The stock market has just had two prosperous “New Year” sessions. VN-Index continued its positive momentum before the Tet holiday and regained the 1,200 point milestone. Trading volume also improved significantly with the value of matched orders maintaining a steady level of over 17,500 billion dong per session. Along with the market’s soaring trend, a series of stocks have also accelerated by 20-40% after just two trading sessions at the beginning of the year.

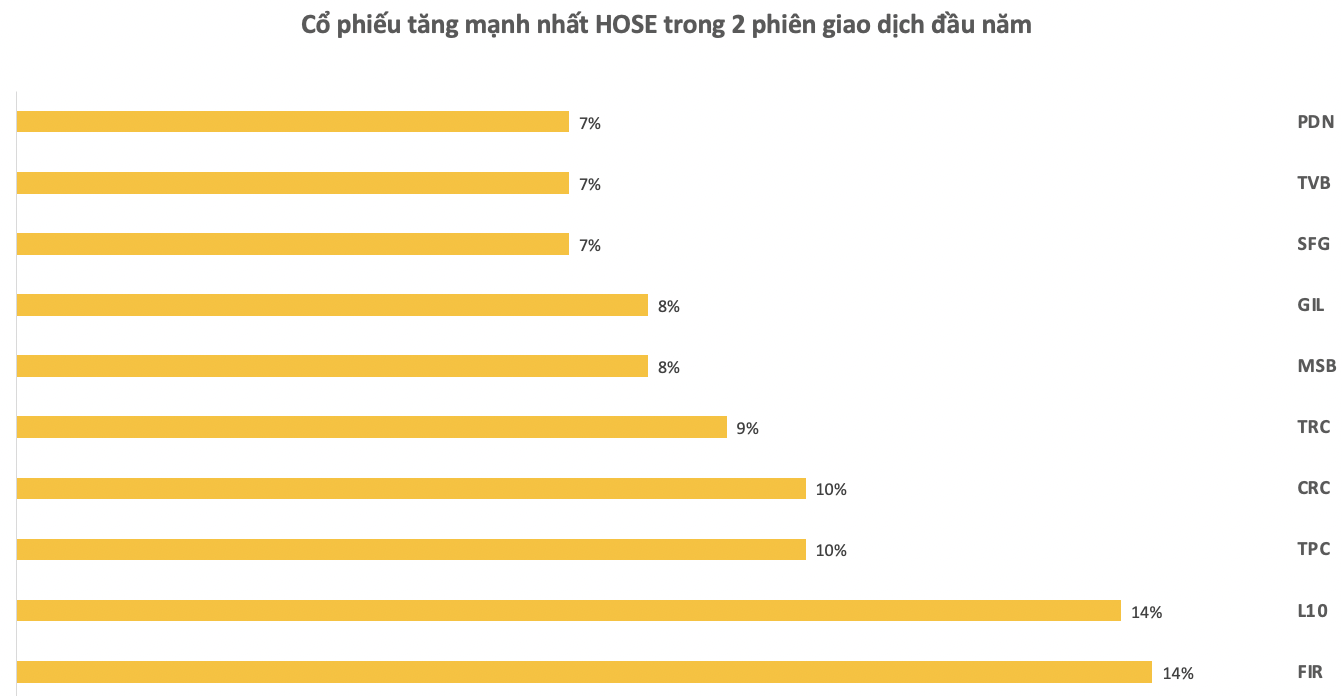

Statistics on HOSE, a range of stocks also reversed in the opposite direction in the first two trading sessions of the year, with increases ranging from 7% to 14%

Leading the pack is a stock in the real estate group FIR of First Real Estate Corporation. After several days of tirelessly “probing the bottom”, FIR kicked off the New Year with two record-setting sessions, reaching 10,400 dong/share. Trading volume in the two most recent sessions also increased dramatically to nearly 2 million shares per session.

FIR is picking up speed ahead of the Annual General Meeting of Shareholders in 2024. Specifically, FIR is expected to hold the meeting between February 16th and no later than March 31st, with the final registration date being February 6th. However, as of now, the company has not announced the specific content and documents.

A banking stock has also attracted attention with two consecutive limit-up sessions, which is MSB of Maritime Commercial Joint Stock Bank. Keeping pace with the hot race of banking stocks, MSB has also increased by about 21% since the end of 2023 to 15,200 dong/share – the highest level of this stock in nearly 21 months.

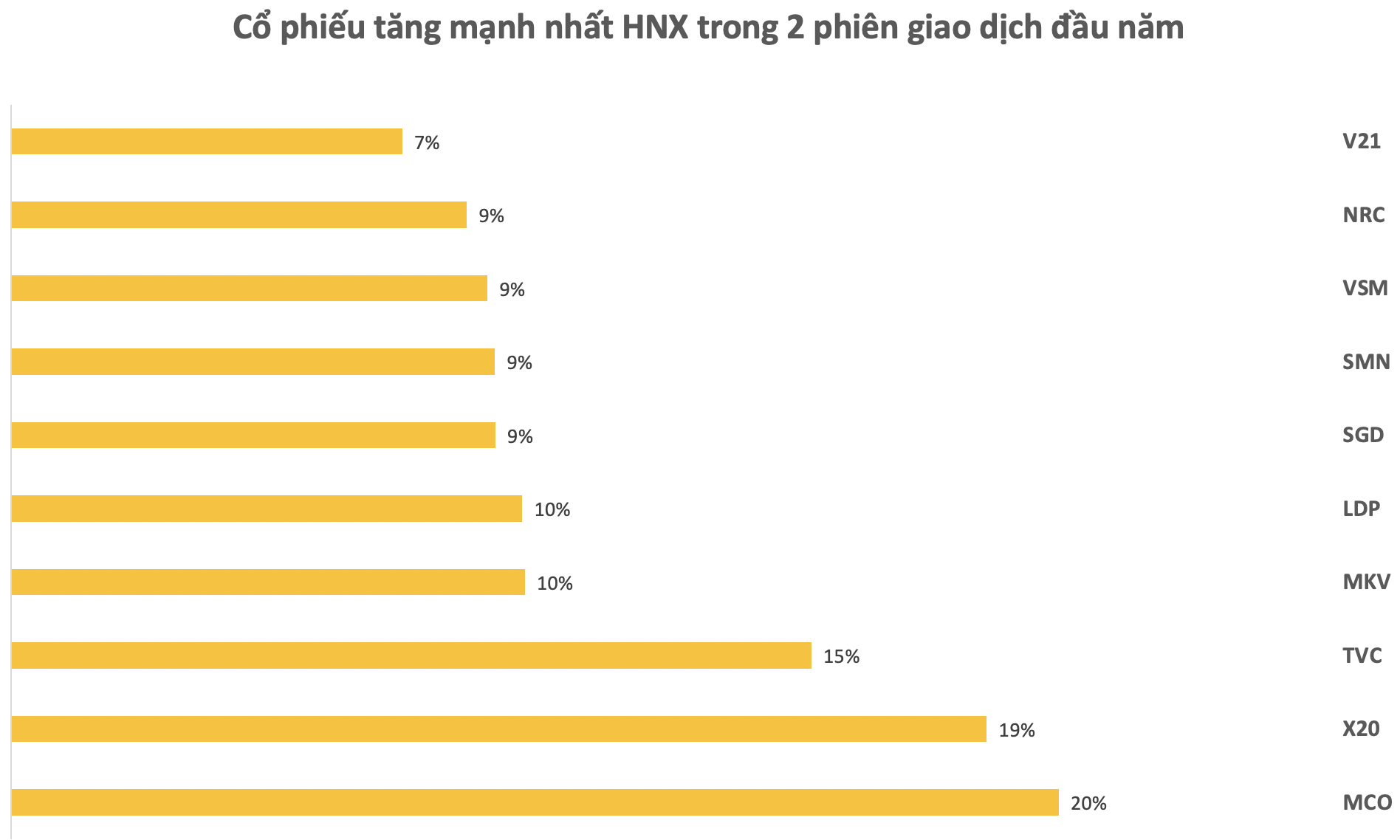

On HNX, heavily increasing stocks have impressive gains ranging from 7% to 20%, but they are mainly stocks with little reputation and relatively low liquidity.

Leading the list of stocks with the strongest increases is MCO of BDC Vietnam Investment and Construction Joint Stock Company. In just the first two limit-up sessions of the year, MCO increased to 12,600 dong, equivalent to an increase of nearly 20%. Speaking of MCO, this stock had once recorded an unprecedented surge of 4 times in just a few months, from an equivalent price of a cup of tea and over 3,000 dong in November 2023 to the current price level.

The stock TVC of Triviet Asset Management Group also gained momentum, increasing over 15% in just the first two trading sessions of the year. The upward trend occurred after HNX recently decided to remove TVC from the restricted trading category starting from February 15th.

The reason is that TVC has overcome the causes leading to securities being restricted from trading and has not violated the regulations on minimum disclosure of information on the securities market for 6 consecutive months since the date the causes leading to the restriction were completely resolved.

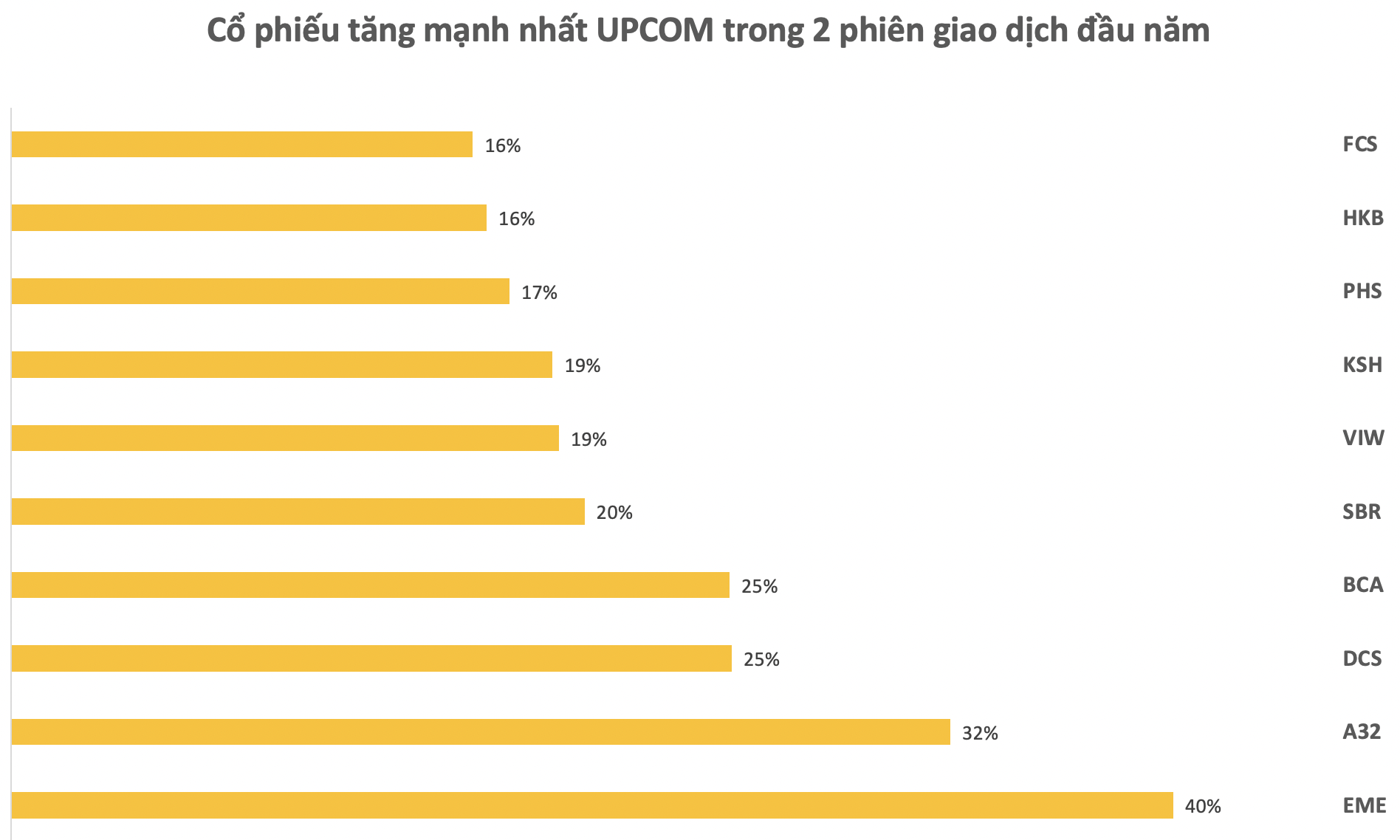

On UPCoM, due to wider trading range, a range of stocks also surged by 16-40%. However, these stocks are hardly well-known, with low liquidity or even no trading, so they have little value for investors.