The market liquidity decreased compared to the previous trading session, with a trading volume of nearly 835 million shares for VN-Index, equivalent to a value of over 19.5 trillion dong; HNX-Index reached nearly 80 million shares, equivalent to a value of over 1.5 trillion dong.

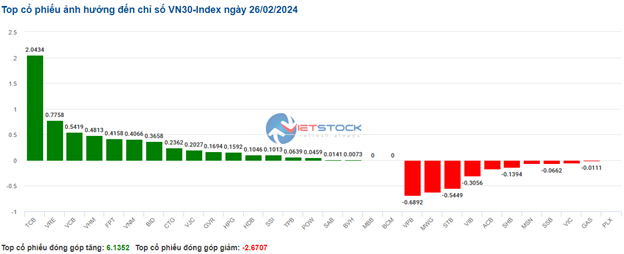

| Top 10 stocks affecting VN-Index on 26/02 (measured in points) |

VN-Index opened the afternoon session with an optimistic atmosphere as buying pressure appeared right from the beginning of the session, pushing the index continuously higher and closing near the day’s highest level. In terms of influence, BID, FPT, GVR, and TCB are the stocks with the most positive impact on VN-Index, contributing over 5.8 points increase. On the contrary, VIC and VPB are the stocks with the most negative impact, taking over 1 point away from the index.

HNX-Index also had a similar trend, with the index being positively affected by stocks such as MBS (6.87%), NTP (4.55%), TNG (3.88%), SHS (2.89%),…

|

Source: VietstockFinance

|

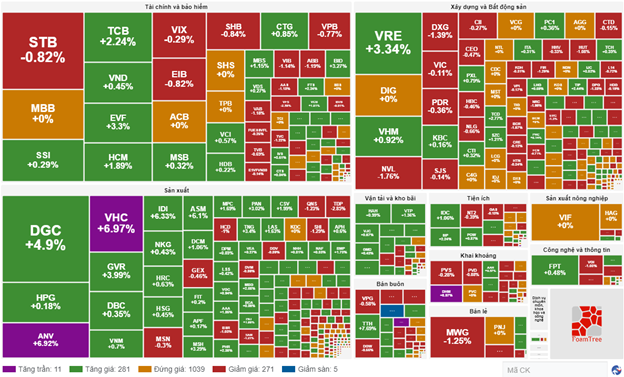

The seafood processing industry is the most robust sector, with a 6.24% increase primarily driven by stocks such as VHC (+6.97%), ANV (+6.92%), ASM (+6.57%), and IDI (+6.75%). It is followed by the plastic-chemical and securities industries with growth rates of 3.97% and 3.79% respectively. On the other hand, the accommodation, food, and entertainment services sector had the steepest decline in the market with a 0.32% decrease primarily driven by NVT (-0.25%) and TTT (-5.15%) stocks.

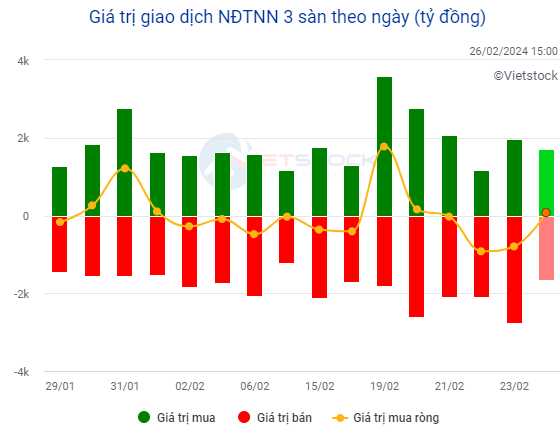

In terms of foreign trading, this group returned with a net buying of over 38 billion dong on HOSE, focused on DGC (214.71 billion dong), HCM (133.96 billion dong), SSI (38.36 billion dong), and HPG (36.54 billion dong). On the HNX exchange, foreign investors net bought nearly 45 billion dong, focusing on IDC (31.55 billion dong), MBS (19.96 billion dong), and CEO (7.38 billion dong).

Source: VietstockFinance

|

Morning session: Foreign investors continue to sell, VN-Index maintains gains

At the end of the morning session, all 3 indices were moving in different directions. VN-Index increased by more than 3.5 points, temporarily stopping at 1,215 points, while HNX-Index slightly decreased to around 230 points.

Trading volume for VN-Index reached over 398 million units, equivalent to nearly 9 trillion dong. HNX-Index recorded a trading volume of 32 million units, with a trading value of nearly 603 billion dong.

Source: VietstockFinance

|

The seafood processing industry is leading the market with a strong growth of 6.14%. Representative stocks in the industry such as ANV, VHC, ASM, IDI all hit the trading limit in the morning session. Other stocks also recorded positive growth, such as FMC up 4.98%, CMX up 4.46%, ACL up 5.18%, and IDI almost reaching the trading limit with a 6.33% increase.

The cash flow continues to improve significantly in the plastic-chemical industry, with stocks like GVR (+3.92%), DGC (+5.2%), BMP (+2.16%), PHR (+1.09%), AAA (+1.85%), CSV (+1.99%),… However, TDP and NET stocks have started the morning session in the red with decreases of 2.85% and 0.12% respectively.

The positive sentiment also spreads to the household goods manufacturing sector, with stocks like MSH, TNG, STK, GDT… ending the morning session with good growth rates.

In terms of foreign trading, at the end of the morning session, foreign investors continued to sell net and dominated most of the past 10 trading sessions. In the morning session, they sold over 18.7 billion dong on HOSE, with the highest selling volume in STB stock. On the HNX exchange, foreign investors net bought over 1.6 billion dong, focusing on IDC stock.

10:30 AM: Investors remain uncertain

Investors appear uncertain, leading to slight fluctuations in the main indices. As of 10:30 AM, VN-Index increased by 7.85 points, trading around 1,219 points. HNX-Index increased by 0.12 points, trading around 231 points.

Most of the stocks in the VN30 basket have shown strong gains. Notably, TCB increased by 2.04 points, VRE increased by 0.77 points, VCB increased by 0.54 points, and VHM increased by 0.48 points. On the other hand, only a few stocks such as VPB, STB, MWG, and VIB still faced significant selling pressure.

As of 10:30 AM. Source: VietstockFinance

|

The seafood processing sector is being strongly bought, with 4 stocks, ANV, VHC, ASM, and IDI, all hitting their price ceiling. Other stocks in the sector also showed positive performance, with FMC up 6.39%, CMX up 6.57%, ACL up 5.18%, and IDI approaching the trading limit with a 6.33% increase.

The cash flow continues to significantly improve in the plastic-chemical industry, with GVR up 3.63%, DGC up 5%, DCM up 1.06%, and BMP up 1.73%…

Compared to the opening, there is still a slight advantage for buyers. The number of stocks that increased was 292 stocks (including 11 stocks hitting the ceiling) and the number of stocks that decreased was 276 stocks (including 5 stocks hitting the floor).

As of 10:30 AM. Source: VietstockFinance

|

Opening: BID continues to lead the VN-Index

After a sharp decline at the end of the previous week, VN-Index opened this morning with a slight recovery but still carried a cautious sentiment as the index fluctuated around the reference level. However, there is still a positive contribution from the seafood processing, transportation – warehousing, and food – beverage sectors.

Notably, BID increased by 4% and is currently the stock with the most positive impact on VN-Index.

Leading the market is the seafood processing sector, which shows a positive trend right from the opening. The green color spreads to stocks with large market capitalization as well as small market capitalization, such as VHC (+2.63%), ANV (+0.97%), ASM (+0.47%), IDI (+1.27%), CMX (+0.69%).

The food and beverage sector also sees mostly positive performance, with stocks like VNM (+0.42%), MSN (+0.3%), SAB (+0.18%), KDC (+0.32%), PAN (+1.51%), DBC (+0.18%), SBT (+0.37%),…

On the other hand, the retail sector didn’t start the morning session on a positive note. Major players in the retail industry like MWG, FRT are experiencing slight decreases, while other stocks in the sector have insignificant gains.

Lý Hỏa