Increased Demand Post Tet Holiday

According to observations, there has been an increase in demand for real estate in the Southern market after the Tet holiday. Apartment projects in Ho Chi Minh City and nearby areas have seen a resurgence in demand. Land plots are also heating up with an increase in listings and searches. As for apartments, the demand is still focused on products that meet the actual needs, have clear legal status, reputable developers, and reasonable prices (ranging from 45-50 million VND/sq.m in Ho Chi Minh City; 30-40 million VND/sq.m in nearby provinces).

Statistics from Batdongsan.com.vn show that the overall interest in condominiums nationwide in January 2024 increased by 66% compared to the same period in 2023, and the number of real estate listings also increased by 46%. Specifically, the search volume for condominiums in January 2024 in Hanoi increased by 71% compared to the same period. Similarly, in Ho Chi Minh City, the demand for condominiums also increased by 59%.

Post-Tet Holidays, the demand for buying and investing in some apartment projects in Ho Chi Minh City is still increasing.

Most of the apartment projects launched after Tet in Ho Chi Minh City are in the next stage and new supply is very rare. It is worth noting that the sales policies for 2023 are still being applied by some developers at the beginning of 2024. This policy retention by businesses is helping to maintain market liquidity even in this low season of the real estate market.

Normally, after Tet – which falls in the lunar month of January – is a period of “playing” in the real estate market. However, this year both real estate companies and buyers have shown strong synchronization with the market, unlike the early months of 2023. Specifically, some sales events organized by developers on a weekly basis have seen a good number of customers coming to visit and learn about the projects. Along with that, the number of customers reserving primary apartments (expected to be launched after Q1 2024 and Q2 2024) is also very promising.

In reality, the real estate market in the Western and Southern regions of Ho Chi Minh City has seen consistent transactions for some reasonably priced apartment projects. In fact, there have been projects that have sold out their inventory after Tet (sold from mid-2023 until now). Although the buying and selling atmosphere has not been lively throughout the entire market, the transactions during this period show the long-term efforts of businesses paying off.

According to industry insiders, the attractive sales policies from developers have somewhat stimulated market demand. Along with that, the fear of missing out on opportunities from buyers has helped improve real estate liquidity after Tet. Some “one-of-a-kind” sales policies are still being applied by developers from the end of 2023 to the first few months of 2024, quickly reviving demand.

For example, at the Flora Panorama apartment project in Mizuki Park by Nam Long (in the Southern region of Ho Chi Minh City), the level of interest is quite high thanks to the attractive policies that the developer has been accompanying buyers with. Specifically, with the “ready-to-move-in” policy, buyers will receive a package of high-end interior furnishings worth up to 500 million VND, receiving the apartment in March 2024. For buyers who choose to finance, the bank will provide a loan of up to 70%, with no principal payments for 2 years, only fixed interest payments of 2% per year for 24 months, equivalent to around 4 million VND/month, receiving the apartment in December 2024. Currently, these apartments are being sold for a price starting from 46 million VND/sq.m.

Another example is the Akari City Phase 2 project (located on Vo Van Kiet Boulevard, Binh Tan District, Ho Chi Minh City) by the same developer, which has also received significant attention after Tet. Currently, the developer is still maintaining the “1-0-2” sales policy. Accordingly, for apartments priced from 45 million VND/sq.m, buyers only need to make a down payment of 150 million VND, and the bank will finance up to 80%. For 2 years, buyers do not have to pay principal, only fixed interest of 1% per year – equivalent to 2 million VND/month until August 2026. In case of buying without financing, there is a 7% discount for quick payments. The project has already completed the construction of 4 towers in Phase 2 and will be ready for occupancy in the fourth quarter of 2024. These are all reasonably priced apartment projects by Nam Long that have been and are still receiving attention from buyers.

Continued Scarcity of Supply

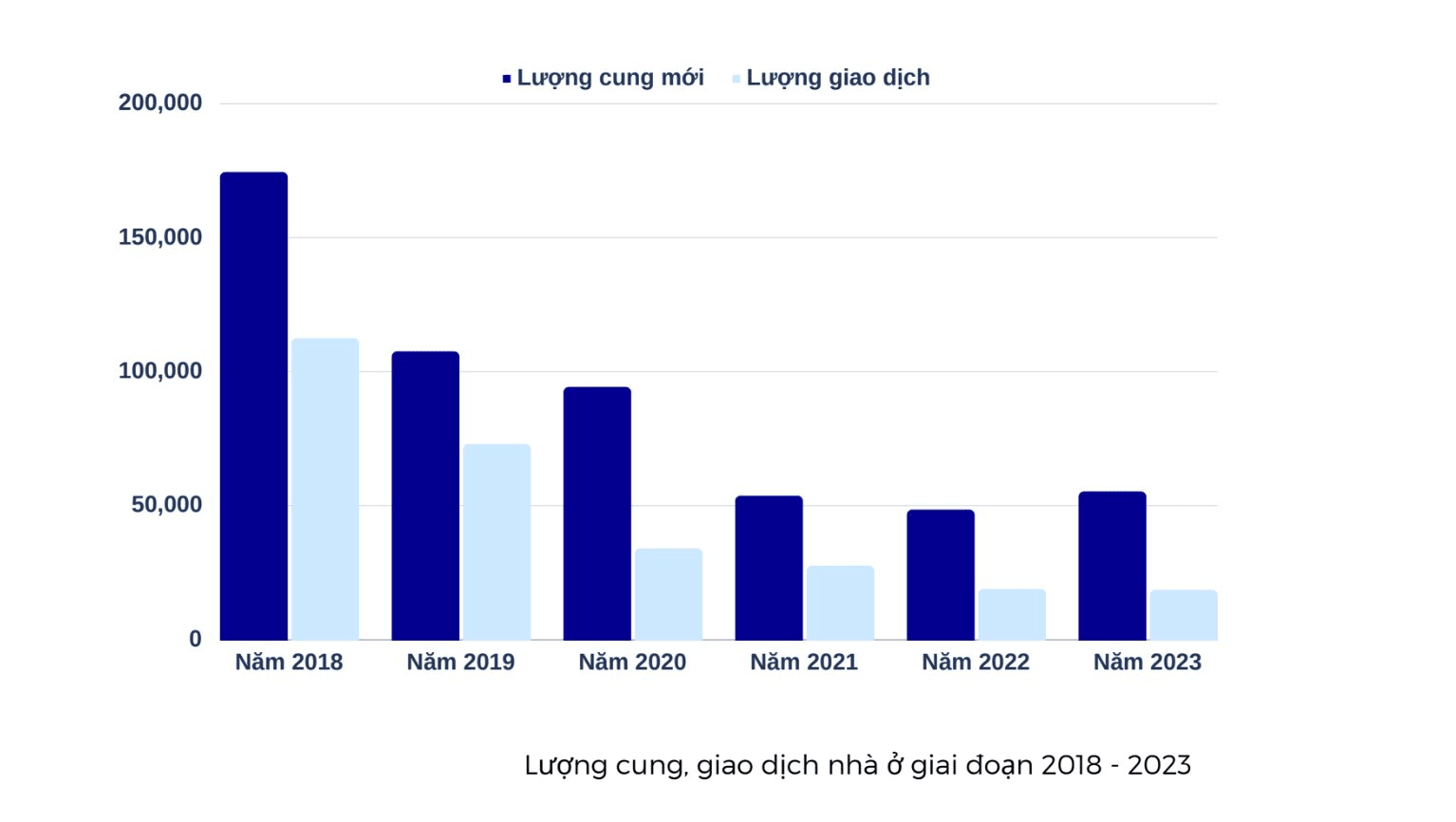

In a recent meeting, Ms. Trang Le – Head of Research at JLL Vietnam, emphasized that although the supply of apartments has shown signs of recovery in 2024, it is still very weak. The situation of scarce new projects will continue in both Hanoi and Ho Chi Minh City. In the past, there were about 30,000 to 40,000 apartments entering the market each year, but in the past few years, this number has only been one-third.

The scarcity of supply will cause the real estate prices to continue to rise in the context of high market demand.

The scarcity of supply coupled with high demand is causing condominium projects to continuously set new price levels. According to the latest report from the Vietnam Real Estate Brokers Association (Vars), apartment prices in Hanoi have continued to rise, while new apartment projects in Ho Chi Minh City have also begun to experience price increases along with a gradual decrease in discounts in the secondary market.

The scarcity of the apartment supply has not improved.

The representative of Vars analyzes that the continuous decrease in housing supply is due to the slow development of projects caused by capital-related policies and decisions made by authorities and agencies in controlling the real estate market. Coupled with the increasing value of urban land as infrastructure and public services are upgraded, condominium prices continue to set new price levels over many years. Currently, the condominium price index in Ho Chi Minh City has increased by 16 percentage points. The demand does not only come from the shift of urban households, but also from the increasing number of labor force and students coming to cities to work and study.