The property management industry is a lucrative market valued at USD 14.1 billion in 2021 and is projected to reach USD 51.73 billion by 2029. In Vietnam, the property management and operation sector is relatively new but equally attractive, thanks to the rapid urbanization and strong growth of the real estate market.

A Lucrative Market Tapped Early by Savills since 1995

In fact, international players have entered this market early since 1995, such as Savills. Savills is known as one of the global property management companies with over 600 offices in more than 60 countries. Having entered the Vietnam market in 1995, Savills has acquired over 28 years of experience in advising and managing various types of real estate throughout Vietnam, including shopping centers, offices, luxury condominiums, and urban areas.

Currently, Savills Vietnam manages over 8 million square meters of real estate. Some famous buildings they manage include PVI Tower, BIDV Tower (Hanoi), Saigon Pearl, The Vista (HCMC)… In addition, Savills is also one of the leading real estate companies with a large and professional staff ready to meet all customer needs.

During the period of 2003-2006, the market experienced a boom with the influx of international brands.

Among them, CBRE – the world’s largest investment and commercial real estate services company – officially entered the Vietnam market in 2003. Today, after 18 years of development, CBRE has over 700 employees working at 3 representative offices in Vietnam.

Although coming later, according to data from Vietdata, CBRE Vietnam is one of the largest property management companies in Vietnam with approximately 1.3 million square meters of real estate. Some typical projects managed by CBRE include Vincom City Towers, Grand Plaza Hanoi,… in Hanoi and The River Thu Thiem, Sunshine Venicia,… in HCMC.

In 2006, Cushman & Wakefield – the professional real estate investment and management group in the US – joined the market. Today, JLL Vietnam has developed into a leading real estate advisory company in Vietnam, with more than 450 employees.

Domestic Players Also Joining the Competition

Domestic players did not miss out on this “piece of cake” either. In 2009, Vietnam Posts and Telecommunications Group (VNPT) partnered with Biken Techno Group of Japan to establish PMC Building Management and Operation Joint Stock Company, which was established in June 2009. PMC is also a well-known building management unit in Hanoi, currently managing large projects such as Ruby GoldMark City, Winhomes Bac Ninh, SaigonMia…

In 2019, Asahi Japan Asset Management & Investment Joint Stock Company was established based on the cooperation between TOYO Group and the Service and Real Estate Corporation DongA Miền Bắc (Daikkyo). Currently, Asahi Japan is managing projects such as Flora Fuji, Golden Park Tower, Opal Boulevard…

My House – a 100% Vietnamese-owned company – was established in 2013 by a team of lawyers, technicians… with high expertise. With over 10 years of experience in consulting and organizing management and operation, My House is currently managing large-scale projects such as Riva Park, To Ky Tower, Sky Center building, Viva Riverside project…

Annual Revenues in the Hundreds of Billions, Most Profitable

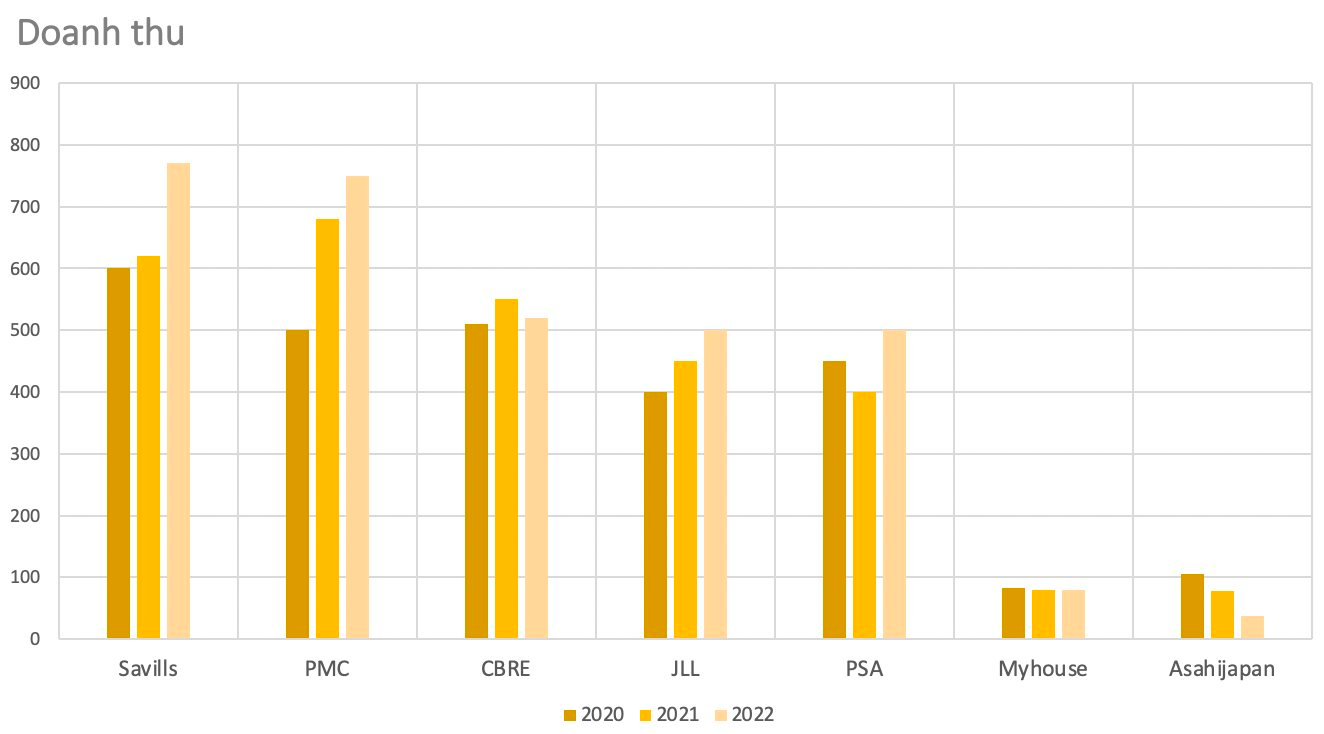

The attractiveness of this market is also reflected in its business performance. According to data from Vietdata, despite the real estate market fluctuations, property management companies have maintained steady growth in their revenue in the period 2020-2022, with annual revenues in the hundreds of billions of VND, most of which are profitable.

Among them, the “pioneering” Savills is leading with a net revenue of nearly VND 790 billion in 2022, an increase of over 21% compared to last year. Although not growing as strongly as its revenue, Savills’ profits over the past 3 years have remained around VND 22-23 billion per year, corresponding to a profit margin of about 3%.

PMC – the joint venture between VNPT and a Japanese Corporation – ranks second. It is noted that PMC’s net revenue and after-tax profits have tended to develop steadily in the 2020-2022 period, with positive annual growth. In 2022, PMC achieved over VND 760 billion revenue – just behind Savills, and a profit of nearly VND 14 billion.

CBRE Vietnam ranks third with a net revenue fluctuating slightly each year within the range of VND 510-550 billion/year. In contrast, the after-tax profits of the company show strong volatility. After nearly doubling its profits in 2021, this figure shows a worrying sign in 2022, returning to a profit level similar to that of 2020.

JLL also achieved a revenue of VND 510 billion in 2022. It is worth noting that the after-tax profits of this unit have made a breakthrough in 2021 – 2022, increasing 3-4 times compared to 2020 profits.