In 2022, Tam Anh Hospital returned to profit

In Ngô Chí Dũng’s medical ecosystem, Tam Anh General Hospital Joint Stock Company (Tam Anh Hospital) is the oldest (established in September 2007). However, the “presence” of Ngô Chí Dũng here is much more discreet when he does not directly hold the position of CEO or legal representative despite owning 50% of the shares (according to the amended business registration certificate on December 1, 2016).

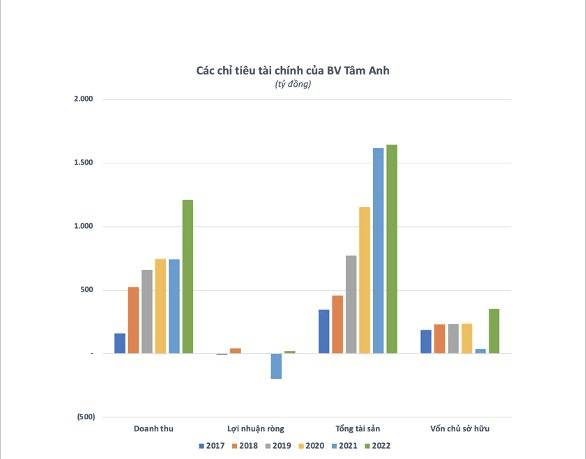

Tam Anh Hospital has a charter capital of 500 billion VND. The total assets at the end of 2022 were over 1,600 billion VND, of which debts accounted for nearly 80% with a balance of nearly 1,300 billion VND. The owned capital at the same time is 355 billion VND, lower than the charter capital mainly due to cumulative losses of 145 billion VND.

The losses of Tam Anh Hospital mainly occurred in 2021 when the hospital lost 198 billion VND. In 2022, the situation was more optimistic with revenue increasing by 63% to over 1,200 billion VND. This is also the highest revenue level of this hospital since its operation. The cost of goods sold and expenses increased at a slower rate, helping Tam Anh Hospital turn a profit of over 19 billion VND.

VNVC has huge revenue but thin profit

Another notable name in Ngô Chí Dũng’s medical ecosystem is VNVC – one of the largest vaccination systems in Vietnam.

The full name of this company is Vietnam Vaccine Joint Stock Company, established on November 11, 2016, with the main business activity being preventive healthcare and vaccination. After 7 years of operation, VNVC’s system has more than 100 vaccination centers.

At the time of establishment, VNVC’s charter capital was 10 billion VND, in which Ms. Nguyễn Thị Hà contributed 3 billion VND (30%), Ms. Nguyễn Thị Xuân contributed 3 billion VND (30%), and Mr. Ngô Chí Dũng contributed 4 billion VND (40%).

Mr. Ngô Chí Dũng (born in 1974) is also the legal representative and Chairman of the Board of Directors of VNVC. After several adjustments, as of July 10, 2020, VNVC’s charter capital increased to 140 billion VND, but the capital structure has not been specified.

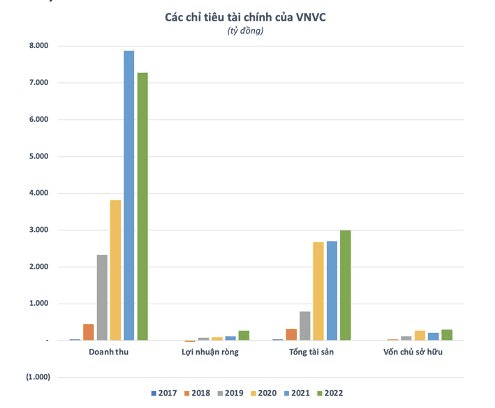

VNVC’s assets are mainly formed from debt capital. The total debts of this company regularly account for about 90% of total assets and are many times higher than the shareholders’ equity. As of the end of 2022, VNVC’s total debts amount to nearly 2,700 billion VND while total assets are less than 3,000 billion VND. Among them, the balance of financial borrowings is over 1,000 billion VND.

It is worth noting that VNVC’s assets are mostly accounts receivable, with a balance of over 1,100 billion VND (accounting for nearly 37%), double the beginning of the year. On the contrary, the inventory of this vaccination chain has decreased significantly from nearly 1,100 billion VND at the beginning of the year to nearly 650 billion VND at the end of the period.

With a brand identity shaped as “national”, VNVC generates “huge” revenue. In 2022, the revenue of this vaccination chain decreased slightly by nearly 8% compared to the previous year, reaching 7,283 billion VND, equivalent to an average daily revenue of nearly 20 billion VND.

Prior to that, VNVC continuously increased its revenue year by year, from a mere 32 billion in 2017 to nearly 7,900 billion VND in 2021.

Despite its huge revenue, VNVC’s profit is not impressive, and even in the first 2 years (2017-2018), it was incurring losses. In 2022, this vaccination chain made a record profit but only at the level of 265 billion VND. The profit margin has increased by 2.2 times compared to the previous year, but the net profit margin is still only about 4%, meaning that 100 VND of revenue brings less than 4 VND of profit.

In addition to Tam Anh Hospital and VNVC, Ngô Chí Dũng’s medical ecosystem also includes a very notable name, Eco Pharmaceutical Joint Stock Company (Eco Pharma) – the company that owns the first pharmacy chain in Vietnam that meets the 3 WHO-GSP, GDP, and GPP standards (Eco Pharmacy).

Mr. Dũng is currently the Chairman of the Board of Directors and CEO of this company.

After more than a decade of operation, Eco Pharma has become a very notable name in the pharmaceutical field, especially in functional foods. During prime time on Vietnam Television (VTV), consumers were very familiar with the series of advertisements for functional products such as Sâm Alipas Platinum, Sâm Angela Gold, Jex Max, Qik Hair, Otiv… all of which are products of this company.