Crude oil surge due to increasing tensions in the Middle East

Crude oil futures prices rose as conflicts continue to escalate in the Red Sea, with Houthi rebels linked to Iran stepping up attacks near Yemen, but the increase was limited due to the rise in US crude oil inventories.

Brent crude oil prices rose 64 cents or 0.77% to $83.67 per barrel. US West Texas Intermediate crude oil futures prices rose 70 cents or 0.9% to $78.61 per barrel..

US crude oil inventories rose 3.5 million barrels to 442.9 million barrels in the week ending February 16, 2024, the Energy Information Administration said on Thursday, compared with analysts’ expectations for a 3.9 million-barrel increase.

US crude oil inventories have increased amid shutdowns at major refineries, causing the utilization rate to be at its lowest in two years, although refineries will soon resume production.

Gold plummets after US data signals strong economy

Gold prices dropped from their highest level in nearly two weeks after a decline in jobless claims signaled a strong economy, while investors await further economic data to predict the US Federal Reserve’s stance on interest rates.

Spot gold dropped 0.1% to $2,022.74 per ounce at 18:42 GMT, after hitting its highest level since February 9th at $2,034.69 earlier in the session.

Gold futures prices fell 0.2% to $2,030.7. Yields on US Treasury bonds rose, making gold bars more expensive for holders of other currencies.

The latest Fed policy meeting minutes released on Wednesday showed that most of the central bank’s policymakers expressed concerns about the risk of cutting interest rates too soon.

In other precious metals, spot platinum rose 1.9% to $899.60 per ounce, palladium rose 2% to $968.40, and silver fell 0.3% to $22.80.

Iron ore continues to fall due to concerns about Chinese demand

Iron ore prices on the Dalian Commodity Exchange (DCE) of China fell for a fourth consecutive session amid concerns about steel demand in China, while prices in Singapore rose due to a weaker dollar.

China’s DCE May 2024 iron ore contract closed down 1.49% at 893.5 yuan ($124.28) per tonne.

Meanwhile, Singapore iron ore prices for March 2024 rose 0.15% to $119.25 per tonne.

Coke prices and coking coal prices increased by 4.12% and 2.98% respectively, due to concerns about supply after China’s top coal-producing region, Sontay, ordered mining companies to restrict production exceeding limits.

On the Shanghai Futures Exchange, rebar prices increased by 0.24% and stainless steel prices rose 1.17%, while wire rod and hot-rolled coil prices fell by 0.15%.

Nickel reaches 14-week high on short covering ahead of Russian sanctions

Nickel prices have risen to their highest level in 14 weeks due to concerns over the expansion of US sanctions against Russia, which has triggered buying activity.

London’s three-month nickel futures prices on the London Metal Exchange increased 2.8% to $17,395 per tonne after reaching a high since November 16, 2023, at $17,415, surpassing the 100-day moving average of $17,054.

LME aluminium fell 1.0% to $2,196.50 per tonne after new UK sanctions against Russia had no impact on the market.

Copper rose 0.4% to $8,580, zinc fell 0.4% to $2,386, lead increased 0.5% to $2,088.50, and tin fell 0.5% to $26,160.

US corn, soybeans hit 3-year lows on weakening US supply

US corn and soybean futures prices hit their lowest level in three years amid expectations of abundant harvest in South America and concerns about demand, analysts said.

Wheat futures prices were mixed in a subdued trading session, with concerns about potential new US sanctions against Russia, the world’s top wheat exporter, as well as the spread between the markets for corn and soybeans.

Corn futures for March 2024 at Chicago fell 4-1/2 cents to $4.06-1/2 per bushel after sliding to $4.04-1/4, the lowest level since November 2020.

Soybean futures for March 2024 at the Chicago Board of Trade fell 12-1/2 cents to $11.48-1/4 per bushel after touching $11.47-3/4, the lowest level since December 2020. CBOT wheat futures for May 2024 rose 3/4 cent to $5.78-3/4 per bushel.

Corn and soybean prices at the CBOT have accelerated their decline since the beginning of 2024 as prospects for the South American harvest have improved despite tense weather.

Expected rainfall over the next few days in the Pampas region of Argentina is likely to boost planting of soybeans and corn for the 2023/24 growing season there, the Buenos Aires Grains Exchange said in a report this week.

Following a record-large US corn harvest in 2023, prospects for increased cereal reserves and reduced feed demand from China have prompted large-scale speculative short positions in corn and soybean futures.

Vietnam’s coffee prices increase due to high demand, low supply

Vietnam’s coffee prices have increased this week due to higher export demand after the Lunar New Year, but some farmers are still holding onto their coffee beans in hopes of higher prices.

Farmers in the Central Highlands, Vietnam’s largest coffee-growing region, are selling beans at prices ranging from 81,600 to 82,500 dong ($3.32 to $3.36) per kilogram, up from 78,900 to 79,200 dong the previous week.

The situation could persist until April when Indonesian farmers begin to sell coffee.

Another trader said that the current weather is favorable for the trees.

Vietnam exported 238,266 tons of coffee in January, up 67.4% from a year earlier and 14.8% from the previous month, according to customs data. Revenue reached $726.6 million, up 133.7% from January 2023.

Insurance premiums for Indonesian Sumatra robusta coffee in Lampung have surged from the previous week, traders said, as demand has increased while farmers are still waiting for the coffee harvest.

A small coffee harvest in the province of Lampung and surrounding areas in southern Sumatra usually begins in March or April, with the main harvest typically starting around June.

In New York, robusta coffee fell 2% to $3,113 per ton and Arabica coffee fell 2.6% to $1.8315 per pound.

Cocoa hits new highs on prospects of reduced production

Prices of cocoa, the raw material for making chocolate, have risen to new highs, rising more than 10% just this week, due to negative production prospects in the world’s second-largest cocoa-growing country.

London’s cocoa futures prices on the ICE exchange have surpassed the psychological barrier of £5,000 while New York cocoa has broken the $6,000 mark, as tightening supplies pushed both markets to new record highs.

London cocoa prices closed up 1.7% at £5,062 per tonne, after earlier hitting a high of £5,100. The nearby contract in New York ended little changed at $5,860 per tonne, after reaching a record high of $6,020.

Analysts believe that London cocoa prices, which rose 70% last year and 50% since the beginning of this year, may start to impact demand as chocolate producers plan to increase prices of their products to cover higher raw material costs.

Raw sugar prices rose 0.26% to 22.83 cents per pound after hitting a more than one-month low of 22.11 cents. Refined sugar in London fell 0.92% to $619.70 per tonne.

Indian rice at record high, Vietnamese rice decreases

Export prices for rice from India have reached a new record high this week due to limited supply and slight improvement in demand, while Vietnamese prices have fallen due to increasing inventory.

Indian 5% broken rice was quoted at a record high of $546 – $554 per tonne this week, up from $542 – $550 per tonne the previous week.

Vietnamese 5% broken rice is being offered at $625 – $630 per tonne, down from $637 – $640 per tonne a week ago.

“Supply is accumulating amid the winter-spring harvest, the largest harvest of the year,” said a trader based in Ho Chi Minh City.

Some traders said they were slowing down the pace of buying rice from farmers with predictions that domestic prices will continue to decline.

Thai 5% broken rice was quoted at $615 per tonne, slightly up from $610 a week ago.

Traders say the increase in prices is due to fluctuations in the domestic currency, while the supply situation remains thin and there have been no large transactions. They also note that expected new supplies are expected to gradually enter the market next month.

Meanwhile, Bangladesh may import 500,000 tonnes of rice through June to cool domestic cereal prices, officials said. Earlier this month, the government slashed import taxes on rice from 63% to 15%.

Highest Japanese rubber in 7 years on Nikkei’s record, oil rises

Japanese rubber futures prices rose to their highest level in 7 years after two days of declines, buoyed by a surge in the domestic stock market and expectations that the upward trend will continue this year, as well as higher oil prices.

July 2024 rubber futures prices closed up 7.6 yen, or 2.57%, at 303.6 yen ($2.02) per kg, the highest since February 17, 2017. The intra-day peak was 307.5 yen, up 3.89% from the previous close.

Rubber futures prices on the Shanghai Futures Exchange traded for May 2024 rose ¥225 to ¥13,760 ($1913.61) per tonne.

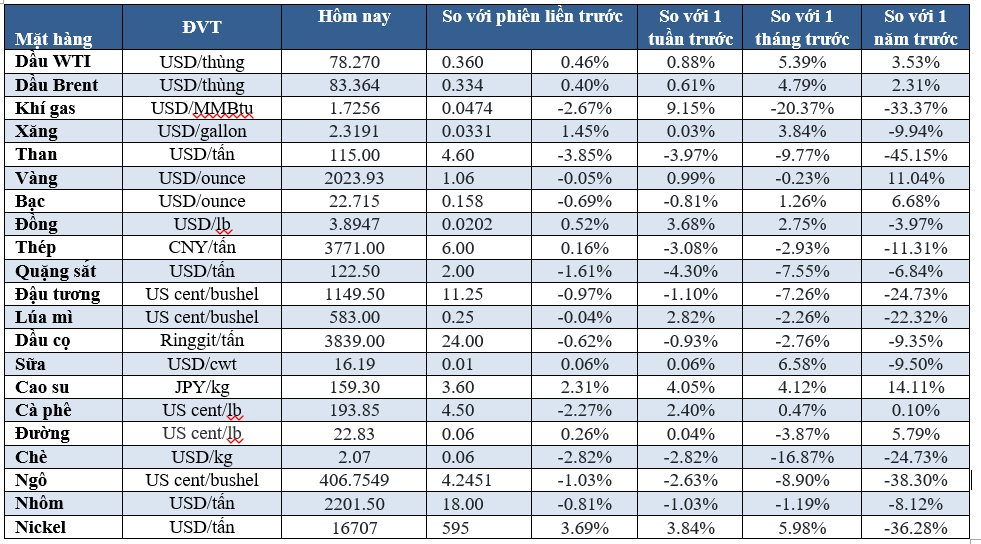

Price of some key commodities as of the morning of February 23, 2024

![VPBank Proudly Presents G-DRAGON 2025 WORLD TOUR [Übermensch] IN HANOI as Title Sponsor](https://xe.today/wp-content/uploads/2025/10/screen-sho-2-218x150.png)