Home buying trends are getting younger

A recent study by PropertyGuru shows that the age group from 22 to 39 is now the main group of home buyers, replacing the over-40 middle class group as before. The percentage of young buyers has been steadily increasing. Among them, the 22-34 age group increased from 39% (2021) to 42% (2023). Gen Z (22-26 age group) saw a breakthrough, with the percentage of buyers increasing from 13% (2021) to nearly 19% (2023), showing a trend of younger ownership of real estate.

The shift of young people becoming the main customer group in the real estate sector, especially in the affordable housing segment, has been happening for many years now, but recently, this trend has become more pronounced. In some apartment projects, the proportion of transactions “closed” in the 22-35 age group is high. A consumer psychology survey conducted by Batdongsan.com.vn on the proportion of people planning to buy real estate in 2024 also shows that 64% are under 39 years old.

Experts have given two reasons to explain this reversal. First, recently, the real estate market has been difficult for the 45-60 age group, which is the group that has accumulated a large amount of assets, so they limit their transaction and business activities during this time. But this is a golden opportunity for the under 35 age group. Second, the development of information technology has brought Gen Y and Gen Z generations many job opportunities with good and even multiple times higher income than previous generations. As a result, people under 35 have been continuously searching for real estate information for the past three years.

In addition, young people today tend to accept going further to buy a house. They leave the central area and search for real estate in suburban areas of major cities with prices ranging from 2-4 billion VND per unit. This group sees buying a house as their top priority in family planning and financial investment.

Recently, when sharing about the demand of the customer group looking for apartments, Mr. Ngo Quang Phuc, CEO of Phu Dong Group – a company specializing in developing affordable apartments to meet the real needs of young customers, said: Most apartment buyers in the company’s projects are in the 25-35 age group, accounting for up to 70%. These customers have modest initial savings and need financial support from the developer; they have a strong desire to own a home.

The company has recently officially introduced information about the Phu Dong SkyOne apartment project to the market, with 75% of the units priced from 1.4 to 1.8 billion VND per unit. The project is located on the frontage of DT 743C street, Tan Dong Hiep ward, Di An City. This is a project in the series of housing projects for young people that Phu Dong has been committed to implementing for many years. In the context of affordable apartments becoming increasingly scarce, the project is expected to attract attention in 2024.

According to Mr. Phuc, selling homes to young people is thought to be easy but it is not. The ease comes from the high demand, especially in recent years, where the target customers are young people with an increasing trend. But the challenge is that young people have limited finances but always have high requirements for design, quality, and aesthetics. At the same time, they are very creative and quickly catch up with new trends, so this segment requires continuous improvement from businesses to keep up with their demands.

“To sell homes to young people, developers must solve the problem of affordability. This seemingly irrational problem is true for young people. Good means a good location with potential and convenient transportation. Beneficial means meeting all necessary requirements such as construction quality, open design, and complete facilities. Cheap means the most reasonable price. To achieve this, developers must accept a reasonable and moderate profit margin. Although businesses really like to build homes at affordable prices to serve the majority of buyers, it is currently very difficult to find suitable land for developing this segment due to the increasing costs of land; financial costs and profit expectations”, shared Mr. Ngo Quang Phuc.

How to increase the supply of affordable housing?

Affordable housing is a segment that meets the needs of the majority, but this type of product is becoming scarce due to the continuously rising apartment prices.

In a recent report by Savills Vietnam, the average first-grade apartment price in the fourth quarter of 2023 was 54 million VND per square meter, increasing for 19 consecutive quarters and up more than 77% compared to the first quarter of 2019. In Binh Duong market, in just 4 years, the average price of Binh Duong apartments has jumped from less than 30 million to 40-48 million VND per square meter. In particular, Di An and Thuan An lead the price range.

In the context of “price storm”, projects with reasonable apartment prices always receive positive attention from buyers. However, to have sustainable liquidity, in addition to general solutions on land funds and policies, the “self-effort” of real estate businesses also contributes to attracting buyers back. Recently, some businesses have closely partnered with banks to provide maximum financial support for buyers. Among them, some developers worked with banks to offer the lowest interest rates for customers. Especially for young customers, the issue of financing the purchase of a home is always considered.

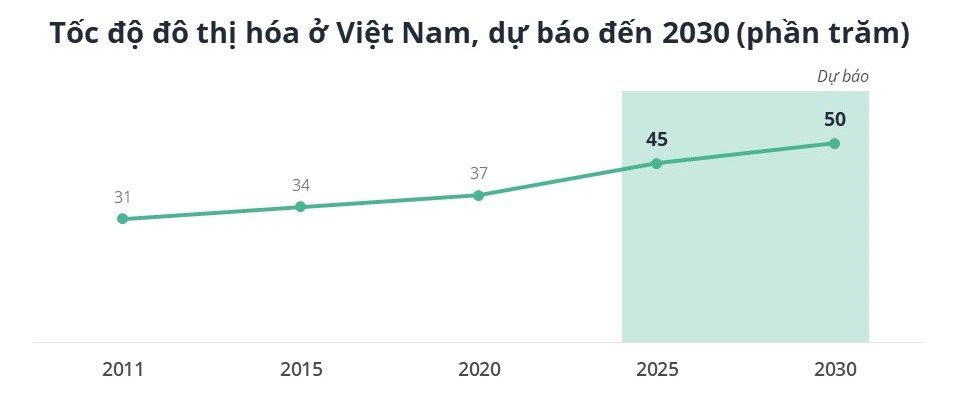

The demand for housing is still high as urbanization is increasing. Source: Avison Young Vietnam.

In a recent analysis on the solution to develop affordable housing, Mr. David Jackson – Managing Director of Avison Young Vietnam stated: House prices have increased rapidly in recent years, making urban residents increasingly struggling to have a decent place to live. High buying prices, rental costs, and unbalanced supply are adding a heavier burden to many households, making the goal of owning a house increasingly out of reach. This situation is not only happening in Vietnam but also in many countries around the world.

In the five-year period from 2019 to 2023, the house price-to-income ratio in Vietnam increased by 19.5%. In neighboring Asian countries such as South Korea, the Philippines, Indonesia, China, and Thailand, the increases were 47.9%; 37.9%; 34%; 18.9%; and 9.4%, respectively. Similar trends are also happening in the United States, Canada, and Germany, with increases of 25%; 22%; and 18.9% during the same period. The above figures show that house prices are becoming increasingly unaffordable and far from income, meaning that the opportunity for people to own a home is becoming increasingly limited. In addition, borrowing interest rates are also not pleasant, making buying a home even more difficult.

When the purchase price, rental price, living costs, and related expenses have a tendency to increase and account for an increasingly high proportion of urban residents’ total income, the need for housing, which is essential, is becoming increasingly “luxurious”. Stretching urban residents from the core area to the outskirts or even to neighboring regions is one of the solutions. However, with an urbanization rate of about 42.6% and a forecast to reach 50% by 2030, the housing problem for everyone can only be solved by multidimensional approaches.

Home buyers are getting younger.

According to the analysis by Mr. David Jackson, housing should be seen as essential infrastructure for social welfare, as a foundation for economic development like roads and utilities. Accordingly, housing development policies are built according to the right priorities, aimed at solving social welfare issues, with support from long-term investments by the State as well as interest rate subsidies or credit support. For private capital – real estate developers building housing, correctly identifying the target audience who have genuine housing needs will determine the project development cycle, from the stage of searching and collecting land funds to positioning and implementing the project. In addition, there are many opportunities to expand cooperation with various capital partners to jointly invest in order to diversify and consolidate cash flows.

“The housing challenge will become more serious if what is created in the real estate market does not correspond to the real value for the community and society, specifically in meeting the needs for rent and housing ownership,” emphasized Mr. Jackson.