According to information shared on the DIA Group’s Business Insights YouTube channel, Mr. Dao Huu Duy Anh, a member of the Board of Directors and CEO of Duc Giang Chemical Group (DGC), stated that in the current economic context, Duc Giang is seeking ways to expand production and increase new products for the Group to reduce dependence on Apatite ore and related products.

Duc Giang Chemical is concurrently implementing three projects. Among them, the Duc Giang Nghi Son project produces chlorine and PVC plastic compounds with a total investment of VND 12,000 billion. The management has set a target to complete the project in 2024, with construction expected to start in July 2024 and completed after 1 year of construction.

According to BSC securities analyst, the Duc Giang Nghi Son project is expected to contribute about VND 3,000 – 4,000 billion to annual revenue, equivalent to about 25% of DGC’s current total revenue, making Duc Giang the largestScale alkali production company in Vietnam.

The Duc Giang real estate project is also in the process of applying for investment licenses and hopes to proceed this year.

As for the bauxite project in Dak Nong with a total investment of VND 50,000 billion, it is a long-term project. Currently, Duc Giang is applying for government permits for mining as well as investment licenses for deep processing projects bauxite to produce alumina and electrolyze aluminum.

In addition, Tia Sang Battery – a subsidiary of Duc Giang – is also implementing a project to produce lithium batteries for electric cars and telecommunications with a designed capacity of 200,000 Kwh/year.

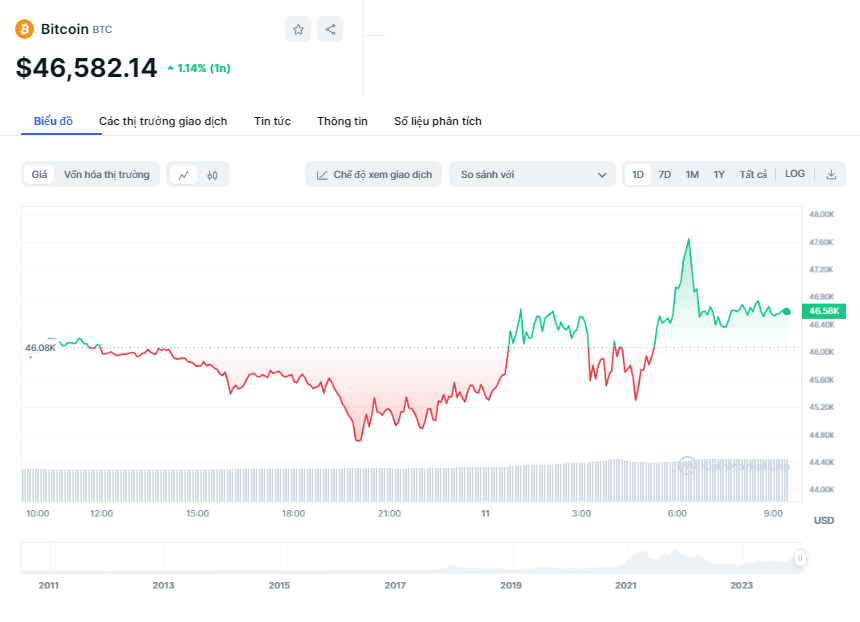

After hitting the daily upper limit the previous day, DGC stock of Duc Giang Chemical Company continued to rise by 4.3% in the trading session on February 27, closing at VND 111,600. This is also the highest level of this stock in the past 20 months, since June 2022.

In fact, DGC has been on the rise for the past month with a value increase of about 27%. The market capitalization of Duc Giang Chemicals has also increased by nearly VND 9,000 billion since the end of January 2024, reaching nearly VND 42,400 billion.

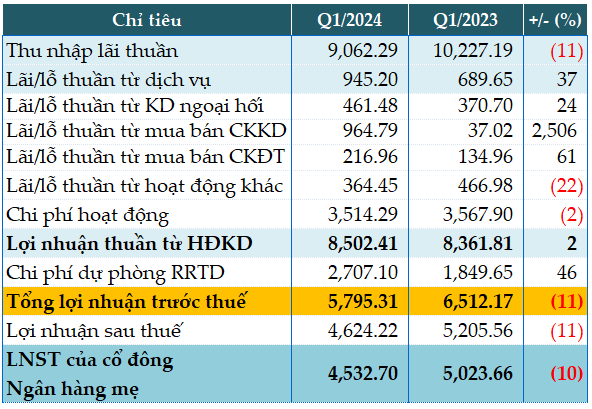

In the whole of 2023, Duc Giang Chemical recorded VND 9,748 billion in net revenue and VND 3,109 billion in net profit after tax of the parent company, a decrease of 33% and 44% respectively compared to the previous year.