Analysts from leading cryptocurrency asset management company Grayscale have spoken about the future price of Bitcoin.

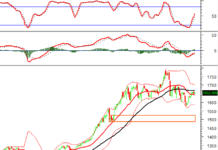

Despite Bitcoin’s 45% price increase in February, reaching $60,000 for the first time since November 2021, Grayscale, the top cryptocurrency asset management firm, said that macroeconomic factors may continue to rise in the near future.

They cautioned that macroeconomics could limit the rise in cryptocurrency value further.

Analysts from Grayscale identified increasing inflation and the possibility of the Fed postponing interest rate cuts as the main factors that could hinder the rise of cryptocurrency prices in the future.

They also added: “Less favorable macro prospects could cause prices to decline again.”

Analysts have stated that if inflation remains high, Fed officials may consider postponing interest rate cuts until the end of the year or even 2025.

“In general, higher US interest rates could have a positive impact on the value of the US dollar and have a potentially negative effect on Bitcoin,” they added.

However, Grayscale still believes that the short-term future of Bitcoin pricing is promising.

The analysts wrote: “In our view, the most likely outcome is that US consumer price inflation will continue to decline, making it easier for the Fed to eventually cut interest rates.”

They advise cryptocurrency investors to keep an eye on upcoming inflation reports, specifically the CPI on March 12th and PPI on March 14th, as well as updates on the Fed’s policy interest rates at the next meeting on March 20th.