According to the latest interest rate table from Sacombank, the bank’s deposit interest rates in February 2024 range from 0.5% to 6.2% per annum for end-of-term interest payment.

Compared to the previous month, Sacombank’s deposit interest rates have decreased for terms of 12 months or less and increased for terms over 12 months. In particular, the deposit interest rate for the 36-month term has increased by 1 percentage point compared to the end of January 2024, reaching 6.2% per annum – which is also the highest deposit interest rate currently applied by Sacombank.

Illustrative photo

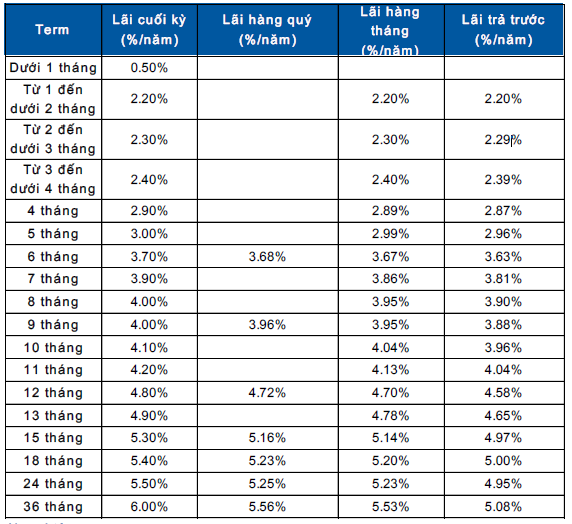

Sacombank’s deposit interest rates at the counter in February 2024

For deposits made at the counter with end-of-term interest payment, Sacombank applies interest rates ranging from 0.5% to 6% per annum.

Specifically, the interest rate for terms less than 1 month is 0.5%; the interest rates for the 1 to 5-month terms range from 2.2% per annum to 3% per annum. Customers who choose to deposit money for 6 and 7 months will enjoy interest rates of 3.7% per annum and 3.9% per annum respectively. For deposits of 8 and 9 months, the interest rate is fixed at 4.0% per annum. Meanwhile, the interest rates for the 10 and 11-month terms are 4.1% per annum and 4.2% per annum respectively.

For the 12-month term, the interest rate is significantly higher at 4.8% per annum. Longer terms, from 13 to 24 months, have interest rates ranging from 4.9% per annum to 5.5% per annum.

The most preferential interest rate for the 36-month term is 6% per annum, increasing by 1% per annum compared to the mid of January 2024.

In addition to end-of-term interest payment, Sacombank also provides flexible interest payment options including quarterly interest calculation (3.68% per annum to 5.56% per annum), monthly interest calculation (2.2% per annum to 5.53% per annum), and pre-paid interest calculation (2.2% per annum to 5.08% per annum).

Sacombank’s deposit interest rates at the counter in February 2024

Source: Sacombank

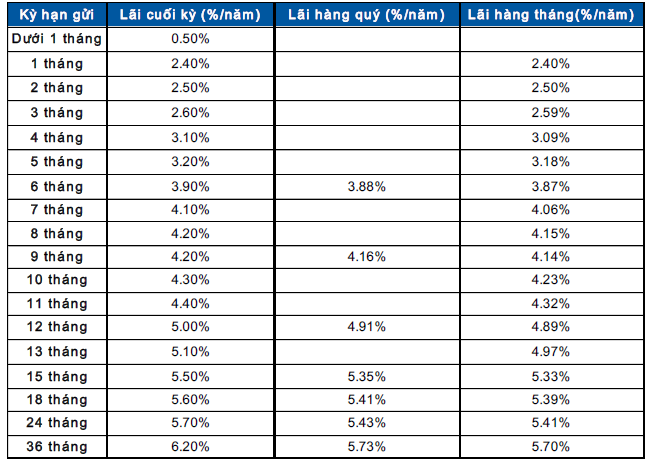

Sacombank’s online deposit interest rates in February 2024

For online deposit products with end-of-term interest payment, Sacombank applies interest rates ranging from 0.5% to 6.2% per annum.

Specifically, the interest rate for terms less than 1 month is 0.5%; the 1 to 3-month terms have interest rates ranging from 2.4% per annum to 2.6% per annum, while the 4 to 5-month terms have interest rates of 3.1% per annum and 3.2% per annum respectively. Deposits for 6 and 7 months enjoy interest rates of 3.9% per annum and 4.1% per annum respectively, while the 8 to 9-month terms have the same interest rate of 4.2% per annum.

The 10-month term has an interest rate of 4.3% per annum and the 11-month term has an interest rate of 4.4% per annum. The online deposit interest rates for the 12 to 24-month terms range from 5.0% to 5.7% per annum.

The highest interest rate applied by Sacombank is 6.2% per annum for the 36-month term. Compared to the rate recorded in mid-January 2024, Sacombank’s highest deposit interest rate has increased by an additional 1 percentage point.

In addition to end-of-term interest payment, customers with online savings accounts can also choose to receive quarterly interest (3.88% to 5.73% per annum) and monthly interest (2.4% to 5.7% per annum).

Sacombank’s online deposit interest rates in February 2024

Source: Sacombank

In addition to traditional products, Sacombank also introduces other savings products such as the “Tăng bảo vệ – Thêm tích lũy” Savings Package, Future Savings, Universal Savings, Prosperous Middle-age Savings, and Wealth Accumulation Savings, providing customers with a variety of investment and savings options.