The General Department of Taxation has just issued document No. 661/TCT-TTKT to the Ho Chi Minh City Tax Department regarding the settlement of value-added tax refunds for members of the Vietnam Cassava Association.

TAX AGENCY “HOLDING” PENDING FILES

At the end of January 2024, the Vietnam Cassava Association sent a letter to the General Department of Taxation requesting the settlement of value-added tax refunds for its members, including Fococev Vietnam Joint Stock Company, in accordance with the directions of the Prime Minister and the Ministry of Finance.

“Up to now, the refund request documents in Section 1 of the Ho Chi Minh City Tax Department have been checked and are eligible for refund, but the Ho Chi Minh City Tax Department has not yet settled the refund for Fococev Company,” said Nghiem Minh Tien, Chairman of the Vietnam Cassava Association.

Fococev Vietnam operates in the production and trading of cassava starch with annual revenue of over VND 3,000 billion, a production capacity of over 320,000 tons/year, and more than 1,800 employees working throughout the system. Currently, Fococev’s system includes multiple factories located in various regions across the country: Son La, Quang Binh, Quang Tri, Quang Nam, Kon Tum, Gia Lai, Phu Yen, Ninh Thuan, Binh Phuoc.

Regarding the difficulties in value-added tax refunds, Nguyen Xuan Son Hai, CEO of Fococev Vietnam Joint Stock Company, said the company has submitted 29 refund request documents from June 2020 to February 2023, with a total refund request amount of VND 355 billion.

According to the process, on July 28, 2023, the Ho Chi Minh City Tax Department accepted the documents. Then, on August 18, 2023, the tax department issued inspection decision No. 1149/QD-CT-KT; on September 5, 2023, the tax department announced the inspection decision and started the inspection.

“According to the confirmation report of the inspection data on October 27, 2023, with 1 member of the inspection team concluding that through the random inspection of 2 sets of export documents, the tax official noted that the refund documents met the conditions for a 0% tax rate for export goods as specified by the tax law,” said the leader of Fococev Company.

Until now, despite the completion of the inspection, the inspection team has not issued an inspection report, and the Ho Chi Minh City Tax Department has not yet settled the refund for Fococev Company.

Subsequently, on December 8, 2023, Fococev Company submitted 2 additional refund request documents for the monthly tax declaration of May 2023 and September 2023, with a total refund request amount of VND 11 billion.

The Ho Chi Minh City Tax Department has announced that it has accepted the refund request documents and classified them as “Refund requests: prior refunds”; “… Time for settlement: 06 working days from the date the tax agency accepts the taxpayer’s documents.”

“After the deadline for settlement has expired without being resolved by the Ho Chi Minh City Tax Department, Fococev Company directly contacted the Ho Chi Minh City Tax Department (Tax Accounting Division) and the Tax Inspection Team (Inspection Division 9) and learned that the Ho Chi Minh City Tax Department has reported on the case of Fococev Company and is awaiting instructions from the General Department of Taxation to resolve the refund for Fococev Company,” said a representative of the company.

Therefore, Fococev Company has sent Communication No. 03/CTTC dated January 3, 2024, to the General Department of Taxation to report on the status of the settlement of the refund request documents, but until now has not received a response from the General Department of Taxation.

Facing the prolonged refund delay, Fococev Company has requested the Vietnam Cassava Association to arrange a direct meeting with the General Department of Taxation and request the General Department of Taxation to provide guidance and instructions to the Ho Chi Minh City Tax Department to settle the value-added tax refund for Fococev Company with a total amount of VND 366 billion.

Of which, there are 29 documents for refund requests from June 2020 to February 2023 with a requested refund amount of approximately VND 355 billion. The Ho Chi Minh City Tax Department has conducted the necessary inspection steps before completion for several months but has not yet settled.

Along with that, there are 02 documents for the refund requests for May 2023 and September 2023 with a requested refund amount of approximately VND 11 billion, classified as prior refunds to be inspected after but have exceeded the time limit for settlement according to regulations.

RISKY VAT REFUNDS IN THE CASSAVA EXPORT FIELD

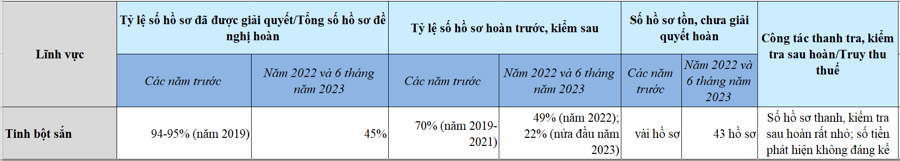

Statistics on the results of VAT refunds in the cassava starch field show that the percentage of successfully settled refund documents out of the total requested documents has been decreasing over the years. Specifically, the success rate of refund documents in 2019 was about 94-95%, which decreased to 45% in 2022 and the first half of 2023.

In addition, the percentage of prior refund and inspection later out of the total requested documents also decreased from about above 70% (in 2019-2021) to 49% (in 2022) and 22% (in the first half of 2023).

It is worth mentioning that the remaining documents for the years 2019-2022 were only a few documents each year, but in 2023, they increased to 43 documents.

Recently, tax authorities have been cautious in refunding value-added tax for fear of allowing fraud and being held accountable. Local tax departments spend a lot of time collecting information and documents to clarify the nature of transactions between businesses, verifying invoices, and waiting for verification results, which delays the settlement of refund documents subject to prior inspection instead of the 40-day period as stipulated.

Furthermore, according to representatives of the General Department of Taxation, tax authorities have discovered some refund documents for cassava starch that show signs of violating the law to misappropriate tax funds, negatively affecting healthy business operations that comply with tax laws. Therefore, it is necessary to tighten the refund process with businesses exporting this type of goods.

To limit the existing issues in the tax refund process, leaders of the General Department of Taxation suggest that tax departments enhance exchanges and disseminate information to business associations and taxpayers regarding value-added tax refund policies, e-invoices to improve taxpayers’ compliance in declaring and refunding value-added tax. At the same time, timely information about the results and information about value-added tax refunds should be provided.

In addition, leaders of the General Department of Taxation also recommend that tax departments enhance their sense of responsibility, complete their work, have a weekly and daily reporting system as instructed by the General Department. In the process of handling documents, if any issues arise, report them to the General Department promptly for timely resolution.