At the end of the day on February 27, the stock market witnessed a lively trading session as the VN-Index rose over 13 points to 1,237.46 points. However, the SAB shares of Saigon Beer – Alcohol – Beverage Corporation (Sabeco) dropped for the fifth consecutive session to the price of VND 56,300/share.

With the stock price now at only VND 56,300/share, Sabeco’s market capitalization is now only VND 72,208 billion (equivalent to USD 2.8 billion).

By the end of 2017, Vietnam Beverage – a member of Thai Beverage – caused a shock by spending USD 5 billion to buy the entire 343.66 million SAB shares from the divestment of the Ministry of Industry and Trade, thereby officially gaining control of Sabeco. However, at the current time, the market value of these shares is only about VND 36,838 billion (about USD 1.5 billion), which means that Thai Beverage of Thai billionaire Charoen Sirivadhanabhakdi is temporarily losing USD 3.5 billion after nearly 6 years.

In fact, ThaiBev invests in Sabeco with a long-term vision, along with the ambition to dominate the beer market in Vietnam and pave the way for the Southeast Asian region. Therefore, the temporary loss on this investment is not a big issue for Thai “tycoons”. According to Nikkei, at a press conference in Thailand in September 2022, representatives of ThaiBev’s leadership shared that Sabeco is a “precious gem”, a rare asset among beer producers in the Southeast Asian region.

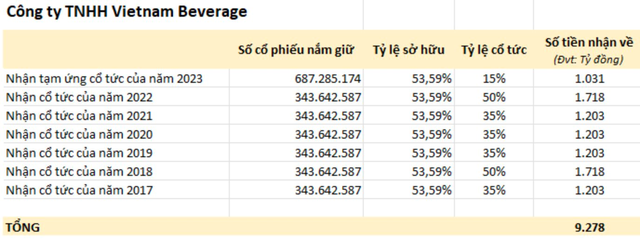

In addition, saying that this Thai billionaire is losing money when investing in Sabeco is not really accurate. Because Sabeco is still paying dividends in cash “generously” every year to shareholders. Therefore, ThaiBev still receives billions of Vietnamese dong in dividends from Sabeco.

In 2023, Sabeco plans to pay dividends at a rate of 35% in cash. Therefore, the leading beer company is expected to pay an additional 20% in dividends and the conglomerate of billionaire Charoen Sirivadhanabhakdi can earn an additional VND 1,374 billion in dividends in the near future. The dividends flowing into the pockets of this tycoon will increase even more when Sabeco continues to distribute cash with a high rate every year.

The decrease in the stock price of Sabeco may come from the bleak prospects of the beer industry in Vietnam. According to a report by Vietdata, as of 2022, beer consumption in Vietnam is at 3.8 million liters/year, accounting for 2.2% of the global market. However, this consumption level may not be able to be maintained in 2023, when there is no longer a bustling buying and selling scene like previous years, or the situation of shortage and price hike every Tet holiday. The beer industry is experiencing an unprecedented decline in consumption.

Even those in the beer industry have already seen these difficulties. Heineken CEO, Mr. Dolf van den Brink, said that beer sales volume in the first half of 2023 declined by 5.6%, due to the economic downturn in Vietnam – one of Heineken’s largest markets. “We are facing a strong economic downturn in our important market, which is Vietnam,” Mr. Dolf said.

Carlsberg representative, Mr. Cees’t Hart, also emphasized that the beer market in Vietnam decreased by 6% in Q2 due to the economic downturn.

In addition, the government is also tightening regulations on the blood alcohol concentration of road users, which is causing a decrease in consumption. Beer producers are also struggling with exchange rates and fluctuating interest rates, which are causing the prices of many input factors and production costs to increase.

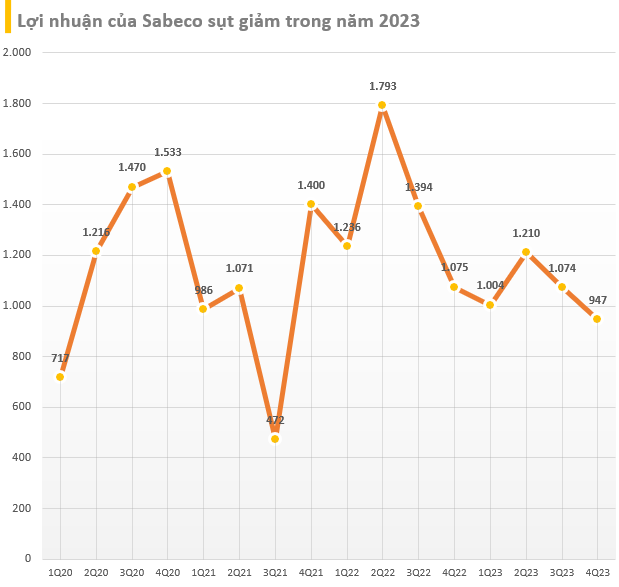

With the decline of the industry and the tightening of regulations on alcohol intake, Sabeco’s business results have been immediately affected. In Q4/2023, Sabeco recorded net revenue of VND 8,520 billion, down 15% compared to the same period. Profit after tax attributable to parent company is VND 947 billion, down 9% compared to the same period. This is the lowest quarterly profit of Sabeco in the past 2 years.

For the whole year 2023, Sabeco’s revenue reached VND 30,706 billion, down 13% compared to the previous year and lower than 2016. Prior to that, the company’s revenue had a strong recovery in 2022, after a sharp decline in 2020 and 2021 due to the impact of the Covid-19 pandemic. Deducting costs, the company after-tax profit was VND 4,255 billion, down 23%.

According to Sabeco’s explanation, in addition to the tightening of Decree 100, the company is also affected by fierce competition, declining consumer demand due to the domestic economic downturn. The input and management costs of the company have also increased, while the profits from joint ventures and affiliations are lower.

Regarding the prospects of Sabeco, SSI Research has a more cautious view for 2024, because the consumption level may continue to be simultaneously affected by Decree 100 and the reduced income of consumers.

Looking at China, the country has implemented strict driving laws since 2011, which will be effective until 2023, beer consumption growth has slowed significantly (see chart below). Therefore, SSI Research believes that similar strict laws applied in Vietnam since 2020 will be the main factors slowing down beer consumption growth.

In addition, consumers tightening their spending is a highlight of 2023, when Heineken recorded a 13% decline in beer consumption in Vietnam in the period of 9M/2023 due to a decline in consumption of premium products. Meanwhile, the company’s mainstream brands such as Heineken Silver and Tiger Crystal have gained market share.

Sabeco also said that the company has gained market share in 9M/2023 mostly thanks to the competitive advantage in the mainstream segment when consumers tighten their spending and turn from premium products to mainstream products. SSI Research expects this trend to continue until 2024. The more favorable malt prices (decreasing by 17%) in 2024 will be a good opportunity because SAB will fix the price of the raw material for the next 9 months from August to September 2024.