Increased Exports by 42%

The Director of Macro Economic Analysis and Market Research at VinaCapital, Mr. Michael Kokalari, stated that Vietnam’s exports continued to grow in Q1/2023, with a significant increase of 42% compared to the same period last year. This growth can be attributed to a 33% increase in the high-tech electronics export sector.

“The growth rate in January was impressive, despite coinciding with the Lunar New Year holiday, which traditionally sees a decrease in exports. VinaCapital expects Vietnam’s export recovery to continue its strong growth in the coming months,” said Mr. Michael Kokalari.

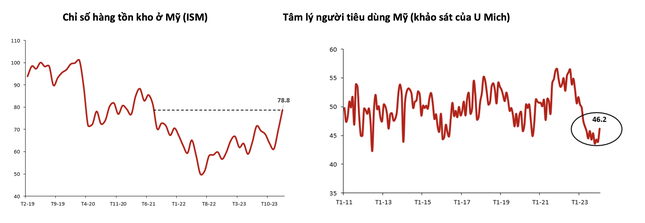

The inventory levels of US companies are decreasing rapidly.

According to VinaCapital’s economic expert, American companies had placed a large number of orders for “made in Vietnam” products during the supply chain disruption caused by COVID-19. To reduce inventory levels, they had reduced orders for these products last year. However, after the fastest inventory reduction in over 10 years, this trend is coming to an end.

As a result, Vietnam’s export orders have rebounded in January this year. A similar trend has also been observed in China, with significant improvement in new export orders last month.

VinaCapital expects Vietnam’s export orders to continue growing in the coming months due to the economic growth in the US. This growth is reflected in the high consumer confidence levels seen in the US since the post-COVID-19 boom.

Mr. Michael Kokalari attributed Vietnam’s strong export growth in January to a nearly 60% increase in the export of computers and electronic products compared to the same period last year. Global personal computer (PC) revenue had decreased by 30% at the beginning of 2023, but it recovered towards the end of the year, partly due to users upgrading to higher configuration machines for artificial intelligence (AI) processing.

Global smartphone revenue also rebounded towards the end of 2023. Vietnam’s smartphone exports increased by 16% in January, thanks to the launch of the new Samsung S24 model.

Boosting Manufacturing

Analysis by VinaCapital shows that the manufacturing sector grew by 19.3% compared to the same period last year in January, outpacing the growth in production. This means that manufacturers’ inventories had decreased the previous month. The combination of decreased inventories and increased new orders implies that manufacturing activities in Vietnam need to be further accelerated to meet the high demand for “made in Vietnam” products.

Boosting manufacturing activities will drive GDP growth. Photo by Hương Chi.

Manufacturing accounts for nearly 25% of Vietnam’s gross domestic product (GDP), so boosting manufacturing activities will drive GDP growth. Additionally, almost 10% of Vietnam’s labor force is employed by foreign direct investment (FDI) companies with relatively high wages.

As a result, the economy will be stimulated by increased manufacturing activities and higher consumer spending this year, supported by increased job opportunities in the manufacturing sector.

“While we do not expect consumer spending to grow strongly in Q1, we still anticipate stronger consumer spending and domestic demand in the later part of this year,” said Mr. Michael Kokalari.

VinaCapital also expects domestic investors to invest more in the Vietnamese stock market this year, as deposit interest rates at banks in Vietnam are near their lowest levels. The broad-based economic recovery will drive corporate profits, making the market valuation very attractive.

“The recovery of the real estate market in Vietnam will take more time as measures to address market issues are still being implemented. Therefore, the stock market is currently the most appealing channel for individuals to invest in the upcoming period,” recommended Mr. Michael Kokalari.