HAGL Company has announced that it has received the official registration paper to purchase privately owned shares from investors for the sale of 130 million privately owned shares. The list of investors participating in the sale is expected to include 3 investors:

+ LPBank Securities Joint Stock Company is expected to purchase 50 million shares, increasing ownership from 0% to 4.73% of charter capital;

+ Thaigroup Corporation Joint Stock Company is expected to purchase 52 million shares, increasing ownership from 0% to 4.92% of charter capital;

+ Individual Le Minh Tam is expected to purchase 28 million shares, increasing ownership from 0% to 2.65% of charter capital. Mr. Tam replaces Mr. Nguyen Duc Quan Tung (registered to purchase 20 million shares but later canceled and did not participate).

The amount mobilized is 1,300 billion VND, HAGL Company plans to use 700 billion VND to supplement working capital and restructure debt for its subsidiary, Hung Thang Loi Gia Lai Company through the form of loan to operate its business; 330.5 billion VND to partially or fully repay the principal and interest of bonds issued by the company on June 18, 2012, with code HAG2012.300; and the remaining 269.5 billion VND to restructure debt for its subsidiary, Lopang Livestock Joint Stock Company, through the form of loan to pay off debt at Tien Phong Commercial Joint Stock Bank.

The sale and purchase of shares will be carried out within the time frame stipulated by law.

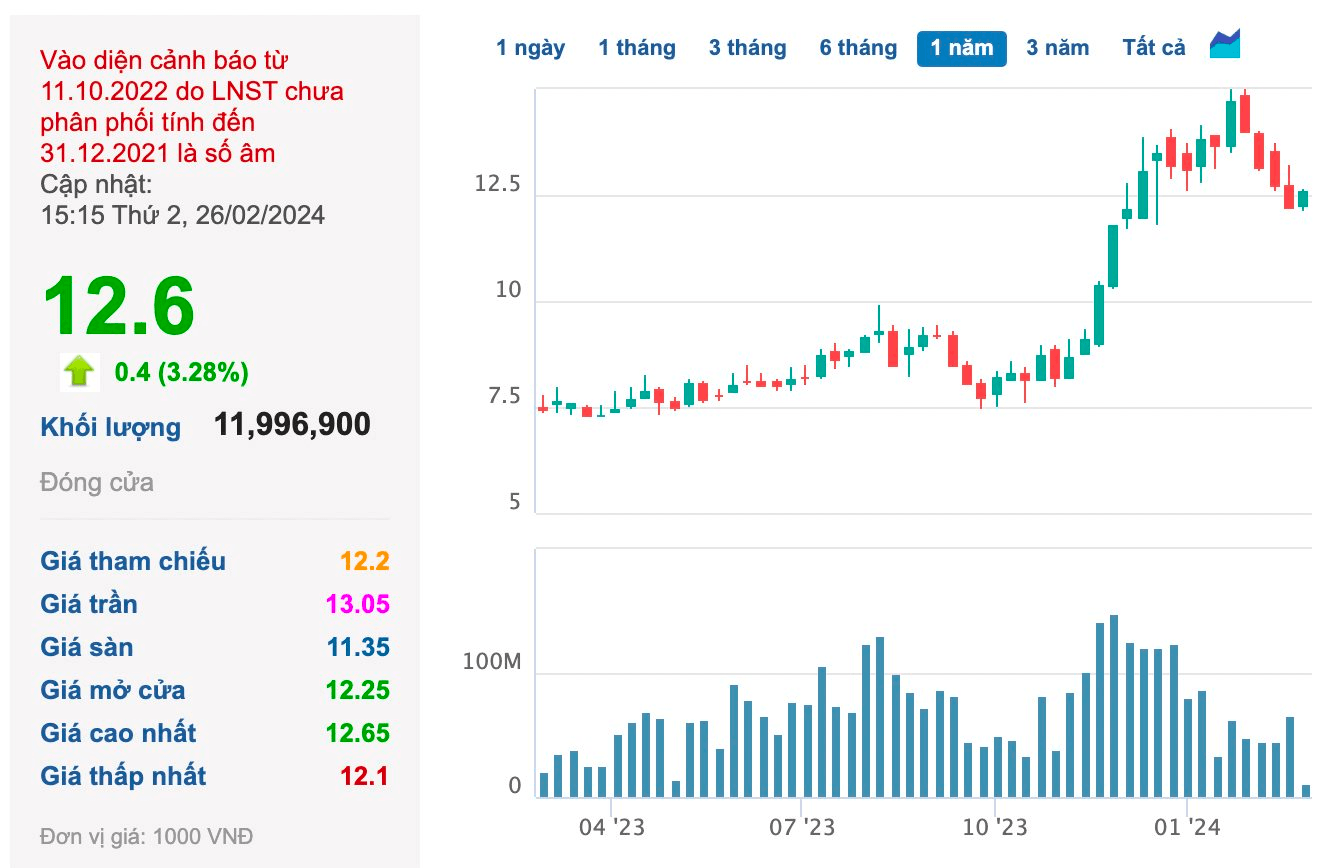

On the market, HAG shares are trading at a price of 12,600 VND/share.