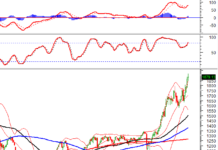

| Price Movement |

On February 19, 2024, BHI recorded the highest trading volume in history with 75 million shares being transferred to foreign investors. The trading value was over 1,628 billion Vietnamese dong, equivalent to 21,708 dong per share. With a sudden surge in liquidity, the stock price of BHI increased by 14.9% compared to the reference price, reaching 23,900 dong per share.

Prior to that, on June 14, 2023, a group of shareholders of BHI signed a transfer agreement for 75% of the shares to DB Insurance. Accordingly, a group of 21 shareholders will transfer 75 million shares to DB Insurance. The transferring shareholder group consists of 2 major shareholders: Saigon – Hanoi Securities Joint Stock Company (9.98 million shares, equivalent to 9.98% of charter capital) and International Financial Investment and Advisory Joint Stock Company (9.83 million shares, equivalent to 9.83% of charter capital), along with 19 other individuals (nearly 55.19 million shares).

Therefore, it can be inferred that the owner receiving the transferred shares during today’s session is DB Insurance.

This means that BHI will become a subsidiary of DB Insurance. According to the information disclosure when registering UPCoM trading, besides the major shareholders T&T, BHI has 2 other major shareholders: Saigon – Hanoi Securities Joint Stock Company (holding 9.98% of capital) and International Financial Investment and Advisory Joint Stock Company (holding 9.83% of capital).

DB Insurance (DBI) is a non-life insurance company established since 1962, headquartered in Seoul, South Korea. DB Insurance belongs to the financial ecosystem of DB and is part of the DB Group. Currently, DB Insurance is the second largest non-life insurance company in South Korea. In 2022, DB Insurance had a total asset of 48.93 billion USD and an owner’s equity of 5.22 billion USD.

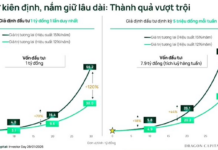

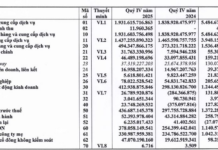

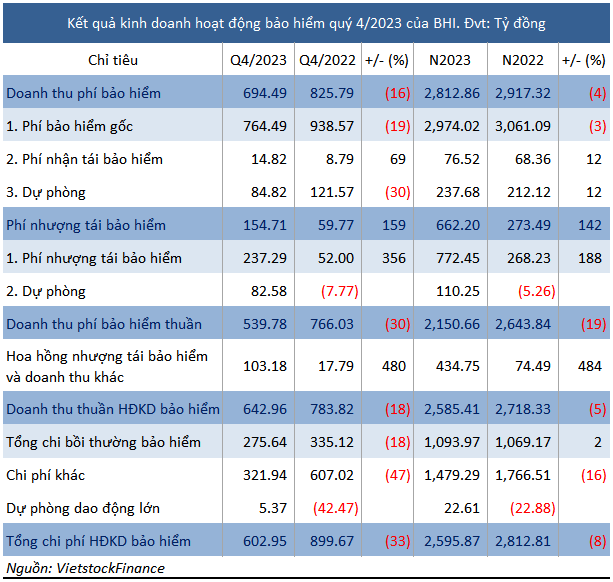

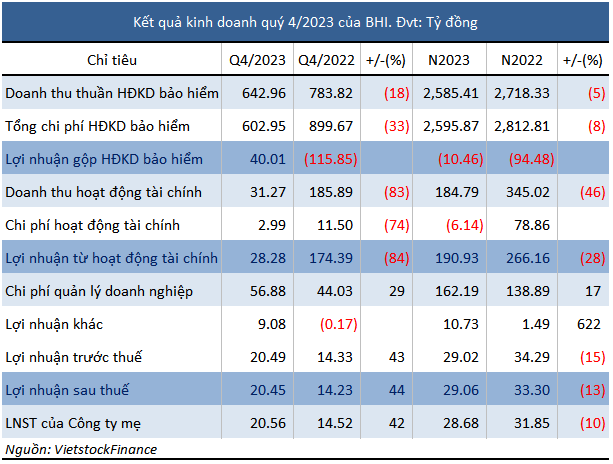

In terms of business performance, in 2023, BHI achieved a net profit of nearly 29 billion dong, a decrease of 10% compared to the previous year. Specifically, the company suffered a gross loss from insurance business of over 10 billion dong and a 28% decrease in financial profit to nearly 191 billion dong.

The insurance operation of BHI incurred losses due to a decrease in net insurance revenue, which was not enough to offset compensation costs and other expenses. In addition, the financial operating profit decreased mainly due to a more than 75% decline in securities trading business profit compared to the previous year, amounting to over 62 billion dong.

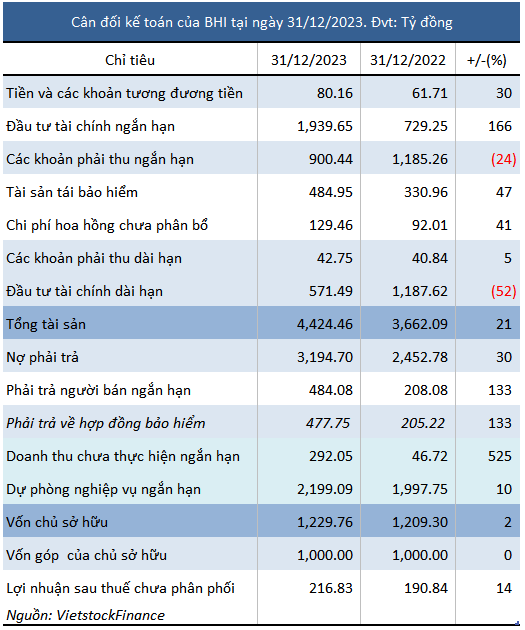

By the end of 2023, BHI‘s total assets reached over 4,424 billion dong, a 21% increase compared to the beginning of the year. Among them, the main assets were in financial investments, with long-term deposits shifting to short-term, leading to a 2.7-fold increase in short-term financial investments to over 1,940 billion dong, while long-term financial investments decreased by 52% to over 571 billion dong.

Debt payable increased by 30% compared to the beginning of the year, reaching over 3,195 billion dong. The increase in payable debt mainly came from high short-term unrealized revenue, which was 6.3 times higher, amounting to over 292 billion dong, and a 10% increase in short-term business provision to over 2,199 billion dong.