On the first trading week, the domestic stock market had its third consecutive session of gains, with a surge of more than 15 points, the highest increase since the beginning of the year 2024. Money eagerly joined the game with positive sentiment spreading from the explosive trading of Vingroup group. HoSE’s liquidity exceeded the $1 billion threshold with a total trading value of over 24,750 billion dong.

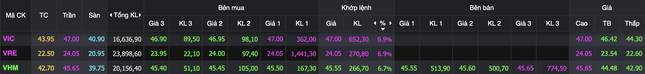

The market focus is on the trading of Vingroup’s 3 stocks. VIC and VRE hit the ceiling and had hundreds of thousands of units of the ceiling price. VHM also increased by 6.7%. VIC was in the top 5 most liquid stocks on the whole market, reaching 772 billion dong, followed by VRE with a trading value of 562 billion dong. This is the 6th consecutive increase of VIC stock with a total increase of over 10%

The 3 stocks of Vingroup all increased sharply.

In just today’s session, the market capitalization of the above mentioned 3 stocks increased by 29,700 billion dong. Of which, VIC’s capitalization increased by 11,700 billion dong, VHM increased by 14,500 billion dong and VRE increased by 3,500 billion dong. The increase in the Vingroup group came after new information about Vinfast from the foreign market .

The development of the Vingroup group with the VIC, VHM, VRE codes has spread positive sentiment to the market, with green color dominating the VN30 basket. The market-leading group also recorded contributions from GAS, BID, VNM, MSN, HPG, VCB, TCB…

According to Forbes statistics, billionaire Pham Nhat Vuong‘s assets just increased by 214 million USD.

Large stock groups such as banking , real estate, and securities have not found consensus, and there is a clear differentiation. Small and medium-sized capitalization stocks also did not record noteworthy transactions in today’s session.

The upward trend mainly depends on pillar stocks, money flows continue to flow into large capitalization groups. HPG leads liquidity with a trading value of 1,223 billion dong, the stock closed up more than 2%. SSI made the list of stocks with trillion dong transactions when reaching 1,139 billion dong. An unexpected late-session transaction helped SSI reverse to the green side, closing up 0.57%.

On the day of the God of Wealth , the stock of the only gold and silver enterprise listed on the market, PNJ, had an unimpressive trading. PNJ closed down 2%, entering the 3rd consecutive session of decline.