The VN-Index closed February 2024 at 1,252.73 points, up 88.42 points, or 7.59%, compared to the end of January 2024, with significantly improved liquidity. The average trading value per session on the three exchanges in February reached VND 21,301 billion, up 26.2% compared to the January average.

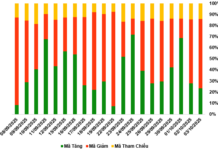

Looking at the monthly timeframe, the allocation of funds peaked in the Information Technology sector, increased in Real Estate, Food, Chemicals, and Petroleum, while it decreased in Construction, Steel, and Retail.

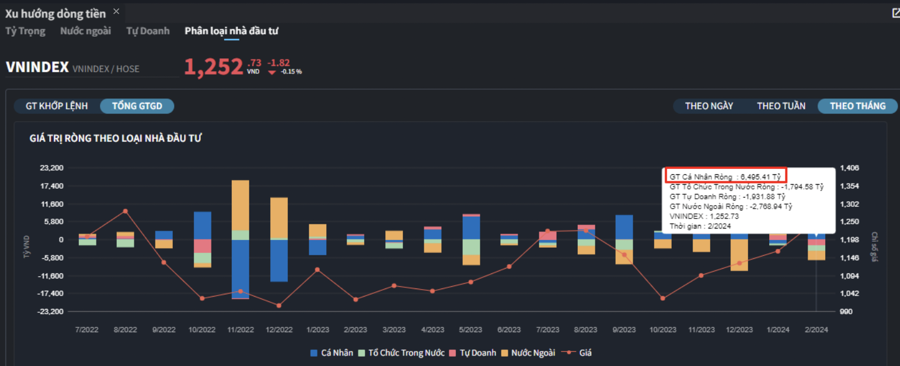

In terms of matched trades, Retail Investors were the only net buyers in February, focusing on net buying in Banking, Food & Beverages, and Real Estate.

The allocation of funds also increased in the large-cap VN30 and mid-cap VNMID groups, while it slightly decreased in the small-cap VNSML group.

Foreign investors were net sellers with VND 2,768.9 billion, and when looking at the matched trades, they were net sellers with VND 4,043.8 billion. Their main net buying focus was on the Chemicals and Basic Resources groups. The top net buying stocks for foreign investors included DGC, HPG, SSI, MSB, CTG, NLG, FRT, KDH, VHC, and VIC.

Their main net selling focus, in terms of matched trades, was in the Banking group. The top net selling stocks for foreign investors included MWG, VNM, VPB, GEX, MSN, VCG, STB, VCB, and FUEVFVND.

Individual Investors were net buyers with VND 6,495.4 billion, with net buying primarily occurring in the Banking sector. The top net buying stocks for individual investors included NVL, VPB, VNM, PC1, MWG, MSN, GEX, NKG, TPB, and MBB.

The main net selling focus for individual investors, in terms of matched trades, was in the Financial Services and Chemicals groups. The top net selling stocks for individual investors included DGC, EVF, SSI, CTG, MSB, VCI, VHC, FRT, and AAA.

Domestic institutional investors were net sellers with VND 1,794.6 billion, and in terms of matched trades, they were net sellers with VND 1,861.2 billion. When looking at the matched trades, domestic institutional investors were net sellers in 9 out of 18 sectors, with the highest value in the Basic Resources group. The top net selling stocks for domestic institutional investors included HPG, ACB, NVL, NKG, FUEVFVND, PC1, FPT, TCB, VHM, and DGC.

The highest net buying value was in the Retail group. The top net buying stocks for domestic institutional investors included DCM, MWG, PVD, CTG, PNJ, LCG, VCI, VNM, HAH, and STB.

Proprietary traders were net sellers with VND 1,931.9 billion, and in terms of matched trades, they were net sellers with VND 857 billion. When looking at the matched trades, proprietary traders were net buyers in 5 out of 18 sectors. The strongest net buying group was the Financial Services and Chemicals. The top net buying stocks for proprietary traders in today’s session included FUEVFVND, EVF, E1VFVN30, BID, AAA, ASM, FUESSVFL, HCM, GEX, and VIX.

The top net selling group was the Banking group. The top net selling stocks for proprietary traders included NVL, MBB, HPG, PC1, SSI, EIB, VSC, TCB, STB, and GMD.

Looking at the monthly timeframe, the allocation of funds peaked in the Information Technology sector, increased in Real Estate, Food, Chemicals, and Petroleum, while it decreased in Construction, Steel, and Retail. In terms of market capitalization, the allocation of funds increased in the large-cap VN30 and mid-cap VNMID groups, while it slightly decreased in the small-cap VNSML group.

In February 2024, the trading value of the VN30 and VNMID groups accounted for 43% and 44.1%, respectively, up from 41.9% and 43.2% in January. The average trading value per session increased by +28.1% (+VND 1,966 billion) for the VN30 group and +27.2% (+VND 1,961 billion) for the VNMID group.

In contrast, the allocation of funds in the small-cap VNSML group decreased to 8.7% from 9.6%.

With a +8.52% increase in February, the VN30 index continued to outperform the VNMID (+5.04%) and VNSML (+5.13%) indices.