND, HAH, PVT, CII, DBC, NLG, DGC.

The main net selling sector for foreign investors was Real Estate. The top net selling stocks for foreign investors included VNM, MWG, VRE, VCB, TPB, PDR, MSN, VCG, HDB.

Domestic institutional investors were net buyers of VND 483.3 billion, with a net selling volume of VND 256.3 billion in matched orders. The main net selling sectors for domestic institutional investors were Banking. The top net selling stocks for domestic institutional investors included ACB, NKG, VRE, VHM, VIX, MBB, NVL, REE, E1VFVN30, FPT.

The main net buying sector for domestic institutional investors was Construction and Materials. The top net buying stocks for domestic institutional investors included HPG, LCG, HAH, SSI, VCI, VPB, PVD, MWG, KBC, GAS.

Proprietary traders were net sellers of VND 932.7 billion, with a net selling volume of VND 166.1 billion in matched orders. The main net buying sectors for proprietary traders were Information Technology and Chemical. The top net buying stocks for proprietary traders in today’s session included FPT, E1VFVN30, AAA, GEX, VRE, VIB, ACB, ASM, PVT, FUEVFVND.

The main net selling sector for proprietary traders was Banking. The top net selling stocks included NVL, MBB, VSC, SSI, TCB, HPG, MWG, GVR, VPB, STB.

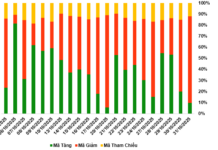

Cash flow trend: The allocation of funds increased in Real Estate, Construction, Steel, Food, and Logistics & Maintenance sectors, while it decreased in Securities, Retail, Information Technology, and Construction Materials. This allocation almost reached the 10-week peak in the Banking sector.

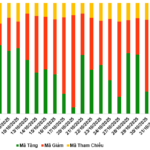

Strength of cash flow: Large-cap VN30 stocks attracted cash flow, while the trading value proportion decreased for mid-cap VNMID and small-cap VNSML stocks.

In the 7th week of 2024, the trading value proportion for VN30 stocks increased to 41.9% from 38.7% in the 5th week. On the other hand, the trading value proportion decreased for VNMID and VNSML stocks, reaching 45% and 8.8% respectively, compared to 46.6% and 10.4% in the 4th week of 2024.

In terms of trading scale, the average trading value per session increased by +8.7% (equivalent to +583 billion) for VN30 stocks, while it decreased for mid-cap and small-cap stocks. Specifically, the average trading value per session for VNMID and VNSML stocks decreased by -3.2% and -14.8% respectively.

In terms of price movement, the VN30 index outperformed the overall market (+4.23%), while VNMID and VNSML had lower increases, at +2.37% and +2.44% respectively.