Corporate bond market expected to face pressure in 2024 due to high volume of maturing bonds

The corporate bond market in the first half of 2023 was sluggish, but improved in the second half of the year thanks to the efforts of regulatory agencies. However, the market still faces significant pressure in 2024 as the volume of maturing bonds reaches its peak, with a total value of nearly 279.2 trillion VND, according to the latest data from the Vietnam Bond Market Association (VBMA).

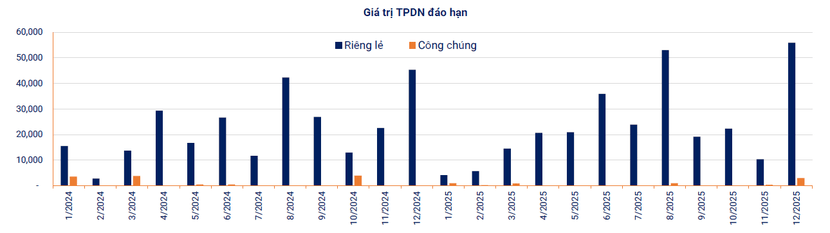

Maturing corporate bonds in 2024 will peak in August and December – Source: VBMA

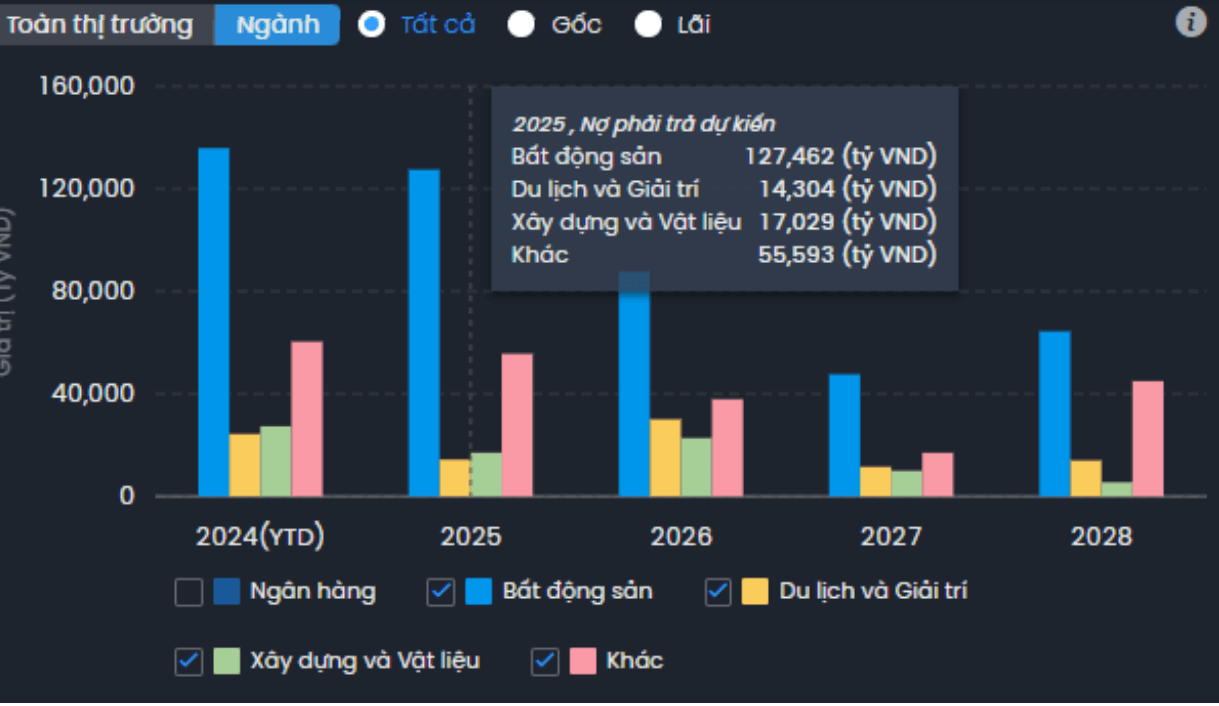

The January 2024 bond market report from FiinRatings also highlights the pressure of maturing bonds as one of the existing risks in 2024. According to the credit rating agency, in addition to the value of individual bonds maturing, the real estate sector accounts for the majority (approximately 115.7 trillion VND, or 41.4%), followed by the construction and materials industry and the tourism and entertainment industry with high values of maturing bonds (27.3 trillion VND and 24.3 trillion VND, respectively).

“These are industries that are still facing many difficulties, and more importantly, the quality of issuing organizations that have mobilized funds in previous years is generally low, with many project companies having thin or newly operational financial capabilities,” FiinRatings commented.

Large amounts of billion-dollar real estate bonds maturing

In fact, data on the bond page of the Hanoi Stock Exchange (HNX) shows that in 2024 there will be a series of billion-dollar bond lots maturing, including many large-value bond lots issued by non-listed or newly established real estate businesses.

A prominent example is bond lot SDICB2124001 of Saigon Investment and Development Corporation (SDI Corp, the investor of Saigon Binh An Urban Area project – trade name The Global City – in An Phu Ward, Thu Duc City) with a total face value of 6,574 billion VND, issued on December 15, 2021, and maturing on December 15, 2024. This is also the largest-value bond lot this year.

Another company with a real estate trading contract with SDI Corp, Dai Phu Hoa Investment Joint Stock Company, also has a bond lot worth 3,560 billion VND due to mature in December 2024.

In addition, there are many other large-value bond lots that will mature in 2024, such as bond lot GHICB2124001, with an issuance value of 5,760 billion VND, by Golden Hill Investment Joint Stock Company (the investor of a high-rise building project at 87 Cong Quynh Street, Nguyen Cu Trinh Ward, District 1, Ho Chi Minh City), maturing on April 15, 2024.

Similarly, a series of other billion-dollar real estate bond lots will also mature this year, including bond lot NAN12301 with an issuance value of 4,700 billion VND by Nam An Investment and Business Joint Stock Company. This bond lot was issued in March 2023 and will mature in September 2024.

Similarly, several other bond lots worth over 4,000 billion VND will also mature this year, such as bond lot SPN12301 of Phuong Nam Trading and Development Investment Joint Stock Company (with a value of 4,695 billion VND, maturing in September 2024); bond lot LVR12301 of Lan Viet Real Estate Limited Liability Company (with a value of 4,100 billion VND, maturing in November 2024); bond lots HYD22301 and HYD22302 of Hung Yen Urban Development and Investment Limited Liability Company (with issuance values of 4,450 billion VND and 2,750 billion VND respectively, both maturing in March).

Expected maturity balances of individual bonds for certain sectors in 2024 and 2025 – Source: FiinPro Platform

In addition, there are also numerous billion-dollar real estate bonds maturing in 2024. Among them, DCTCH2124001 bond lot worth 2,000 billion VND by DCT Partners Vietnam Trading and Services Limited Liability Company and ANKHANG2019-02 bond lot worth 1,000 billion VND by An Khang Real Estate Development Company Limited are both due in June 2024; PTJ12301 bond lot worth 1,900 billion VND by Phu Tho Land Joint Stock Company will mature in August 2024; HTCH2024001 bond lot worth 1,400 billion VND by Hoang Truong Tourism Real Estate Investment Limited Liability Company and GLTCH2124001 bond lot worth 1,000 billion VND by Golf Long Thanh Investment and Business Joint Stock Company will both mature in December 2024.

DB Investment and Development Limited Liability Company – the company behind the urban real estate brand Ecopark – has a bond lot DBICB2124001 with a total face value of 1,360 billion VND, maturing in October. Meanwhile, Big Gain Investment Joint Stock Company has two bond lots with a total value of 2,000 billion VND due in June and July this year…

Large-value maturing bonds increase liquidity pressure for businesses

In the construction and materials industry, 2024 is also the year when many companies have to find a way to repay billion-dollar bonds. Among them, Trung Nam Construction Investment Joint Stock Company has three bond lots maturing this year with a total value of 4,100 billion VND, including 2,000 billion VND for bond lot TNGCB2224003 (maturing in April 2024), 2,000 billion VND for bond lot TNGCB2124001 (maturing in May), and 100 billion VND for bond lot TNGCH2224005 (maturing in July).

Vietnam Construction Import-Export and Trading Joint Stock Corporation (Vinaconex) still owes 1,300 billion VND in principal of bond lot VCGH2124011, maturing in June 2024. This bond lot, with a total issuance value of 2,500 billion VND, was issued by the company in June 2021 and has since been repurchased before maturity with 1,200 billion VND.

Similarly, HELIOS Investment and Services Joint Stock Company still has two bond lots HELIOS.BOND.01.2019.1000(1) and HELIOS.BOND.01.2019.1000(2) worth 1,000 billion VND and 500 billion VND respectively, maturing in June and August 2024.

Mr. Nguyen Tung Anh, Director of Credit Risk Research and Sustainable Financial Services at FiinRatings

For the tourism and entertainment industry, Danh Viet Trading and Services Joint Stock Company has 8 bond lots maturing in August with a total value of over 3,400 billion VND, of which the bond lot with the highest value is DANHVIETL2024202 (1,500 billion VND).

Van Huong Investment and Tourism Joint Stock Company also has two bond lots DRT12103 and DRT12104 with a total value of 1,500 billion VND maturing in September and October this year.

Meanwhile, April this year will mark the maturity of two bond lots VPLB2024002 and VPLB1924001 (each worth 1,000 billion VND) issued by Vinpearl Joint Stock Company. During the period of 2018-2020, the company issued dozens of bond lots, but all were repurchased on time.

In addition, many companies in other industries have bond lots worth hundreds of billion VND that will mature in 2024.

In a discussion with the author, Mr. Nguyen Tung Anh, Director of Credit Risk Research and Sustainable Financial Services at FiinRatings, believes that the significant increase in maturing bonds in 2024 poses certain risks to the bond market. First and foremost is the increased liquidity pressure for businesses to prepare funds to repay bond principal and interest. Many businesses may face difficulties due to ongoing business conditions for various reasons.

However, representatives from FiinRatings also believe that most of these are bond lots issued during the active periods since 2021, and investors need to note that issuing organizations are project companies. Therefore, bondholders need to monitor the legal progress of the projects and their ability to execute sales or review the ability to fulfill their debt obligations to find appropriate solutions or even evaluate the ability to trade on the HNX if the bond has liquidity.

Representatives from FiinRatings also believe that within the entire system, these risks can gradually be controlled as all parties make efforts to restructure and have appropriate plans. This is because the quality of bond issuers of issuers has significantly improved in line with the requirements of the new regulations from Decree 65, and the market has learned lessons, mainly from businesses with better credit profiles and transparency that have participated in issuances.

“However, I believe that the mentioned risks are unlikely to occur, especially when market regulators have been actively monitoring and especially have taken reasonable policy steps and approvals to prepare for 2024. On a broader scale, functional agencies have also proposed many solutions to help businesses access appropriate capital sources, increasing opportunities for a healthy market recovery. Therefore, I believe that we can be optimistic about the ‘slow but steady’ recovery of the market,” Nguyen Tung Anh expressed his viewpoint.