VinFast, the Vietnamese electric car manufacturer, has announced its business results for the fourth quarter of 2023. The company recorded a revenue of VND 10,418 billion ($437 million), an increase of 26% compared to the previous quarter and a 133% increase compared to the same period in 2022. The significant increase in profit margin is due to cost optimization.

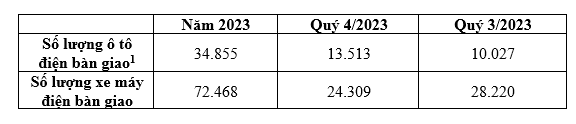

For the whole year of 2023, the company brought in VND 28,596 billion ($1.198 billion), a 91% increase compared to the previous year. VinFast delivered a total of 34,855 electric cars in the financial year 2023, marking a 374% increase compared to the previous year. In the fourth quarter alone, the number of deliveries was 13,513 vehicles, a 35% increase compared to the previous quarter.

Although there was a slight decrease compared to the third quarter, the number of electric motorcycles delivered in the fourth quarter still grew by 48% compared to the same period last year, bringing the total number of deliveries for the year to 72,468 units.

Chairwoman of VinFast’s Board of Directors, Ms. Le Thi Thu Thuy, shared: “2023 was a successful year with many first milestones for VinFast, a highlight of which was the listing on the U.S. stock exchange. We introduced exciting new products, expanded our distribution network, consolidated our position in existing markets, and seized opportunities in important potential markets. These efforts have recently yielded positive signals in markets such as the U.S. and Indonesia. Building on the strong growth momentum, we have set a target to deliver 100,000 cars in 2024, reaffirming our commitment to creating a greener future for everyone.”

Ms. Nguyen Thi Lan Anh, CFO of VinFast, affirmed: “In the fourth quarter of 2023, VinFast recorded significant growth in revenue and improved gross profit margin. We will continue to focus on improving investment efficiency and strengthening the financial balance sheet by continuing to optimize production costs, bill of materials (BOM) costs, and global capital investment (Capex) costs. This will be a crucial support for VinFast in expanding into markets, especially potential markets such as Indonesia and India, thereby driving strong sales growth.”

REVENUE GROWTH AND IMPROVED GROSS PROFIT MARGIN COMPARED TO 2022

VinFast delivered a total of 34,855 electric cars in the financial year 2023, marking a 374% increase compared to the previous year. In the fourth quarter alone, the number of deliveries was 13,513 vehicles, a 35% increase compared to the previous quarter.

Although there was a slight decrease compared to the third quarter, the number of electric motorcycles delivered in the fourth quarter still grew by 48% compared to the same period last year, bringing the total number of deliveries for the year to 72,468 units.

VinFast’s total revenue reached VND 10,418 billion ($437 million) in the fourth quarter, an increase of 26% compared to the previous quarter and 133% compared to the same period in 2022, driven by an increase in sales volume and a diverse product range.

For the whole year, VinFast’s total revenue reached VND 28,596 billion ($1.198 billion), marking a 91% increase compared to the previous year.

After deducting costs, VinFast recorded a gross loss of VND 4,174 billion ($174.9 million) in the fourth quarter, and a gross loss of VND 13,164 billion ($551.6 million) in 2023. The gross profit margin of VinFast has significantly improved compared to 2022, from -82% to -46%. Meanwhile, the gross profit margin in the fourth quarter improved from -82.6% to -40.1%.

As planned, VinFast’s Capex in the fourth quarter was $213 million, mainly used to develop VF 6, VF 7 models, build a factory in North Carolina, develop showrooms and charging stations.

EXPANDING DISTRIBUTION NETWORK AND PRODUCT RANGE, BUILDING A SOLID FOUNDATION FOR FUTURE DEVELOPMENT

In 2023, VinFast accelerated its development with a multi-directional strategy, including expanding its global retail network, diversifying its product range, and improving manufacturing capabilities to build a solid foundation for 2024 and long-term development goals.

In terms of product launches, VinFast introduced 4 new SUV models in various segments in Vietnam, including the flagship VF 9, VF 5, VF 6, and VF 7 models. The VF 6 model, which was launched in October in Vietnam, exceeded the initial sales expectations of the Company.

In the fourth quarter, VinFast made a significant transition from a direct-to-consumer distribution model, which was cost-intensive, to a more cost-saving hybrid model that leverages existing distribution infrastructure, through the establishment of dealer networks in the U.S. and globally.

So far, the company has 13 stores in California and 6 dealerships in 5 states: North Carolina, New York, Texas, Florida, and Kansas, with 75 registered dealers joining the network. The company expects to have about 130 retail outlets in North America and 400 retail outlets globally by the end of 2024. Dealer sales will significantly contribute to the sales in the second half of 2024.

FOCUS OF 2024: INCREASING REVENUE AND COST OPTIMIZATION

In the financial year 2024, VinFast aims to balance revenue growth and cost optimization, based on an optimized production and material cost platform, as well as strategic investment in potential markets in the region.

To boost electric vehicle sales, VinFast will expand its distribution channels by leveraging the networks and experience of dealers in each market.

The unique battery leasing policy of VinFast can significantly boost sales in new markets. This mechanism helps reduce the initial selling price and monthly operating costs of VinFast vehicles to be comparable, or even more competitive, than some gasoline models in the market.

The company’s second key goal in 2024 is cost optimization. VinFast is implementing initiatives to reduce material costs by 40% within two years of each new model launch, partly through technical efforts such as redesigning components and optimizing platforms, and the remaining part through supply and procurement initiatives such as internal sourcing and switching suppliers. Additionally, VinFast will continue to optimize production costs and other expenses.

BUSINESS PROSPECTS

VinFast aims to deliver 100,000 vehicles in 2024 through an expanding distribution network. Brighter macroeconomic prospects also support the implementation of the company’s development strategies.

VinFast enters 2024 with positive signals. In California, the direct sales channel has seen a significant increase in the number of orders in January and February, indicating an early boost in the U.S. market.

After establishing a foundation in markets such as the U.S., Canada, and some European countries, VinFast’s global expansion plan in 2024 will focus on other global markets, including potential markets close to Vietnam like Indonesia and India. This step aligns with the cost capital optimization strategy, including the goals of production and material (BOM) cost optimization.