CASA (Current Account Savings Account) is defined as a non-term deposit. It is a type of bank deposit that customers actively make, perform regular payments and enjoy non-term interest rates with very low interest rates, almost equal to 0.

Statistics from the financial reports of 27 banks show that many banks have recorded impressive growth in non-term deposits in the past year 2023. More than half of the surveyed banks improved this ratio compared to the end of 2022.

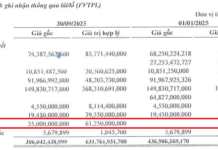

Among them, TPBank is one of the banks with the most impressive growth in CASA ratio (non-term deposits/customer total deposits). The balance of non-term deposits at this bank at the end of 2023 reached over 44 trillion dong, an increase of 35% compared to the end of 2022. This growth rate is much higher than the growth rate of term deposits.

Accordingly, the CASA ratio of TPBank at the end of 2023 reached 22.7%, a strong improvement compared to the 18.0% at the end of 2022. This is also the highest CASA ratio of TPBank ever. Thanks to that, TPBank has surpassed many big banks to enter the Top 5 banks with the highest CASA ratio.

In recent years, many banks have identified increasing CASA ratio as one of the important goals in business activities. Banks that maintain stable and outstanding CASA will have an advantage in overcoming the difficulties and challenges of the market. Because the higher the CASA, the lower the cost of capital for that bank, helping the bank have a competitive advantage over competitors. If the bank can maintain the growth of non-term deposits compared to the total mobilization, it will be able to offset the increased costs from term mobilization and bond issuance. This helps banks have the opportunity to expand the net interest margin (NIM) despite the increase in mobilization costs. In addition, high CASA also demonstrates that the bank is increasingly favored by customers for daily transactions such as payment, salary receipt, stock investment, shopping, etc.

Therefore, the race to increase CASA is becoming more intense, especially when most commercial banks have waived digital banking services. Therefore, banks must truly bring different experiences, good quality of service to be able to increase CASA. To do this, banks have continuously updated new technologies and focused on improving customer experiences.

For example, the example at TPBank, this is one of the earliest digital banks in Vietnam. 12 years ago, when new technologies played only a part in the bank’s activities, TPBank clearly defined the strategic path of using technology as a leverage. The bank pioneered to bring outstanding experiences such as the LiveBank automatic bank, eKYC application – electronic identity verification method to open accounts, and online card opening. The bank also leads with many technologies, features such as ChatPay, VoicePay, FacePay creating different and interesting experiences for customers.

Parallel to the strong increase in CASA ratio, TPBank also proved attractiveness in the market when it officially reached 12 million customers on the last days of 2023, at the same time achieving nearly 1 billion transactions on the digital banking application (App TPBank Mobile), equivalent to 98% of the transaction volume.

Recently, with the positive results achieved in 2023, TPBank is one of the nominated enterprises in the category of “Unit making brilliant progress” at WeChoice Awards 2023, to honor Vietnamese businesses demonstrating positive changes in 2023. After the voting period, TPBank is one of the 3 units honored in this category.