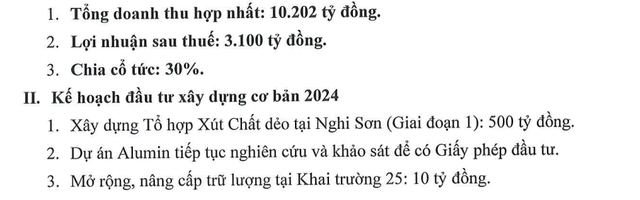

According to the annual General Meeting material of Duc Giang Chemical JSC (stock code: DGC) in 2024, the company sets a target of consolidated total revenue of VND 10,202 billion for next year, a year-on-year increase of 4.6% compared to the 2023 actual result; post-tax profit of VND 3,100 billion, a decrease of 4.4%. The dividend for 2024 is expected to maintain at 30%.

In 2023, the company recorded revenue of VND 9,748 billion, a decrease of 32% compared to the previous year’s performance; post-tax profit of VND 3,241 billion, a decrease of 46%. The reasons are the unfavorable gold market conditions, both domestically and internationally, with rapidly declining prices and lower demand than usual. Meanwhile, other products such as fertilizers, feed additives… have stable prices and increasing production volume.

The corporation also plans to start construction of the plasticizer plant in Nghi Son (phase 1) with a cost of VND 500 billion, commencing in June. In addition, the company will continue to research and survey the Alumina project (with a capacity of 2 million tons of alumina and 300,000 tons of aluminum ingot) to obtain an investment license. The board of directors said that the Alumina project is facing many procedures and requires opinions from many related departments before issuing the license.

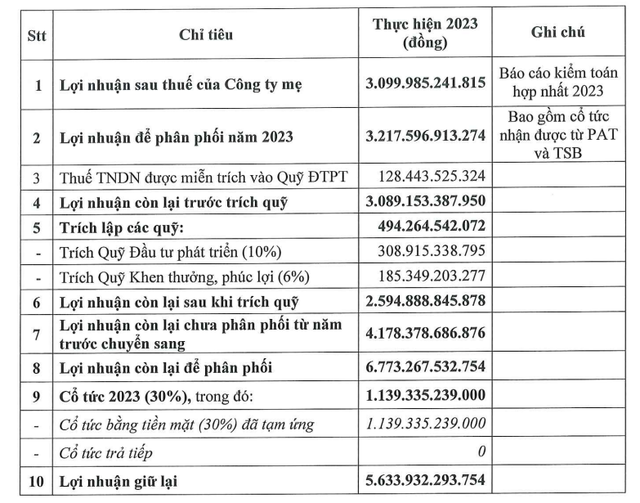

With the 2023 business performance plus the dividends received from Apatit Vietnam (PAT) and TS Battery (TSB), the Board of Directors of Duc Giang Chemicals JSC proposed to distribute a 2023 dividend rate of 30% (already advanced). After distribution and setting aside various funds, the remaining retained profit reaches VND 5,634 billion.

Researching the merger plan of PAT into Duc Giang Chemicals JSC

At the upcoming general meeting, the Board of Directors of Duc Giang Chemicals JSC wants to propose to shareholders the merger of Apatit Phosphate 6 into Duc Giang Chemicals Co., Ltd. Lao Cai. The corporation acquired the Apatit Phosphate 6 factory of Nam Tien Corporation JSC last year, with the aim of increasing the production of phosphate to serve the production of rice phosphate acid of Duc Giang Chemicals JSC.

In addition, Duc Giang Chemicals JSC also wants to merge Apatit Vietnam JSC (PAT) into the corporation. PAT was established in 2014, specializing in the production of gold phosphate with a capacity of 20,000 tons/year at Tung Loong Industrial Zone, Bao Thang District, Lao Cai Province, with a charter capital of VND 250 billion.

PAT became a public company and listed on UPCoM in mid-2022. Upon its listing, the company “shocked” the market by achieving a post-tax profit of VND 963 billion, 3.7 times higher than 2021. At the same time, PAT also stood out with an impressive cash dividend of over 306% in 2022, and 90% was already advanced in 2023.

Currently, Duc Giang Chemicals JSC holds 51% of PAT’s capital through Duc Giang Chemicals – Lao Cai. In addition, Mr. Dao Huu Huyen – Chairman of the company and his son Mr. Dao Huu Duy Anh – General Director of the company, own 16.7% of PAT’s capital.

2024 is the end of the tenure 2019-2024, and the members of the Board of Directors and the Supervisory Board in the 2019-2024 tenure will end their term at the 2024 annual General Meeting. Accordingly, the Board of Directors proposes to the General Meeting to elect new members for the next tenure.

The candidates for the Board of Directors for the 2024-2029 tenure include: Mr. Dao Huu Huyen, Mr. Dao Huu Duy Anh, Mr. Pham Van Hung, Mr. Luu Bach Dat, Ms. Nguyen Thi Thu Ha. The candidates for the Supervisory Board are: Mr. Nguyen Van Kien, Mr. Vu Van Ngo, Ms. Pham Thi Hoa.