In that context, foreign investors sold nearly 95 billion VND across all three exchanges. Specifically, on HOSE, foreign investors sold nearly 158 billion VND; on the other hand, they bought nearly 62 billion VND on HNX and over 1 billion VND on UPCoM.

On HOSE, the stocks that foreign investors net bought the most were VIX, with a net value of nearly 316 billion VND; followed by the stock DGC, with nearly 98 billion VND; and then the two stocks SSI and VCI from the securities sector, with net values of nearly 72 billion VND and 45 billion VND respectively.

In the afternoon, VNM and the fund certificate FUEVFVND were sold hundreds of billions VND, with net values of 153 billion VND and 146 billion VND respectively.

During today’s trading session, the securities sector dominated the “stage” with a surprising surge, leaving many investors wondering why. Among them, stocks such as AGR, PSI, TVS, and APS all hit the trading limit; other stocks such as VIX, SHS, and DSC also experienced significant increases of 5% to 6%.

In contrast, the banking sector declined, with most stocks experiencing price declines, such as MBB, STB, LPB, TCB, CTG, and ACB… and only a few stocks made small gains, such as VCB, VPB, and TPB.

In addition to the securities sector, stocks in the manufacturing sector also saw substantial increases, with DGC being the most prominent stock hitting the trading limit. The stock MSN also increased by over 5%. Fertilizer stocks such as DCM and DPM increased by nearly 2%, and BFC hit the trading limit.

Stocks DGC and MSN were also the two stocks that contributed the most to the index’s increase, offsetting the decrease caused by the banking stocks. 9 out of the top 10 stocks that had the most negative impact on the VN-Index were banking stocks, such as BID, CTG, MBB, HDB, TCB, STB, ACB, LPB, MSB; the remaining stock was SAB.

Morning session: Surprising Reversal

Although in the early hours of the morning session, the VN-Index maintained a positive upward trend and gradually reached higher levels. However, the index started to decline after reaching 1,268.56 points and closed the morning session at 1,261.77 points, down nearly 1 point compared to the previous session.

Liquidity showed signs of improvement compared to the previous session’s average, as well as the average of the last 5 sessions.

Foreign investors also traded in a tumultuous manner, with the selling side having the upper hand, resulting in a net selling of nearly 63 billion VND across all 3 exchanges in the morning session. Specifically on HOSE, foreign investors net sold over 80 billion VND, with the most net bought stocks being VIX, DGC, and HPG; conversely, they heavily dumped VNM and the fund certificate FUEVFVND.

The securities sector continued to perform well, with AGR and PSI hitting the trading limit, and the stock SBS increasing by 5.19%. Notable mentions include VCI, VIX, and SHS.

In the banking sector, most stocks were in the red, with many stocks experiencing price declines such as MBB, ACB, CTG, STB, EIB, LPB, HDB, VIB. However, some stocks like TPB, SHB, and TCB remained unchanged, while the stock VCB remained in the green.

In the manufacturing sector, the stock DGC increased by 3.36%, TNG increased by 2.27%. Notably, the stock BFC hit the trading limit, and the stocks DPM and DCM also increased. Steel stocks such as HPG, HSG, and NKG declined.

PVS and PVD were positive mining stocks, while HMR hit the trading limit for unknown reasons.

In terms of the top stocks influencing the index, VCB continued to play a significant role in supporting the market, with a contribution of nearly 1 point, which is greater than the combined contribution of the next 5 stocks. On the other hand, CTG, HDB, and MSB were the three stocks that had the most negative impact on the VN-Index.

10:35 AM: Steady Increment

As of 10:25 AM, the VN-Index increased by over 3.5 points compared to the previous session, surpassing the 1,266 point mark.

Although the upward trend was maintained, the index fluctuated around 1,264 points before moving higher. Market liquidity was more positive than the previous session’s average but lower than the average of the last 5 sessions.

The securities sector continued to please investors who placed their bets on this sector, with a majority of stocks showing gains on the market. The stock AGR increased with its full trading limit, while the stock SBS increased by nearly 6.5%; other stocks such as SSI, VND performed well; MBS, SHS, HCM increased by over 1%, and the stocks VIX, VCI, and ORS increased by over 2%;

The banking sector also saw many stocks experience positive price increases. Among them, VCB played a leading role in driving the index up, having the largest impact on the index along with two other banking stocks: VPB and TCB. Conversely, the three banking stocks CTG, BID, and HDB had the largest negative impact on the index, followed by VNM, ACB, and STB.

Market Opening: Positive

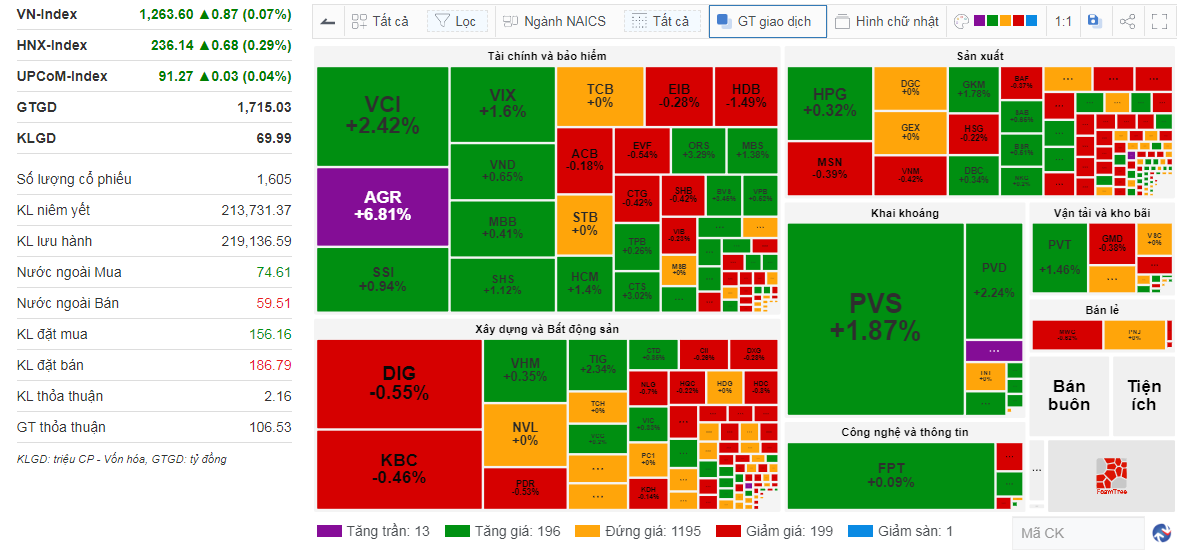

The VN-Index opened the trading session with a decrease but quickly recaptured the positive territory. As of 9:24 AM, the index increased by 0.87 points, reaching 1,263.6 points, with 13 stocks hitting the trading limit, 196 stocks increasing, 1,196 stocks standing still, 199 stocks decreasing, and 1 stock hitting the circuit breaker. The Large Cap, Small Cap, and Mid Cap sectors also gained points.

Market movement at 9:24 AM. Source: VietstockFinance

|

The stock VCB is currently leading the list of stocks that have a positive influence on the VN-Index, while BID is the stock that has the most negative impact on the index.

The VN-Index is positively following the movements of the U.S. market, where all three major indexes increased in the trading session on March 6.

Meanwhile, in a prepared speech for the two hearings before Congress on March 6-7, Federal Reserve Chairman Powell expressed concerns about the risks of inflation and the Fed’s reluctance to loosen monetary policy too quickly.

“As we consider adjustments to monetary policy, we will be carefully assessing incoming data and the outlook for the future, as well as the balance of risks,” he said. “The Committee will still not raise interest rates until we are confident that inflation is sustainably below our 2% target.”