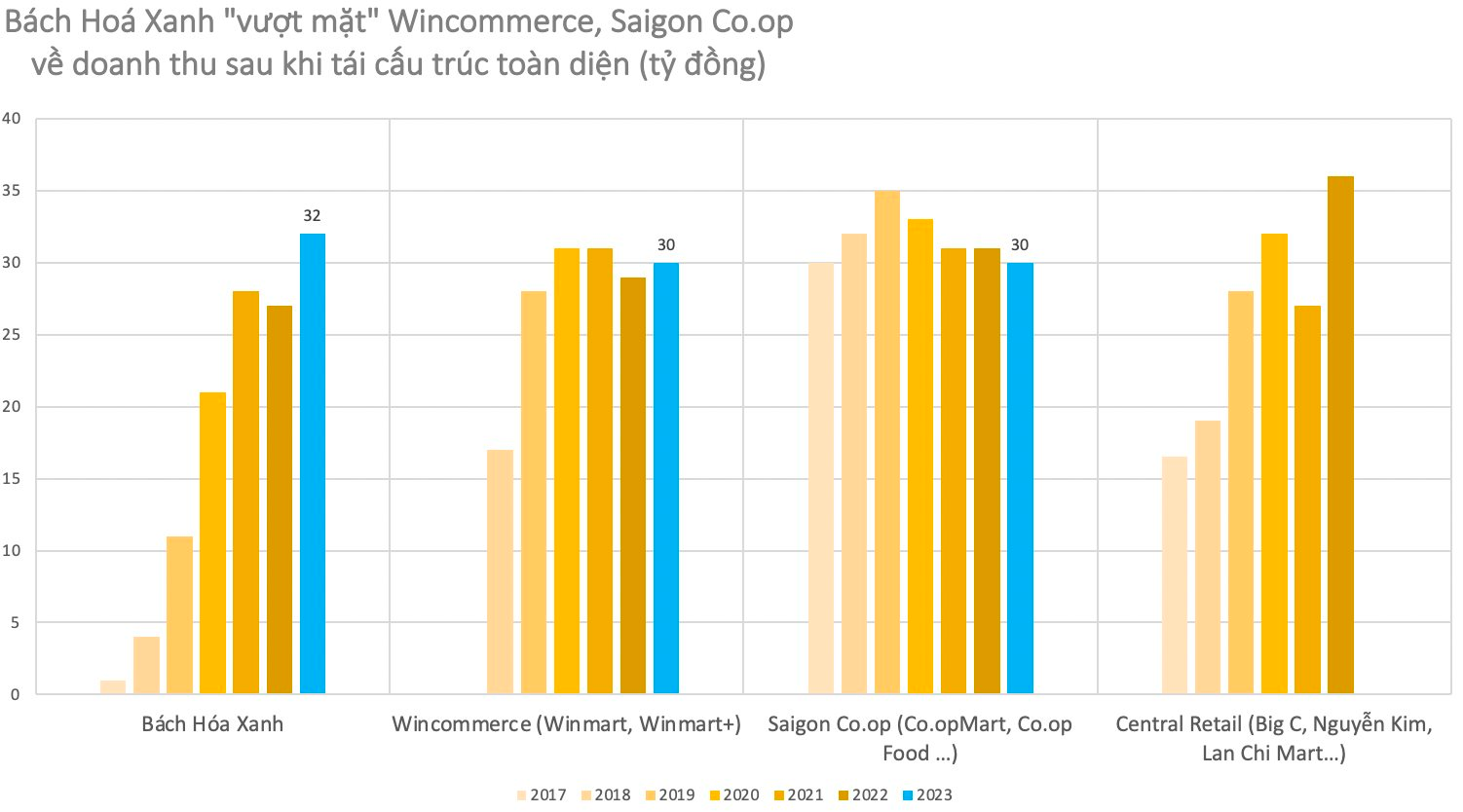

The arrangement of retail giants in the supermarket and convenience store channels continues to change in 2023. If in 2022, Saigon Co.op rose to regain its leading position in revenue, it now has to “give way” to “newcomer” Bach Hoa Xanh of Mobile World (MWG).

It is called a newcomer because compared to Saigon Co.op, Central Retail or the Wincommerce chain (formerly Vincommerce), Bach Hoa Xanh is relatively young. This is also the first time this chain has surpassed its predecessors to lead in revenue with VND 31,600 billion – an increase of 17% compared to 2022. The figure for Wicommerce last year was VND 30,054 billion, and Saigon Co.op reached VND 30,000 billion.

This breakthrough takes place after 1 year that Bach Hoa Xanh announced a comprehensive restructuring strategy, especially on the threshold of IPO and divestment to foreign partners.

According to information from Reuters, CDH Investments from China is negotiating to buy a minority stake in the Bach Hoa Xanh chain from Mobile World Investment Corporation (MWG). If an agreement is reached, the valuation of the Bach Hoa Xanh chain can reach USD 1.7 billion.

“CDH Investment is intending to buy from 5% to 10% of the shares of Bach Hoa Xanh,” this source said. The discussions are still ongoing and it is not known whether they will definitely happen or not.

The first time Mobile World announced a plan to sell a portion of the minority capital of the Bach Hoa Xanh chain was in 2022. Then this plan was suspended due to unfavorable market conditions. Last year, the resale process was restarted and attracted the attention of the Singapore GIC sovereign investment fund and companies from Thailand.

Besides strong growth in sales, according to information from MWG, in December 2023, with an average revenue of VND 1.8 billion per Bach Hoa Xanh store also unexpectedly announced that it had achieved the break-even target after all corresponding costs of current operation and based on core business operations (not including (i) one-time costs fully accounted for in the fourth quarter and (ii) part of the depreciation expenses related to the increase and decrease in store area).

So, the “promise” after many years of MWG has also been temporarily fulfilled.

Bach Hoa Xanh is known as the new venture of Mobile World Investment Corporation (MWG) when the two mobile phone and electronics sectors enter a saturated phase. The reality also proves the “enthusiasm” of this tycoon.

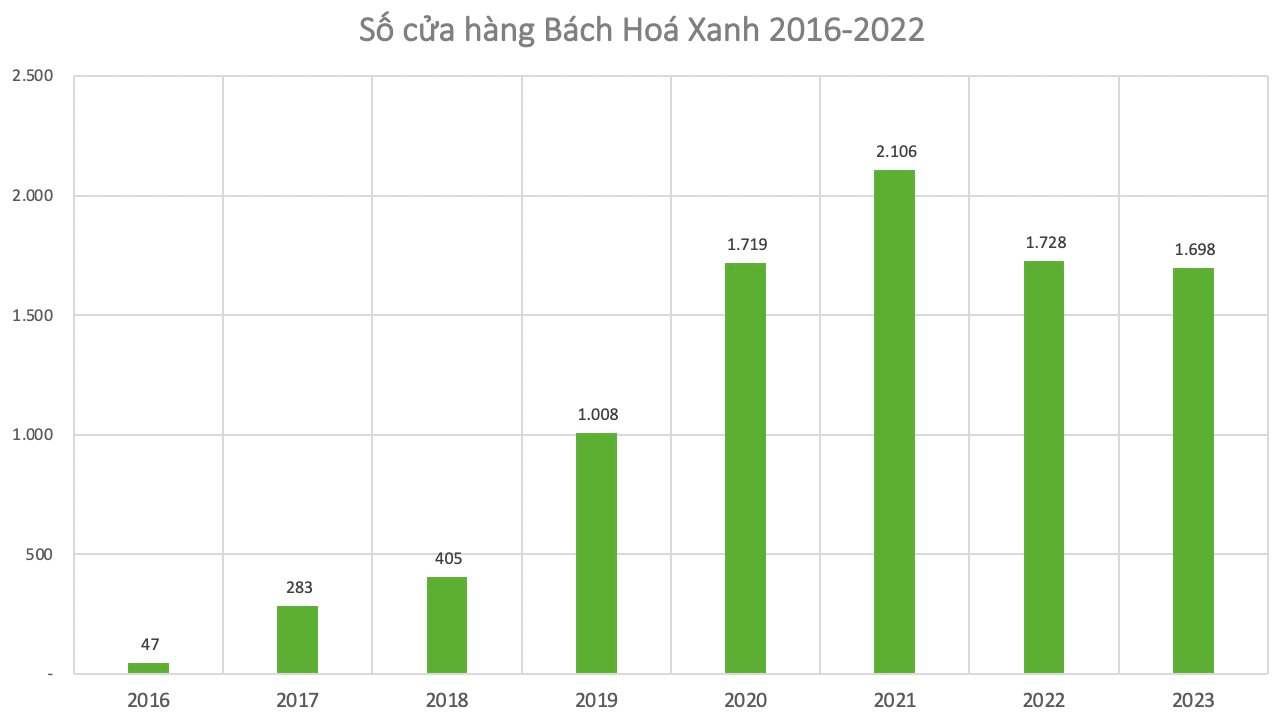

The first Bach Hoa Xanh store officially entered the market at the end of 2015. At the end of 2016, Bach Hoa Xanh completed the testing phase with over 40 supermarkets focusing on Tan Phu and Binh Tan districts, Ho Chi Minh City. In 2018, Bach Hoa Xanh announced that it had found the formula for success, this is also the year that MWG’s leadership declared that it would devote itself to Bach Hoa Xanh, with ambitions to dominate the food retail market.

By 2020, Bach Hoa Xanh – according to the sharing of Mr. Tai – rose to become the main growth “pillar” of the entire Company, with revenue doubling compared to 2019 and contributing 20% to total MWG revenue.

With the motto of convenient shopping point, with affordable prices, Bach Hoa Xanh has made a very good impression on consumers in the early years. In 2021, Bach Hoa Xanh continues to be the main growth driver of MWG: Revenue and scale reached a peak with VND 28,000 billion, more than 2,100 stores nationwide (45 times after 6 years).

However, when the Covid-19 epidemic broke out, the economy suffered a sharp decline in purchasing power, and the Company’s index also declined. Not to mention, being caught in the peak media crisis phase of the pandemic in 2021 and the departure of the person holding the reins, Mr. Tran Kinh Doanh, there are many opinions that Bach Hoa Xanh is an unsuccessful step of MWG. When, also with the old strategy (successfully applied in the mobile phone and electronics segments), Bach Hoa Xanh in the rapid expansion process has encountered too many problems and challenges.