Vinamilk delays the dividend payment for the 3rd quarter of 2023. Photo: Thu Minh

|

Vinamilk has chosen March 18, 2024 as the record date for shareholders to receive the interim cash dividend for the 3rd quarter of 2023, delaying it by about 1 week from the original plan of March 12, 2024. No other information has changed.

Vinamilk explained that the change is to align with the record date for shareholders attending the 2024 annual general meeting.

|

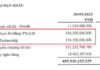

Details about the change in the record date for receiving the interim cash dividend for the 3rd quarter of 2023 of Vinamilk

Source: Vinamilk

|

According to the plan, Vinamilk will pay the interim cash dividend for the 3rd quarter of 2023 in cash at a rate of 9%, equivalent to 900 VND per share, on April 26, 2024. With nearly 2.09 billion outstanding shares, the dairy giant is estimated to need nearly 1.9 trillion VND.

Previously, the Company paid 3.1 trillion VND for the 1st quarter at a rate of 15% in October 2023 and paid over 1 trillion VND for the 2nd quarter at a rate of 5% in February 2024. Thus, the total amount of dividends Vinamilk has paid and will pay for 2023 is over 6 trillion VND, equivalent to a total rate of 29%.

|

Previous interim dividends for 2023 by Vinamilk

Source: VietstockFinance

|

Regarding the plan for the 2024 annual general meeting, Vinamilk will hold it on April 25, 2024, through online conferencing at 10 Tan Trao, Tan Phu Ward, District 7, Ho Chi Minh City. The meeting is expected to discuss many important matters, including the approval of the 2023 results and the 2024 plan.

In 2023, Vinamilk achieved a slight growth in revenue of nearly 1%, reaching 60.369 trillion VND, marking the third consecutive year the company has surpassed the milestone of 60 trillion VND in revenue. Of which, domestic revenue was 50.617 trillion VND, equivalent to the same period; while overseas market revenue was 9.751 trillion VND, up 5.4%.

The store channel saw a revenue growth of 13% for the whole year. In the near future, Vinamilk will upgrade its stores in the system of 653 stores to introduce products.

The gross profit margin of the leading company reached 40.7%, an increase of nearly 1 percentage point. In addition, thanks to the control of operating expenses, consolidated post-tax profit was 9.019 trillion VND, up 5.2% and exceeding the 5% target for the year. Net profit also increased by over 4% to 8.874 trillion VND. Earnings per share (EPS) reached 3.796 VND, up 4.5% compared to the same period.