Illustrative image

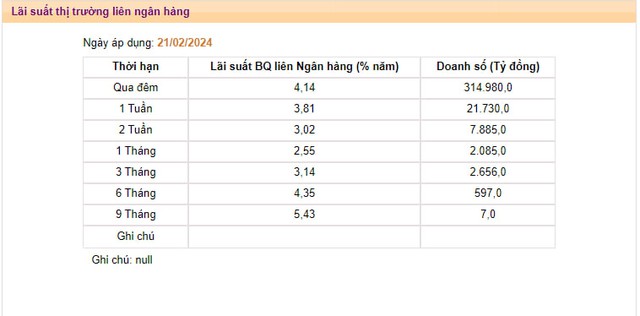

According to the latest data from the State Bank of Vietnam, the average interbank VND interest rate overnight (the main term, accounting for about 90% of the transaction value) in the session on February 21 has increased to 4.14%, from 2.15% in the previous session. Thus, after just one night, the interbank overnight interest rate has nearly doubled and reached a record high since late May 2023.

This is the third consecutive strong increase in the interbank overnight interest rate. Compared to the level recorded at the end of the previous week, the interbank overnight interest rate has nearly quadrupled and is much higher than many previous peaks during the peak period of Lunar New Year payment (2.38% recorded on February 7).

Along with the overnight term, interest rates in the other key terms have also increased significantly compared to the end of the previous week: the one-week term increased from 1.27% to 3.81%; the two-week term increased from 1.39% to 3.02%; the one-month term increased from 1.85% to 2.55%.

The interbank interest rate has been rising rapidly and strongly with the overnight term still higher than the one-week to three-month terms, accompanied by a high trading volume, indicating that the system’s liquidity is showing signs of stress in the short term and is likely to ease in the coming sessions.

Source: SBV

In this context, the State Bank of Vietnam (SBV) has conducted two consecutive sessions of net pumping of liquidity into the banking system through the open market operations (OMO) lending paper collateral channel. Specifically, in the sessions on February 20 and 21, one member of the market won OMO with a cumulative volume of over VND 6,037 billion, a term of 7 days and an interest rate of 4% per annum.

Previously, the OMO channel had almost no new transactions generated in the second half of 2023 and the beginning of 2024, despite the SBV’s continued bidding activities to support liquidity for banks in need. This appeared in the context of abundant system liquidity, as reflected in the CITAD balance (deposit of excess capital of credit institutions deposited at the SBV) reaching over VND 300,000 billion and the interbank interest rate falling to a historically low level. Even in the third quarter of 2023, the government had to restart the bond channel to absorb excess system liquidity in order to reduce pressure on the exchange rate.

However, after the sudden surge in credit growth in December 2023, the interbank interest rate has tended to increase again, especially in the period before and after the Lunar New Year.

The sharp increase in the interbank interest rate along with the resurgence of borrowing demand through the OMO channel after months of “freezing” indicates that the system’s liquidity is no longer excessive.

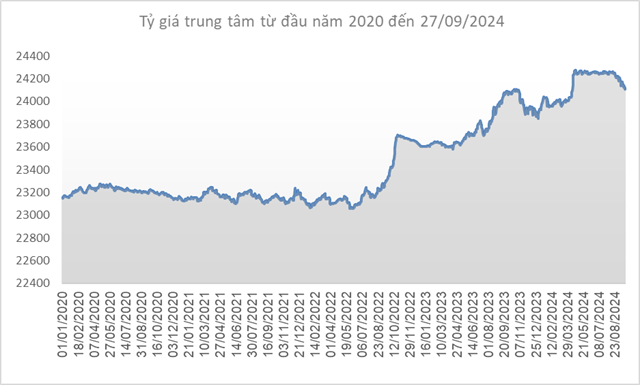

In another aspect, the sharp increase in the interbank overnight interest rate also helps reduce pressure on the exchange rate – which has been under significant pressure as the greenback has staged a strong recovery in the international market.

According to data from Vietcombank, the bank with the largest foreign exchange trading volume in the system, the USD price is currently bought and sold at VND 24,390 – 24,790 per USD, an increase of 190 dong in both trading directions compared to levels before the Lunar New Year holiday.

In the latest macro report released, VCBS commented that the interest rate landscape continues to sink to new lows, creating constant pressure on the exchange rate as the DXY index remains at a high level. Accordingly, the possibility of a VND depreciation will continue to exist, and the exchange rate movement will depend heavily on foreign currency supply at each point in time with factors dominated by direct and indirect investment flows, remittances, etc.