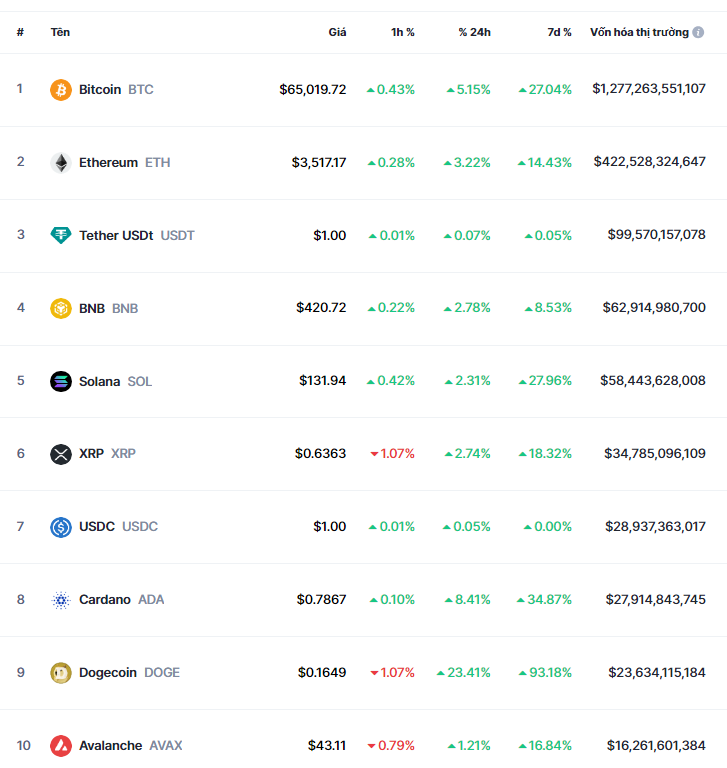

Recently, the price of Bitcoin has experienced a strong increase, surpassing the $62,000 threshold and causing speculation about the beginning of a significant price cycle.

The price of Bitcoin has created excitement in the cryptocurrency community and surprised opponents in the past few weeks.

BTC is currently trading at over $62,000, while the price increase in February demonstrated the longest monthly green candle in history.

Although there has been a significant price increase, some important factors and upcoming events may just be the beginning of a large price surge.

One important factor is the Bitcoin halving event, expected to take place in April this year. This event reduces the rate of new BTC mining and has the potential to increase the value of BTC if it follows the principles of supply and demand.

Another sign signaling that the price of Bitcoin could rise even further in the near future is investors shifting from centralized exchanges to personal wallets.

According to CryptoQuant, the net BTC flow on exchanges has been negative in the past few weeks, with a huge red candle charted on March 1st.

Keeping assets in personal wallets demonstrates the high confidence of investors and a desire to hold for the long term, while reducing immediate selling pressure.

In the past, the peak of the Bitcoin price cycle is often associated with record-breaking levels of Google searches.

Although the popularity of this asset on the world’s largest search engine has increased in recent months, it is still much lower compared to the levels observed at the end of 2021.