|

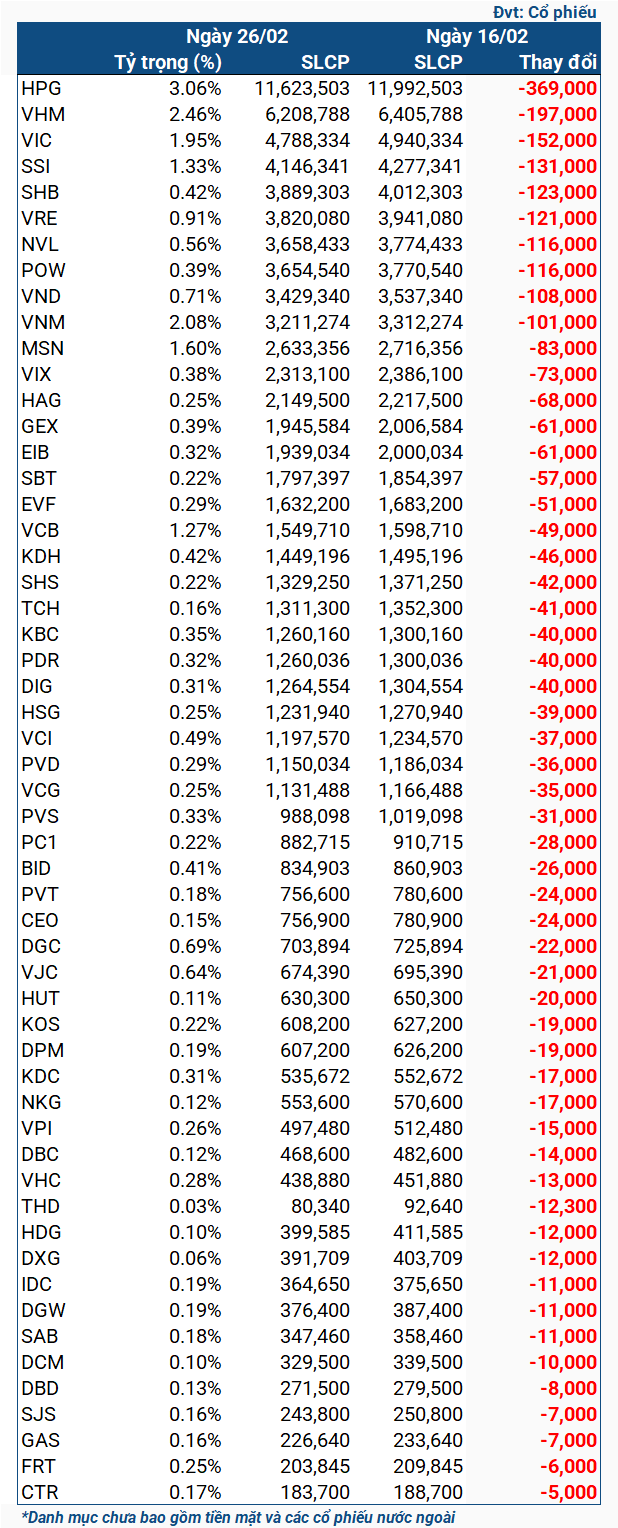

Changes in iShares ETF’s stock from 16/02 – 26/02

|

HPG is the stock that iShares ETF sold the most during this period, with 369 thousand shares. VHM and VIC followed, with 197 thousand and 152 thousand shares respectively. Additionally, there are 7 stocks that were sold over 100 thousand shares, which are SSI, SHB, VRE, NVL, POW, VND, and VNM.

The net selling from iShares ETF occurred in the days leading up to the effective date (01/03/2024) of MSCI’s Q1/2024 review. Even though it has become an active fund, it seems that this investment fund still uses MSCI’s index baskets as references in recent reviews.

According to the review results, MSCI Frontier Market Index added 3 Vietnamese stocks, namely FTS, NKG, and SJS. Meanwhile, MSCI Frontier Markets Small Cap Index added 5 Vietnamese stocks, which are PGC, DHA, NAF, VPH, and VTO. On the other hand, this index removed NKG and SJS (transferred to MSCI Frontier Market Index) as well as VPD.

As of February 26th, the total net asset value of the Fund was over 444 million USD, significantly decreasing compared to the level of nearly 458 million USD recorded on February 16th. Among that, 27.6% was allocated to Vietnamese stocks, with the top weightings belonging to HPG (3.06%), VHM (2.46%), VNM (2.08%), and VIC (1.95%).